Company Logo

Europe Travel Insurance Market Revenues From Artificial Intelligence Software Market In Europe In U S D Million 2018 2022

Europe Travel Insurance Market Revenues From Artificial Intelligence Software Market In Europe In U S D Million 2018 2022

Dublin, Feb. 23, 2024 (GLOBE NEWSWIRE) — The “Europe Travel Insurance – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 – 2029” report has been added to ResearchAndMarkets.com’s offering.

The Europe Travel Insurance Market size in terms of gross written premiums value is expected to grow from EUR 4.39 billion in 2024 to EUR 6.05 billion by 2029, at a CAGR of 6.20% during the forecast period (2024-2029).

2021 saw the Travel Insurance industry grapple with a multitude of challenges including pandemic impacts, disruptive technology, and climate-related risks. COVID-19 accelerated the transition to digital solutions because of necessity and enabled insurers to manage the pandemic’s impact by allowing workforces to operate remotely effectively and efficiently. But with this shift came the rise in cyber threats.

However, whilst last year necessitated a faster pace of change than was perhaps ideal, looking forward the insurers will want to continue to adapt to protect their operations, and market and promote customer retention. Customer demand for more interactive and efficient digital platforms and products is set to continue, which will require travel insurers’ ongoing adaption to new technologies. With that will possibly come associated cyber risks, with ransomware and supply chain attacks continuing to increase. However, digital transformation remains important for insurers wanting to stay relevant, competitive, and reputationally sound in the current market.

Europe Travel Insurance Market Trends

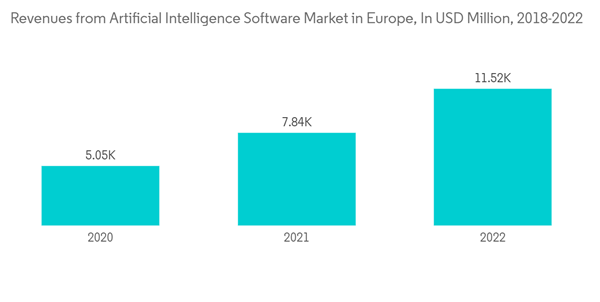

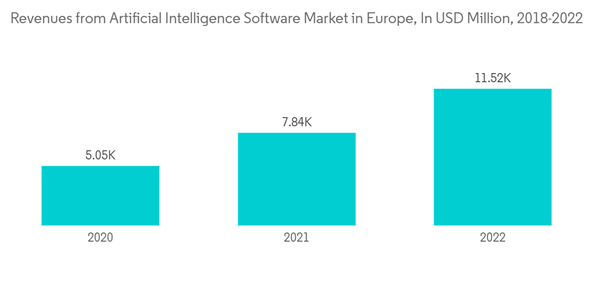

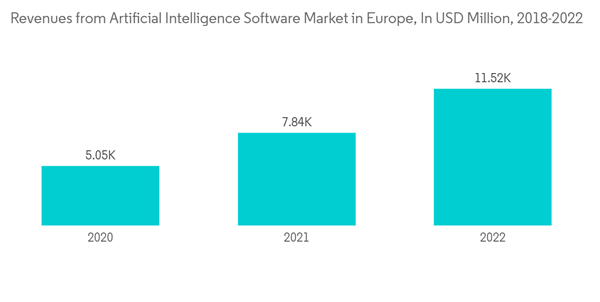

Artificial Intelligence in Insurance

As the use of artificial intelligence (AI) becomes more widespread across the travel insurance industry, regulators are examining how its use could potentially impact customers. Specifically, the European Commission is proposing cross-sectoral regulations that would control – and, in some instances, prohibit – certain practices: for example, the use of AI systems by public agencies, or on their behalf, for social scoring purposes. Given the growing societal concerns about customer privacy, data security, and the potential impact of AI on human agency, it is no surprise that the EC and other entities are exploring new guidelines. In effect, we take the view that a regulatory stance is essential and applaud the early position taken by the EC. However, proposals from certain policymakers could limit insurers’ abilities to undertake certain practices: for example, to assess risk and price policies accurately, personalize customer experiences, and mine data assets for actionable insights. Since the industry is already required to adhere to a wide range of regulatory requirements, a sensible step would be for insurers to collectively engage with regulators to explain how they both protect consumer data and ensure fair, unbiased use of AI in all its forms. They should also reassure regulators that the necessary precautions are being taken by insurers to safeguard against possible problematic cases.

Travel and Tourism Industry is driving the Insurance Market

Some of the most well-known cities and nations in the world are found in Europe. There is something for every kind of tourist because of the intriguing history, numerous different cultures, and stunning natural scenery. There are 44 countries in Europe, 27 of which are designated as belonging to the European Union, according to the UN. Travel and tourism generated USD 1,450 billion for Europe’s overall GDP in 2021. France is the most visited country in Europe in 2019, welcoming 89.4 million foreign visitors. With 50% of all international visitor arrivals, Europe as a whole (EU and non-EU) continues to be the most popular travel destination in the world.

The notable increase in the travel and tourism sector in recent years, which can be attributed to rising disposable incomes, an increase in business trips, and the easy accessibility of online travel bookings and discounted package holidays, is one of the key factors propelling the growth of the Europe Travel Insurance Market. Consumers are increasingly opting for Travel Insurance to manage risks such as airline cancellations, luggage and important document loss, and medical crises, which is growing the Travel Insurance Market share. Convenient choices for clients to acquire Travel Insurance via online comparison-shopping sites such as direct airline sites and online travel agents (OTAs), company websites and apps, and others support the Europe travel insurance market’s development.

Europe Travel Insurance Industry Overview

Europe Travel Insurance Market is consolidated in nature. Some of the key major players operating currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are expanding their market presence by securing new contracts and by tapping new markets.

Story continues

A selection of companies mentioned in this report includes

Allianz

Assicurazioni Generali S.P.A.

American International Group Inc.

AXA

Aviva

Insure & Go Insurance Services Limited

TATA AIG

The April Group

Mutuaide

Zurich

For more information about this report visit https://www.researchandmarkets.com/r/xy03aq

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager [email protected] For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Source link : https://finance.yahoo.com/news/europe-travel-insurance-market-poised-094500366.html

Author :

Publish date : 2024-02-23 08:00:00

Copyright for syndicated content belongs to the linked Source.