Across the European Union (EU), digital banks are already adapting to this evolving landscape. Bunq, a Dutch neobank, is leading the way with innovative offerings such as Freedom of Choice, which allows users to control deposit investments, and MassInterest, which offers a 3.36% bonus rate to reward savers. Additionally, Bunq’s entry into the insurance market in May will allow it to diversifying its income streams and reduce reliance on interest margins.

Bunq boasts over 12.5 million customer, and total deposits of over EUR 8 billion. This year, it plans to increase its global headcount by over 70% to expand into new regions including the UK and the US, Bunq CEO and co-founder Ali Niknam told CNBC last month.

In Germany, N26 has expanded into investment products, offering services such as stock and exchange-traded fund trading, as well as portfolio management. This strategic move not only diversifies its revenue streams but also attracts a broader customer base, particularly those looking for easy access to financial markets, C-Innovation says. It also positions N26 as a more comprehensive financial platform that meets both banking and investment needs.

N26 has introduced several new products this year, including Joint Accounts, which allow N26 customers to manage both their personal finances and finances shared with a partner, as well as Instant Savings accounts, which offer customers in 13 European markets up to 4% interest on deposits.

N26 serves eight million customers across 24 European markets. The digital bank reported a 27% increase in revenues to more than EUR 300 million in 2023, and says it is on track to become profitable in the second half of 2024.

Klarna, the Swedish buy now, pay later (BNPL) giant, is a standout example of how digital banks are using advanced technology to stay ahead. The company has implemented solutions that leverage artificial intelligence (AI) to not only reduce operational costs and remain competitive as margins tighten, but also enhance customer experience in the increasingly competitive BNPL space.

These solutions include Kiki, Klarna’s bespoke internal AI assistant. In its first month, Kiki handled 2.3 million conversations, managing two-thirds of Klarna’s customer service interactions. It effectively performs the work of 700 full-time agents, matching human staff in customer satisfaction scores. Used by 87% of Klarna’s employees, Kiki responds to approximately 2,000 inquiries daily, significantly streamlining operations.

Klarna has also introduced an AI assistant for its 150 million customers via its app. This assistant is designed to enhance the shopping and payments experience and is capable of managing a range of tasks, including multilingual customer service, managing refunds and returns, and fostering healthy financial habits.

Digital banks in the UK put a focus on product diversification

In the UK, banks like Starling Bank, Revolut and Monzo are putting a strong focus on product diversification and innovation, allowing them to remain profitable in a lower-rate environment.

Revolut continues to offer a broad suite of services, including travel insurance, stock trading, and budgeting tools, which help diversify its revenue streams and reduce reliance on traditional banking margins. The digital bank has launched a number of new products this year, including Mobile Wallets, a remittance service; Revolut X, a stand-alone crypto trading platform; and Revolut BillPay, a new feature designed to help businesses manage and pay bills to suppliers in over 150 destinations with just a few clicks. It’s now working on a new stablecoin initiative as it seeks to expand its crypto offering.

Additionally, Revolut is pursuing cross-border expansion with plans to enter the Middle East by seeking licenses to operate in the United Arab Emirates (UAE) and Dubai. This expansion will enable Revolut to offer remittance services, tapping into a region with significant growth potential. By providing such diverse financial products and expanding globally, Revolut can better withstand interest rate fluctuations, offering value-added services that go beyond core banking.

Revolut, which operates in more than 40 markets globally, claims more than 45 million customers, making it one of the most prominent digital banks in the world.

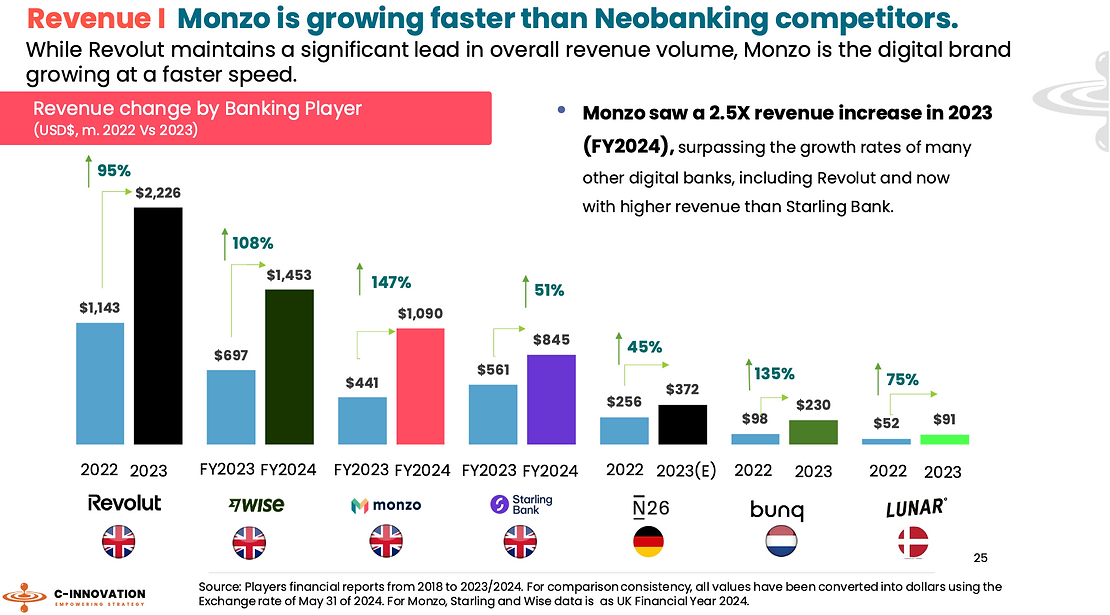

Revenue change by banking player, Source: Monzo Snapshot Report 2024, C-Innovation, 2024

Revenue change by banking player, Source: Monzo Snapshot Report 2024, C-Innovation, 2024

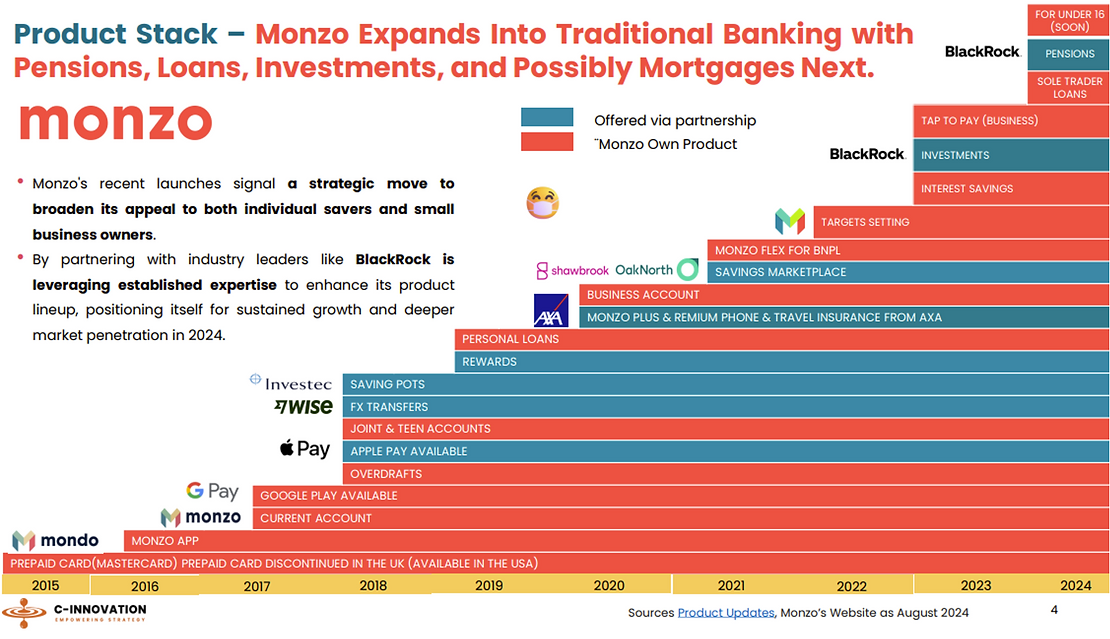

Similarly, Monzo is positioning itself through product diversification. Recent moves include the launch of a pension consolidation product with BlackRock, which allows customers to combine pots, a free account for 6 to 15 year olds, an “industry-first” Call Status fraud prevention tool that prevents customers falling victim to impersonation scams, the Monzo Investments offering, and an instant-access savings account.

Like Revolut, this broad product range enables Monzo to reduce reliance on interest-based income by generating fee-based revenue from various financial services. Moreover, its Monzo for Under 16s offering allows it to cultivate future loyalty, which will be crucial in maintaining a solid customer base as interest margins shrink, C-Innovation says.

Monzo claims it is the 7th largest bank in the UK, boasting more than 10 million customers. The digital bank achieved its first full year of profitability in 2024, reporting a pre-tax profit of GBP 15.4 million (US$20.5 million) for the financial year ending March 31, 2024.

Monzo’s product offerings, Source: Monzo Bank Profile 2024, C-Innovation, 2024

Monzo’s product offerings, Source: Monzo Bank Profile 2024, C-Innovation, 2024

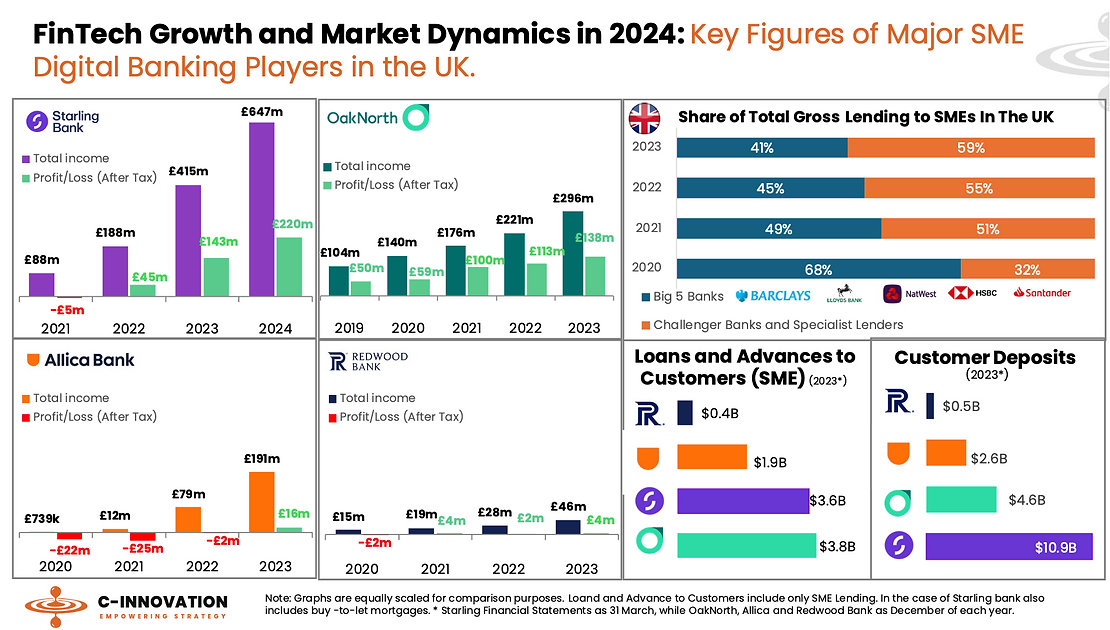

Starling Bank as well is diversifying its revenue streams, focusing heavily on its expansion into business banking and the provision of tailored services for small and medium-sized enterprises (SMEs). This helps cushion the effects of reduced lending margins.

The digital bank has also been franchising its software to other banks through a service called Engine, with recent partnerships in Australia with AMP and Romania with Salt Bank highlighting the bank’s commitment to scaling this technology.

Starling Bank, which offers personal, business, and joint accounts through a mobile app, has 4.2 million customers and serves about 9% of the UK’s SME banking market. The digital bank has been profitable for three years now.

Major SME digital banks in the UK, Source: Monzo Bank Profile 2024, C-Innovation, 2024

Major SME digital banks in the UK, Source: Monzo Bank Profile 2024, C-Innovation, 2024

Featured image credit: edited from freepik

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=66fcf20b3989425c857c538a1c4afeab&url=https%3A%2F%2Ffintechnews.ch%2Fvirtual-banking%2Feuropean-digital-banks-focus-on-innovation-amid-lower-interest-rates-challenge%2F72669%2F&c=1783122032820293394&mkt=de-de

Author :

Publish date : 2024-10-01 23:46:00

Copyright for syndicated content belongs to the linked Source.