SWX:PMN Earnings and Revenue Growth as at Sep 2024

Simply Wall St Value Rating: ★★★★★★

Overview: IVF Hartmann Holding AG, with a market cap of CHF338.19 million, specializes in providing medical consumer goods both within Switzerland and internationally.

Operations: IVF Hartmann Holding AG generates revenue primarily from Infection Management (CHF54.18 million), Wound Care (CHF40.21 million), and Incontinence Management (CHF32.11 million).

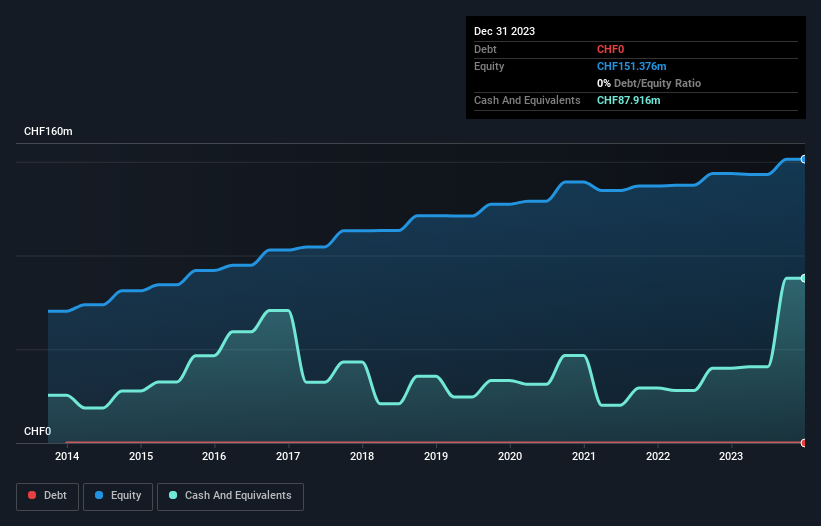

IVF Hartmann Holding, a notable player in the medical equipment sector, has shown impressive earnings growth of 34.9% over the past year, outpacing the industry average of -2.4%. Trading at 88% below its estimated fair value, it offers significant upside potential. The company is debt-free and has been for five years, eliminating concerns about interest payments. Additionally, IVF Hartmann is free cash flow positive and reported a levered free cash flow of CHF 17.50M as of June 2023.

SWX:VBSN Debt to Equity as at Sep 2024

Turning Ideas Into ActionsContemplating Other Strategies?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:CFT SWX:PMN and SWX:VBSN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66f394422240457686c12a07ccd585cf&url=https%3A%2F%2Ffinance.yahoo.com%2Fnews%2Fdiscovering-undiscovered-gems-switzerland-september-040825523.html&c=4772612188941821801&mkt=en-us

Author :

Publish date : 2024-09-24 21:08:00

Copyright for syndicated content belongs to the linked Source.