France and Italy want to squeeze more tax from companies to bring bloated budget deficits under control and ensure their credibility with bond investors.

Author of the article:

Bloomberg News

James Regan

Published Oct 04, 2024 • 4 minute read

You can save this article by registering for free here. Or sign-in if you have an account.

7(l8x4g4gkygd(17jl5rb1[[_media_dl_1.png EurostatArticle content

7(l8x4g4gkygd(17jl5rb1[[_media_dl_1.png EurostatArticle content

(Bloomberg) — France and Italy want to squeeze more tax from companies to bring bloated budget deficits under control and ensure their credibility with bond investors.

Across Europe, extra money is needed to fill the hole caused by multiple crises – the cost of Covid support, helping households with energy bills during the inflation spike and funding Ukraine’s resistance to Russia’s invasion.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account.Share your thoughts and join the conversation in the comments.Enjoy additional articles per month.Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one accountShare your thoughts and join the conversation in the commentsEnjoy additional articles per monthGet email updates from your favourite authorsSign In or Create an Account

or

Article content

Measures that target cash-rich firms and the wealthy help governments avoid austerity on the scale seen during the euro-area debt crisis. They also allow politicians to tell frustrated voters that the burden of repairing government finances doesn’t all fall on them.

But special tax increases may prove to be a short-term fix for a region that’s in need of a radical overhaul. And there will be uncertainty – a bugbear for business – about how long such policies will remain in place and how much they will cost year to year. Some industries have already criticized the proposals.

France’s budget situation in particular is in focus. The premium that it must pay to borrow compared with some of its peers has widened toward levels last seen during the sovereign debt crisis.

As it grapples with its fiscal situation, the government has been forced to admit it needs an additional two years to get its deficit within the European Union’s limit.

On Wednesday, French President Emmanuel Macron endorsed a temporary tax on the country’s largest companies, a move that marks a departure from his longstanding pro-business stance. A day later, Italy’s finance minister said he’ll raise taxes on companies that benefited most from the economic turbulence of recent years.

Top Stories

Thanks for signing up!

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

“Temporary tax hikes offer a tangible immediate boost to the public finances, but of course that doesn’t last, so this sort of measure does nothing to improve fiscal sustainability,” said Jamie Rush, chief European economist at Bloomberg Economics. “In fact, by creating uncertainty around the stability of the tax system, it reduces incentives to invest and therefore comes at a long-term economic and fiscal cost.”

The French government plans around €60 billion ($66 billion) in spending cuts and tax hikes next year to bring its deficit to 5% of GDP from around 6.1% this year. It won’t hit the EU’s 3% limit until 2029.

Just under €20 billion would be generated by temporary tax increases on wealthy individuals and large companies, as well as increased green taxation.

‘Disastrous’

A combination of additional levies and fiscal consolidation may weigh on spending and demand in the euro region.

That’s a negative for economic growth at the best of times. It could be even more dangerous now given the gloomy outlook, particularly in Germany, which has been hit by multiple challenges and is forecast to stagnate this year.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

The International Air Transport Association called the French plans “disastrous.” Director General Willie Walsh said the answer can’t be to “tax the productive parts of the economy to a standstill.”

Markets are on edge about France partly because the government lacks a majority in parliament to approve the budget.

Prime Minister Michel Barnier will likely have to use constitutional tools to bypass a vote on the bill, a move that increases the chance of no-confidence motions.

The country’s 10-year yield trades about 80 basis points above the equivalent German rate. Last week, it even surpassed Spain’s, which carries a lower credit rating.

“This new ‘plan’ may be more realistic, but could also come as a let-down for traders thinking that a more earnest effort should have tried to meet the 2027 goal,” said Thierry Wizman, global FX and rates strategist at Macquarie Group Ltd. “As we saw in the UK in September 2022 during the brief government of Liz Truss, traders may not be so patient.”

Investors’ attention will now turn to a cascade of reviews on France’s ratings, with Fitch at the end of next week, Moody’s on Oct. 25 and S&P Global on Nov. 29.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

What Bloomberg Economics Says…

“The fiscal effort needed to reach Barnier’s new targets is already substantial — the decision to finance a third of the consolidation plans through tax hikes on wealthy individuals and profitable corporations, despite the strong opposition from his allies in French President Emmanuel Macron’s camp, underscores the magnitude of the challenge.”

—Eleonora Mavroeidi and Maeva Cousin. Click here for the full INSIGHT.

Italy’s plans are likely to prove similarly difficult to implement. Last year, proposals for an extra tax on lenders were effectively abandoned after they triggered a major selloff in Italian stocks. Finance Minister Giancarlo Giorgetti has promised there wouldn’t be a repeat of that mistake.

He noted that the defense industry had seen its profits jump, though he didn’t offer further details.

There could also be opposition from the pro-business Forza Italia party that forms part of Prime Minister Giorgia Meloni’s coalition government.

So far, investors have proved much more sanguine about Italy. Historically, it’s been at the epicenter of concerns given it has the largest debt pile in Europe after Greece, but markets have been reassured by Meloni’s approach.

Advertisement 6

This advertisement has not loaded yet, but your article continues below.

Article content

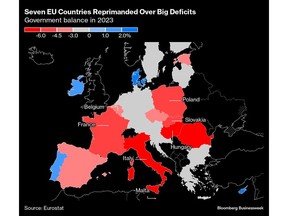

Still, France and Italy are among the countries put under EU infringement procedures for excessive deficits earlier this summer. Italy aims to bring its budget gap below 3% in 2026 from an expected 3.8% this year.

The EU’s limits on debt and deficits came back into force at the start of this year after months of difficult negotiations that saw the EU’s two biggest economies — Germany and France — clash over the level of effort that should be required. The rules had been suspended to allow for emergency spending during and after Covid lockdowns.

—With assistance from Alice Gledhill, Aline Oyamada and James Hirai.

Article content

Share this article in your social network

Source link : https://financialpost.com/pmn/business-pmn/europes-cash-strapped-governments-turn-to-corporate-profits

Author :

Publish date : 2024-10-04 04:22:23

Copyright for syndicated content belongs to the linked Source.