Click here to become a member

Ireland has been remarkably successful in wooing FDI over the decades. But taxation has only been one of the attractions—as several authors, including Eoin O’Malley, have shown.

Ireland’s reputation as a good place to live or do business is being damaged much more by its dearth of housing, with inexorably rising homelessness and high private rents. This is driven by a conservative government’s failing policies, where very little social housing is being built while up to €10 billion per annum in public money flows into and distorts an already-imbalanced housing market, boosting house prices.

Despite Ireland’s economic success, there has also been too little investment in public infrastructure. Cathy Kearney, Apple’s vice-president for European operations, privately told the government in the summer that the company was not satisfied with infrastructure in Ireland and warned that there was strong international competition for FDI.

Yet Apple has been a serious player in Ireland for decades and is likely to remain so. It first invested in the country 44 years ago, with 60 manufacturing employees in its Cork campus. This has grown 100-fold to 6,000 today and is now its European headquarters. Apple is one of the few Irish technology firms that is unionised.

Tax subsidies

Eighteen years ago, the Irish Congress of Trade Unions took a case against an Irish tax subsidy, the Business Expansion Scheme, to the European commissioner responsible for competition. ICTU did so because the Irish government initially did not know the cost of the scheme (€240 million over eight years), nor its benefits and beneficiaries.

Government officials told ICTU that the claim would fail because tax subsidies were not taken seriously by the commission. This proved to be to be the case.

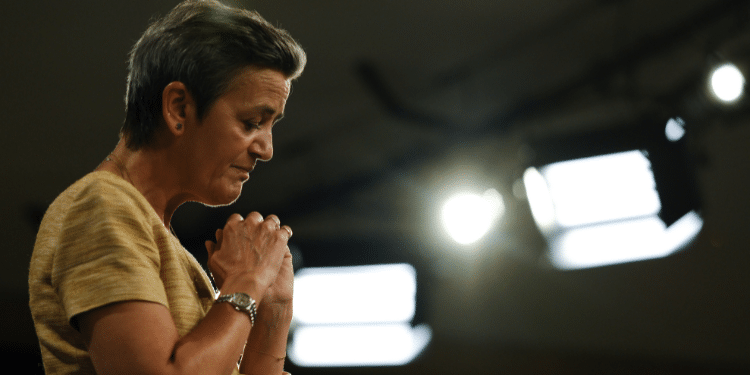

Margrethe Vestager’s assumption in 2014 of the commission portfolio on competition however ended the ineffectiveness. Tnis goes some way to combat the (justified) populist claim that large corporations and rich people do not pay anywhere near the same taxes as the wider public.

Today, the subsidies to businesses by all European states—for tourism, industry, farming and via regional aid—are vast and should be regularly reassessed. This judgment gives hope that these schemes will have to have sunset clauses built in, saving European taxpayers billions of euro over time.

Vestager described the ruling as ‘a HUGE win for tax justice and social fairness. Because when businesses don’t pay their taxes, they deprive our society from the money needed for our education, our health systems, our infrastructure … for all things that constitute our society.’

She is correct. But much more need to be done on taxation and to ensure genuine competition.

Exchequer surpluses

The Irish government should not spend one cent of this €14 billion on current expenditure. Happily, it does not need to: the Irish economy is again booming. With exchequer surpluses, the government managed to transfer €4 billion to the National Reserve Fund in 2023, boosting it to €6 billion. It is hoped that most of the €14 billion will land in this sovereign-wealth fund initially, to be drawn down for investment in housing, public transport, water and ‘human capital’.

The judgment shows that tax subsidies must be justified. The new OECD BEPS system is coming into play, meaning that there is hope that corporations are going to pay more taxes. Vestager, a Danish social liberal, has demonstrated to all EU citizens that the law must be upheld. She said: ‘It was the win that made me cry because it is very important to show European taxpayers that, once in a while, tax justice can be done.’

The United States is a major part of the problem of the low taxation of corporations. It allows them not to pay taxes on income not repatriated to the US which may (or may not) be paid in other jurisdictions—including tax havens such as Ireland and former British colonies in the Caribbean. If the US does finally reform its tax code, it will have international ramifications.

Ireland had already been moving, albeit slowly, in the right direction. The ‘double-Irish Dutch sandwich’ tax scandal was eventually ended in 2020. And Ireland finally signed up to the OECD BEPs tax scheme, with the corporate tax rate now a minimum of 15 per cent—higher than Ireland’s previous 12.5 per cent. The race to the bottom, led by Ireland, has ended and progressive corporate taxation is beginning to emerge.

Paul Sweeney was chief economist with the Irish Congress of Trade Unions for a decade.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66f619846e79473b90e11d6e5d5c71ee&url=https%3A%2F%2Fwww.socialeurope.eu%2Fireland-the-eu-and-the-apple-tax-case&c=9433592565472332994&mkt=de-de

Author :

Publish date : 2024-09-19 20:00:00

Copyright for syndicated content belongs to the linked Source.