The European Court of Justice has upheld a €13 billion penalty levied against Apple eight years ago for unpaid taxes, and told the Irish government to collect it.

So what? It’s a lot of money, and Apple can’t appeal. Which makes the ruling a landmark as…

a signal that tech giants can’t defy the EU’s laws indefinitely if they want to do business in its marketplace;a warning to EU member states with low-tax regimes that effectively penalise those with higher taxes; a victory for Margrethe Vestager, the EU’s competition commissioner, who’s been fighting to make this verdict stick for nearly a decade; and a reminder that Apple’s claim never to have had a special tax deal in Ireland was always baloney.

“Political crap.” When the European Commission first issued the €13 billion back-tax order in 2016, Apple’s CEO, Tim Cook, responded with a barnyard epithet and said it would be overturned on appeal. It was. But the manure’s now on the other foot.

Yesterday’s ECJ verdict reverses the appeal court ruling. It’s costly even for Apple, which must forfeit a total of €13.8 billion including interest, currently held in an escrow account. It’s also embarrassing. The highest court in Europe has found that for 16 years Apple – and Ireland – were breaking the law.

Illegal how? In 1991 and 2007 Dublin approved variants of “double Irish” tax deals whereby Apple could book profits from across Europe, India, Africa and the Middle East in low-tax Ireland, then move them offshore. Apple’s bespoke arrangement involved two Irish subsidiaries:

a branch office paying standard Irish corporation tax on a small fraction of Apple’s profits, anda “headquarters” paying almost nothing on everything else by claiming not to be tax-resident in any country.

Yesterday’s ruling found that the 1991 and 2007 deals violated EU state aid rules by effectively handing subsidies to Apple.

Apple said: “We always pay all the taxes we owe wherever we operate and there has never been a special deal.” It accused the Commission of ignoring Apple’s position, which is that “our income was already subject to taxes in the US”.

In reality: being subject to US tax doesn’t mean US tax was paid – until Trump slashed corporate tax rates in 2018. Apple then repatriated $252.3 billion on which it paid $38 billion in tax for an effective saving of $43 billion. Before that the Commission had found that in some years Apple was paying an effective tax rate of 0.005 per cent on profits channelled through Ireland.

Thanks but no thanks. The ruling is awkward for Ireland, which must collect the €13.8 billion without scaring off multinationals still basing their European operations in Dublin for its 12.5 per cent profits tax. So the government is stressing the historic nature of the case, in which it appealed the original verdict along with Apple.

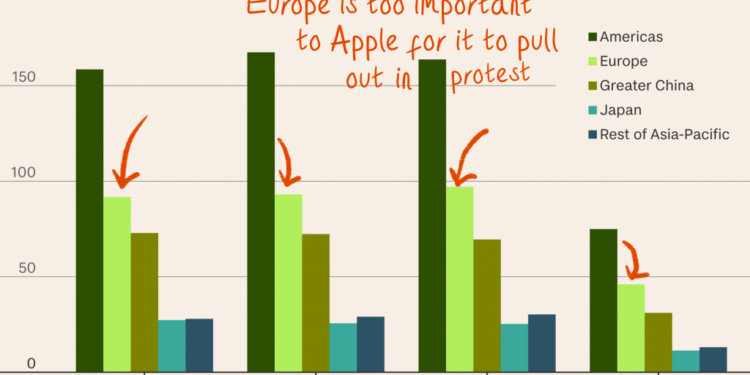

Even though it stood to gain €13 billion? Indeed. Hosting companies like Apple is worth much more than that. Last year the EU Tax Observatory found that Ireland and the Netherlands each benefited to the tune of about $140 billion from profit-shifting in the five years to 2019.

Justice for once. The ECJ’s ruling was unexpected; the court often sides with member states rather than Brussels and they currently show little inclination to cede more tax sovereignty to Europe, says Aidan Regan, a professor of political economy at University College Dublin. Vestager said it made her cry to see “tax justice” delivered after so long.

About that €13 billion. How and where it’s being held aren’t clear. “Like all Apple’s tax affairs it’s highly secretive,” Regan says. “I’d imagine there’s only a handful of people who know what’s in that account and how it’s to be collected.” But it’s equivalent to about 14 per cent of Ireland’s total annual public spending.

What’s more… Ireland is already running a budget surplus of about €8.6 billion, thanks largely to tax reforms introduced after the original 2016 fine.

Thanks for reading. This article is part of our Daily Sensemaker, a free newsletter from Tortoise. Take once a day for greater clarity.

Click here to sign up and email [email protected] to tell us what you think.

Choose which Tortoise newsletters you receive

more from tortoise

Brazil vs Musk

Why X has been banned in Brazil – and how Elon Musk is fighting back

Source link : https://www.tortoisemedia.com/2024/09/11/europe-takes-a-13-billion-bite-out-of-apple/

Author :

Publish date : 2024-09-11 07:00:00

Copyright for syndicated content belongs to the linked Source.