Simply sign up to the European banks myFT Digest — delivered directly to your inbox.

A court has agreed that a Russian businessman can sue a Monaco private bank under US anti-mafia organised crime legislation from 1970 that has never been used against a bank in Europe.

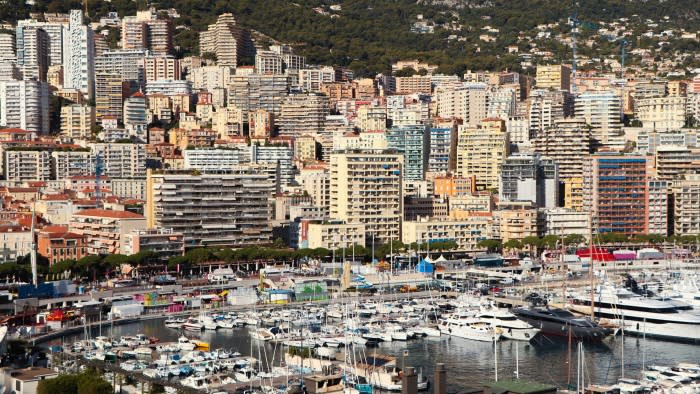

CMB Monaco — which is owned by Italy’s Mediobanca and caters to the ultra-wealthy from its headquarters in Monte Carlo — is set to face the landmark civil jury trial this summer. An attempt by CMB to stop the case going ahead was dismissed by a California judge at the end of March.

Lawyers in the case believe CMB is the first European bank to be sued under the Racketeer Influenced and Corrupt Organizations, or Rico, Act. It was signed into law in 1970 during the presidency of Richard Nixon and was used by Rudy Giuliani when he was US Attorney for the Southern District of New York to pursue the heads of New York’s five mafia families in the 1980s.

It has also been used to target the Hells Angels, junk-bond king Michael Milken, Fifa and most recently Donald Trump in criminal cases.

The case against CMB centres on a long-running dispute between two Russian businessmen, one of which is a client of the bank.

Former politician Ashot Yegiazaryan and his business partner Vitaly Smagin had invested in a Moscow property deal in 2003 that eventually went sour. Seeking to recoup his investment, Smagin successfully sued Yegiazaryan in the London courts, winning an $84mn arbitration award in 2014.

Yegiazaryan — who by this point had left Russia and moved to Beverly Hills — refused to pay. Smagin then sued Yegiazaryan in the Californian courts and obtained a freezing order on Yegiazaryan’s Californian assets.

In response, Yegiazaryan moved his money through a series of shell companies to his Monaco account at CMB. When CMB did not transfer the money to Smagin, he launched a Rico lawsuit against Yegiazaryan and CMB, claiming the bank helped his former business partner evade the enforcement of the Californian court order.

“This participation of CMB Bank was critical to Mr Yegiazaryan’s plan as it allowed him to hinder, delay, and . . . prevent collection by Mr Smagin of his legitimate debt, despite multiple court orders around the world authorising the same,” Smagin’s lawyers have claimed in US court documents seen by the Financial Times.

The Rico Act allows individuals and companies to be sued for allegedly participating in an enterprise that engages in racketeering, which includes fraud, extortion, money laundering and obstruction of justice.

CMB filed a motion to dismiss the suit last year, arguing the Rico Act did not apply because Smagin still lives in Russia and the law relates only to US claims.

The bank’s lawyers argued that allowing non-US residents to pursue Rico lawsuits would lead to “spurious claims by litigants with no real connection to the US”.

However, judge Gary Klausner of the Central District of California court rejected the appeal, reaffirming a US Supreme Court decision that Rico claims can be made by non-US residents.

“When viewed in the light most favourable to him, [Smagin’s] allegations that CMB orchestrated a years-long freeze of the . . . assets to prevent [Smagin] from recovering the award is sufficient to allege a deprivation of money or property,” the judge wrote in his ruling.

Legal experts believe the case could open up foreign banks to being pursued through the US courts under Rico laws, where penalties can be much higher.

The case is due to be heard over seven days in June.

CMB and lawyers for Smagin declined to comment. Lawyers for Yegiazaryan did not respond to a request for comment by the time of publication.

Source link : https://www.ft.com/content/f949684e-7f3f-4b20-b9ff-cd73270bac06

Author :

Publish date : 2024-04-09 07:00:00

Copyright for syndicated content belongs to the linked Source.