The EU Parliament’s ECON had voted on 23 October 2023 for a one-year delay to all 3 ViDA pillars. However, this is non-binding but certainly reflects concerns that businesses and tax authorities will not be ready by 2025 for pillars 2 and 3.

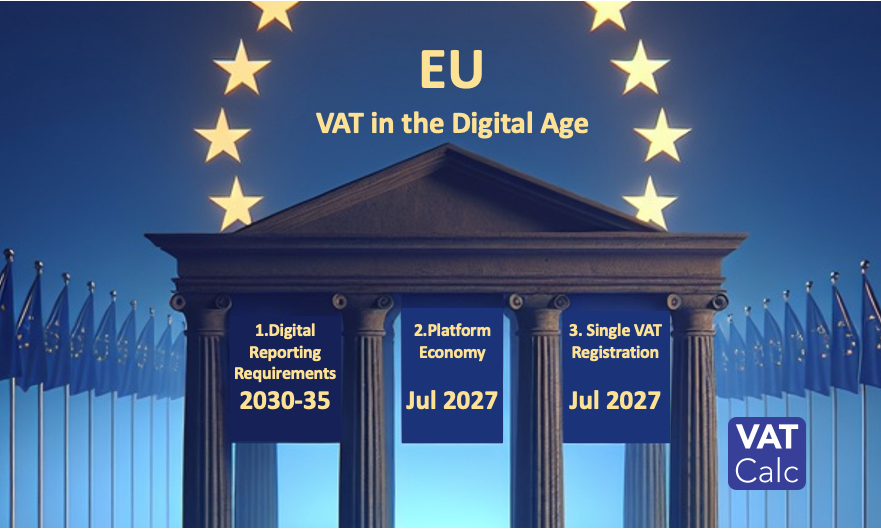

VAT in the Digital Age old timetable – now delayed

2025 (now July 2028) – Single VAT Registration & Platform Economy pillars

2028 (now July 2030) – Digital Reporting Requirements pillar

Introduction of Digital Reporting Requirements for header-level data of intracommunity supplies within two days of the supply.

E-invoices supplant paper invoices for legal purposes except in limited circumstances. Member states have the option to impose e-invoices for domestic transactions but all national regimes must converge with the EU e-invoicing standard, EN 16931.

No new pre-clearance e-invoice regimes may be introduced by member states. Those already in place, Italy SdI and Poland’s 2024 planned e-invoicing, may continue until January 2028.

Ending of summary invoices

Mandatory structured e-invoicing for intra-community supplies of goods based on EN 16931 standard. These will include new data fields (e.g. settlement details)

Withdrawal of ESL reporting since supplanted by the new DRR regime, above.

Richard Asquith

editor

Richard is a frequent contributor to international VAT and GST debate and public policy consultations. Prior to VAT Calc, he helped establish and grow two tax tech businesses. He started his career with the ‘Big-4’, working with KPMG and EY in the UK, Hungary, Russia and France

Source link : https://www.vatcalc.com/eu/eu-vat-in-the-digital-age-vida-adopted-by-ec/

Author :

Publish date : 2024-09-27 05:01:13

Copyright for syndicated content belongs to the linked Source.