LSE:OXB Revenue and Expenses Breakdown as at Sep 2024

Simply Wall St Growth Rating: ★★★★☆☆

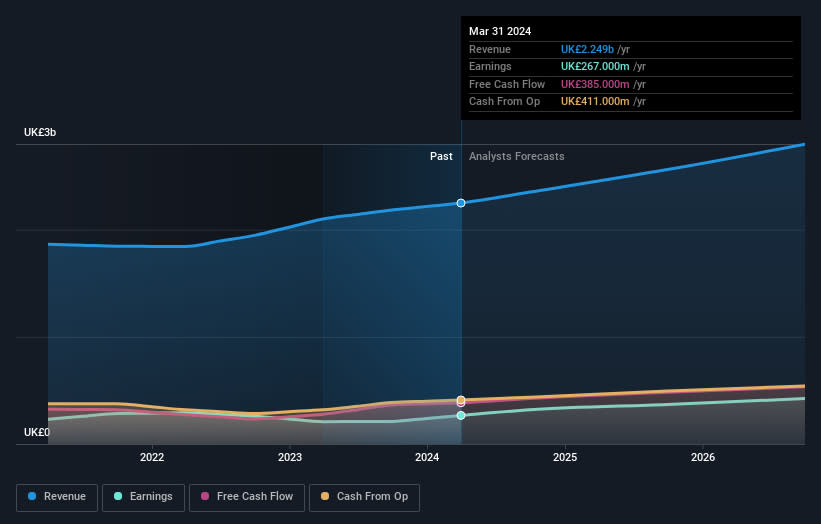

Overview: The Sage Group plc, along with its subsidiaries, offers technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally, with a market cap of £10.12 billion.

Operations: Sage Group generates revenue primarily from Europe (£595 million), North America (£1.01 billion), and the United Kingdom & Ireland (£488 million). The company focuses on providing technology solutions and services tailored for small and medium businesses across these regions.

Sage Group, with a strategic emphasis on enhancing its software solutions through partnerships like the one with VoPay, is significantly improving operational efficiencies for SMBs. This collaboration not only streamlines payroll processes by integrating advanced payment technologies but also addresses major industry pain points such as manual tasks and security risks. With recent financial performances showing a 7.9% revenue growth to £1.737 billion and earnings projected to rise by 15.1% annually, Sage is aligning its offerings to meet the evolving demands of digital finance management—evidenced further by their robust R&D commitment which bolsters their competitive edge in the tech-driven business landscape.

LSE:SGE Earnings and Revenue Growth as at Sep 2024

Where To Now?

Delve into our full catalog of 47 UK High Growth Tech and AI Stocks here.

Shareholder in one or more of these companies? Ensure you’re never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:GNS LSE:OXB and LSE:SGE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66f56bf6fe1e4afaaa1f9049e606b14e&url=https%3A%2F%2Ffinance.yahoo.com%2Fnews%2Ftop-high-growth-tech-stocks-130253576.html&c=13934701944604912405&mkt=en-us

Author :

Publish date : 2024-09-26 06:02:00

Copyright for syndicated content belongs to the linked Source.