Where does the European Retail Investment Strategy stand?

Retail investors constitute an important part of the EU market and have great investment potential. According to EU statistics, the retail participation in capital markets is still modest with about only 30% of retail savings being placed in equity and investment fund shares.

On May 24, 2023, the European Commission unveiled the proposal for a Retail Investment Strategy (RIS), an umbrella directive modifying multiple aspects of existing legislation. The key aim is to foster an environment conducive to increased participation of retail investors in capital markets in Europe.

Currently, only 17% of EU household assets are invested in financial securities such as stocks or bonds, a stark contrast to the US at 43%.1On average, retail investors encounter fees that are 40% higher than institutional investors.2Furthermore, almost half (45%) of European investors question the neutrality of investment advice they receive from financial intermediaries.3

The Commission plans to amend the legislative structure for retail investments to achieve the following:

Increase retail investors’ participation in EU capital marketsEnhance trust and confidence in capital marketsHelp retail investors achieve better outcomes while contributing to the wider EU economyContribute to the wider EU economy

Read More

Read Less

The proposed rules are still likely to be subject to change. As per the current timeline foreseen in the draft Directive, from the date of publication in the Official Journal of the European Union, Member States will have 12 months to transpose the directive into their national law and 18 months to apply the new provisions. Therefore, final requirements will likely not become applicable before the beginning of 2026. The file may be further delayed if a final compromise is not reached before the end of the current European Commission mandate on 31 October 2024.

Read More

Read Less

Retail investors often struggle with accessing comprehensible and comparable information necessary for making informed investment choices. In this sense, the Commission, back in May 2023, proposed an omnibus directive aiming to ensure that the legal framework for retail investments sufficiently empowers consumers, encourages improved and fairer market outcomes and creates the necessary conditions to grow retail investor participation in capital markets. The Retail Investment Strategy (RIS) Proposal, aims to, inter alia:

Modernize disclosure rulesDevelop benchmarks for evaluating financial productsAddress potential conflicts of interestEnsure financial advisors examine retail investors’ financial situations more carefullyRequire that marketing be fair, clear and not misleadingImprove financial advisors’ and retail investors’ knowledge of financial marketsImprove investor categorizationEnhance supervisory cooperation between national competent authorities and the European supervisory agencies

Read More

Read Less

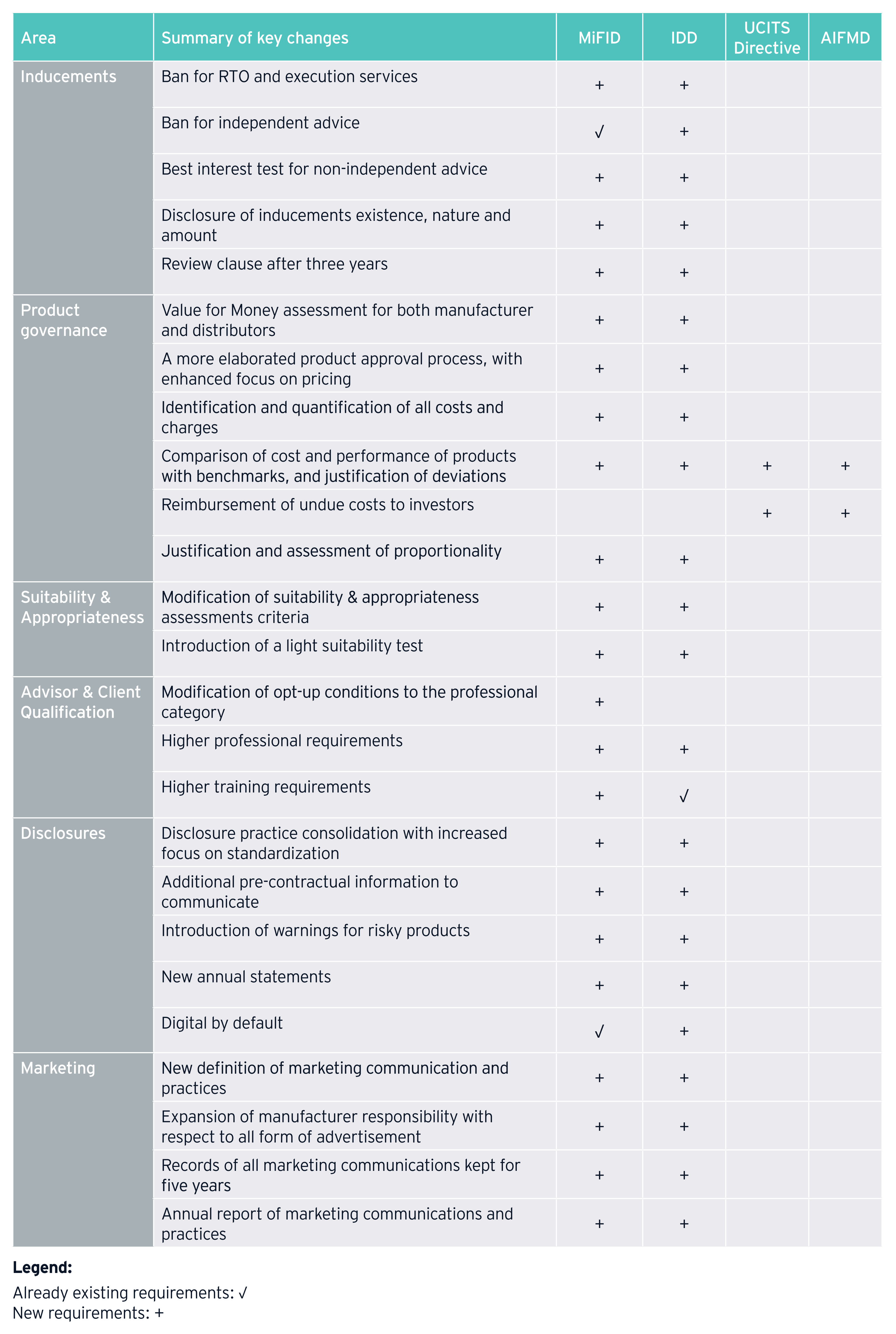

The RIS will impact manufacturers4 and distributors of financial products in the following key areas:

Read More

Read Less

The RIS will impact distributors of financial products by amending MiFID II in a number of key areas. The highlights are listed below.

1. Inducements

Ban on inducements for RTO and execution servicesBest interest test for non-independent advice to replace Quality Enhancement testReview clause after three years

2. Product governance

Value for Money assessment apply to both manufacturers and distributorsCost & performance of products to be compared with relevant benchmarks elaborated by ESMA

3. Suitability and appropriateness

Modification of suitability assessment criteria for investment advice and portfolio managementModification of appropriateness test criteria for RTO and Execution

4. Advisor and client qualification

Modification in opt-up conditions to the professional category for retail clientsEnhanced requirements for financial advisor competency

5. Disclosure

Disclosure practice consolidation with increased focus on standardizationIntroduction of warnings for risky financial instruments

6. Marketing

New definition of marketing communication and practicesExpansion of investment firms responsibility with respect to all form of advertisement on distributed products

Read More

Read Less

The RIS aims to improve value for money for investors in ways that will affect UCITS Management Companies (ManCos) and Alternative Investment Fund Managers (AIFMs).

Effective pricing processes

UCITS ManCos and AIFMs are required to maintain, operate and review an effective pricing process that can accurately identify and measure all costs borne by the investment fund or its unitholders. Note that undue costs charged to the investment fund or its unitholders will need to be reimbursed by the UCITS ManCo/AIFM. The following will need to be assessed:

Whether any costs charged are undue: this necessitates the fair treatment of investors and it is necessary for the investment fund to operate in line with its investment strategy/objective or to fulfill a regulatory duty

Whether costs borne by retail investors are justified and proportionate: this includes all the relevant characteristics, including the investment objective, strategy, expected returns, level of risks and other relevant characteristics

Cost and performance

Costs and performance will need to be compared to relevant benchmarks, as elaborated by ESMA.

ESMA will develop and make publicly available benchmarks to enable the comparative assessment of costs and performance

Benchmarks shall display a range of costs and performance from funds that present similar levels of performance, risk, strategy, objectives, or other characteristics, and will be updated on a regular basisIf there is a deviation from the relevant benchmark, it must not be marketed to retail investors by the IFM, unless it is justified by additional tests

Read More

Read Less

The RIS is expected to impact several areas of insurance distribution. It will impact the Insurance Distribution Directive (IDD) as follows:

1. Inducements

Ban on inducements for RTO/ execution & independent adviceReview clause in three yearsInducements for non-independent advice subject to best interest test

2. Best interest

Replacing “no detriment test” of IDDRequirement to advise customers based on an appropriate range of products, emphasizing cost-efficiency, alignment with customer’s needs, and recommending at least one product with no “superfluous” features

3. Value for money

Elaboration on the product approval process, including the benchmarking of costs and chargesIn case of deviation from benchmark, requirement for product approval subject to demonstration that costs and charges are proportionate and justified

4. Suitability and appropriateness tests

Additional information to be collected for suitability (advised) and appropriateness (non-advised sales) testsIntroduction of “light” suitability test

5. Professional requirements

Higher level of minimum necessary knowledge necessary of insurance products key characteristics, risks and features, as well as of financial risks borne by the policyholders

6. Disclosure

Additional pre-contractual information to be communicatedManufacturers to draw an annual statement with key information for retail clientsNew warnings for risky insurance productsProvision of disclosures and information in electronic format

7. Supervisory collaboration

New annual reporting for insurance distributors with 50+ cross-border clientsEIOPA to establish electronic database with the reported informationSet-up of a platform for enhancing cooperation of supervisory authorities

8. Marketing

Marketing material of insurance-based investment product (IBIPs) should make product features and risks easy to understandThe manufacturer of an IBIP is responsible for the content of marketing communication and its updates, whereas the distributor handles its usageRecords of all marketing communications to be kept for five years

Read More

Read Less

References

Close references

[1] Based on Eurostat’s sectoral national accounts (international data cooperation, NAID_10), 2021

[2] Performance and Costs of EU Retail Investment Products, ESMA Annual Statistical Report, 2022

[3] Monitoring the level of financial literacy in the EU, Eurobarometer, 2023

How EY can help

It depends on where you stand in your journey. Our dedicated EY Luxembourg RIS team offers support across a range of areas, elaborated below.

Awareness & Impact Assessment

Since the draft Directive has already been proposed, and the market has digested the topic and feedback is ongoing, awareness and impact assessments should take place as soon as possible, for those who want to be ready on time.

Understand the RIS, and raise awareness among decision-makers

Analyze firm impact, identify and qualify main impacts (e.g., scenarios, quantification, etc.)

Gap Analysis & Action Plan

As we get closer to a final version being published, a detailed gap analysis should be undertaken and an action plan established.

Map detailed gaps against the RIS requirements and determine actions needed to comply

Take strategic decisions (e.g., those related to revenue/service/operating model)Develop the action plan for implementation

Implementation

As we get closer to a final version being published, firms will need to start thinking about application, and should start preparing for implementation as soon as possible.

Elaborate on business requirements, functional specifications, design of solutions, etc.Project manage and coordinate workstreamsUpdate policies, procedures and client documentationReview control frameworks and monitoring plansConduct trainings and change management programs

Read More

Read Less

modal-close-button

Welcome to EY lu (en)

You are visiting EY lu (en)

lu

en

Source link : https://www.ey.com/en_lu/insights/wealth-asset-management/ris-eu-retail-investment-strategy

Author :

Publish date : 2024-08-13 15:06:15

Copyright for syndicated content belongs to the linked Source.