Some content could not load. Check your internet connection or browser settings.

The biggest headwind has come from China, the world’s largest car market, which has been hit by the property sector slowdown. Although Beijing has unleashed a swath of stimulus measures to bolster the economy, the likes of Volkswagen and Mercedes-Benz are likely to struggle as customers choose local brands with superior technology and low pricing.

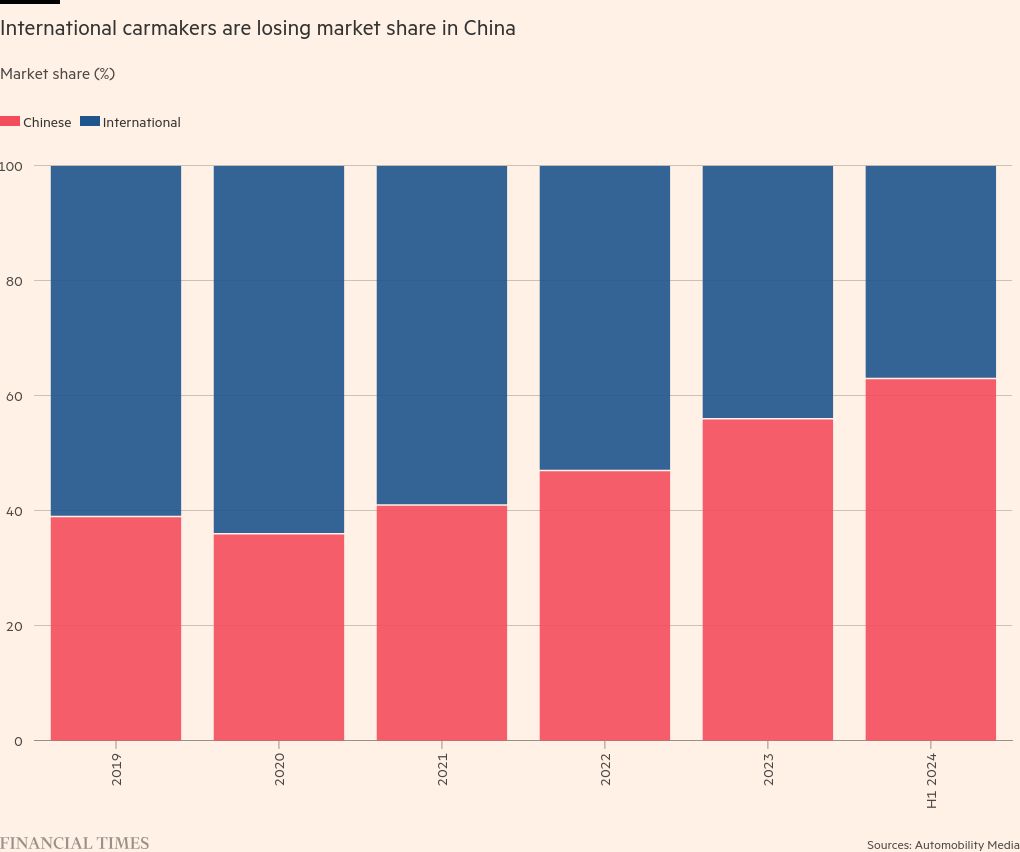

Foreign brands’ market share of Chinese auto sales is at a record low of 37 per cent in the first seven months of 2024, down from 64 per cent in 2020, according to data from Automobility, a Shanghai consultancy.

The decline has been particularly steep for German carmakers, who now have less than a 15 per cent share compared with nearly 25 per cent four years ago, Chinese industry data shows.

In recent weeks, Mercedes-Benz and Porsche have warned of lower than expected profits as sales of luxury cars in China have been hit by sluggish consumer spending.

Western carmakers, which had enjoyed economies of scale from selling large volumes of petrol cars in China, will see those benefits declining as they lose their market share to local rivals offering state of the art EVs, according to Matthias Schmidt, an independent car analyst.

International carmakers would have to compensate for the squeezed margins by raising prices in other markets. “There are a lot of negative consequences [in the Chinese market] that are not staying within China’s borders,” he said.

In Europe, where higher interest rates have capped sales growth, car companies also are struggling with slowing growth in EV sales and supplier bankruptcies causing component shortages.

The outlook is unlikely to improve next year with new EU carbon emissions standards forcing European carmakers to sell more EVs rather than petrol cars despite sluggish demand.

“From a pricing perspective, 2025 could be a very difficult year in Europe,” said Daniel Schwarz, an automotive analyst at Stifel. “They have to sell more electric cars. People don’t want them. They have to provide more discounts for these cars.”

The slowing growth in electric vehicle demand also has fuelled a decline in overall European sales. During June to August, new vehicle registrations dropped 3 per cent for Volkswagen and nearly 10 per cent for Stellantis, according to figures released by the European car industry body.

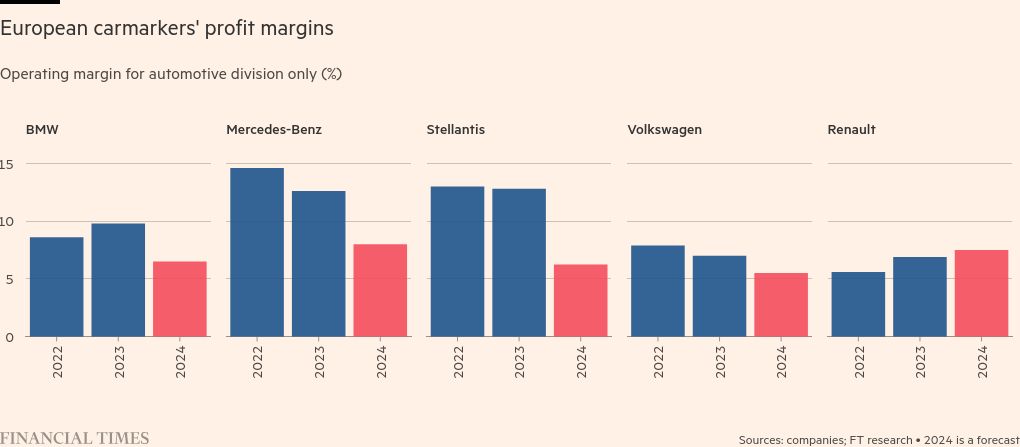

Volkswagen, which counts China as its biggest single market, is considering shutting plants in Germany for the first time in its 87-year history as it seeks to cut costs to survive the challenges. Europe’s largest carmaker posted an operating margin of 0.9 per cent for its VW passenger car brand in the first half, and last week warned its overall operating profit margin would fall to 5.6 per cent in 2024, compared with last year’s 7 per cent.

The discounts in Europe will further pressure automotive cash flows, which are or will turn negative for Volkswagen, Stellantis and Aston Martin.

The industry also has been shaken by new supply chain issues following the increasing number of insolvencies among car suppliers, particularly in Germany.

UK luxury-car maker Aston Martin and Ineos Automotive, a new car brand launched by billionaire tycoon Jim Ratcliffe, have blamed component shortages for delays with production, while Porsche issued a profit warning in July due to disruptions caused by flooding at an aluminium supplier.

“Over the past six to nine months, blue-chip suppliers have had fires, floods or administrators appointed to an extent and a scale that I personally haven’t seen in my career,” Adrian Hallmark, Aston Martin’s new chief executive, told investors after the London-listed group cut its vehicle delivery target on Monday.

In addition to external factors, some of the problems have been self- inflicted, said analysts. Peugeot and Chrysler maker Stellantis, for example, is struggling in the US after it had priced its vehicles too high.

“We’ve made some mistakes this year and we’ve . . . paid the price in the share price,” Natalie Knight, chief financial officer at Stellantis, said recently. The group’s shares have more than halved since their peak in March.

Recommended

Following its profit warning on Monday, the world’s fourth-largest carmaker’s operating profit margin is estimated to plummet to 2.4 per cent in the second half compared with 10 per cent in the first six months of the year. That is due to the heavy discounts the group is offering to US dealerships to clear high inventory in its biggest market.

Bernstein analyst Stephen Reitman said this year will be a pivotal test case as to whether car manufacturers will try to overcome slowing demand with painful cuts to production or turn to a bruising discount battle with rivals, which will hurt their profitability.

“We knew that 2024 was going to be a tough year and so a test of their pledges to favour value over volume,” Reitman said, adding: “If companies cut production instead of trying to kill each other with discounts, then investors may look a bit more positively at the sector. But if they fail and revert to old ways, it will be much more negative.

Additional reporting by Edward White in Shanghai

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66fceac1e7f047e88dc4d5946b30ebf4&url=https%3A%2F%2Fwww.ft.com%2Fcontent%2F7e0ca35e-d6a8-48b7-b657-cf547f3994cb&c=16030199852203136172&mkt=de-de

Author :

Publish date : 2024-10-01 21:00:00

Copyright for syndicated content belongs to the linked Source.