Figure 1: Tourism services and balance of payments of Cyprus with Russia

Source: IMF, Article IV Executive Board Consultation, May 2023

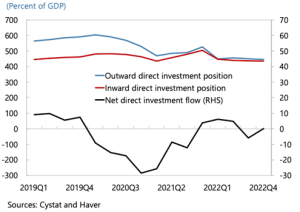

Figure 2: Direct investment position and flows with Russia

Source: IMF, Article IV Executive Board Consultation, May 2023

Modelling EU Sanctions

The Russian-Ukraine war and the subsequent EU sanctions have brought again to the spotlight the discussion about sanctions’ economic impact on both the sanctioned and sanctioning countries and their effectiveness as a response to terrorism, military conflicts, and other foreign policy crises (Hufbauer and Jung, 2020; Crozet and Hinz,2020; Garicano et al., 2022).

Our modeling approach is as follows: Initially, we calibrated the model to reflect the current state of Cyprus’ economy, especially in terms of its sectoral breakdown (tradable and non-tradable sectors) and its domestic and foreign assets position. This has served as our departure point. Then based on the most recent balance of payments and inflation data, we simulated these sanctions as a combination of exogenous foreign shocks, particularly affecting the tradable sector, namely the exports of services (mainly tourism and financial services), imported goods inflation, and the decrease in inward foreign direct investment from Russia to Cyprus. We also factored in the uncertainty regarding the duration of the sanctions, assuming a duration of approximately three years before returning to pre-war baseline (equilibrium) levels.

Modelling the Cypriot Recovery and Resilience Plan

Employing the same modelling tool as above, we performed two sets of policy simulations:

RRP investments tied to grants and loans, excluding structural reforms, against a neutral policy baseline. In Cyprus, the RRP offers grants and loans totaling 1.2 billion euro, equivalent to around 4.8% of its GDP. We allocate 75% of these funds to public investment and 25% to enhancing public consumption, assuming a linear spending profile from 2021 to 2026. Grants are assumed to be budget neutral.

RRP structural reforms. Quantifying reforms presents significant challenges in economic modeling terms due to assumptions about how structural reforms impact the macroeconomy. Therefore, our analysis focuses only on a subset of the Cypriot RRP reforms, that is: product market (e.g., business competitiveness support), productivity (e.g., digitalization of the public sector, R&D), and labor market (e.g., increasing labor force participation). Then we link these reforms to structural indicators, relying on empirical literature to guide us on their impact on economic variables (i.e. the elasticity of specific variables to a change in each of these indicators). We gathered indicators across three policy areas: market competition and regulation (OECD Product Market Regulation Index), labor markets (e.g., labor force participation rates), and productivity (e.g., EU Innovation Scoreboard, EU Justice Scoreboard). We then map these indicators into our model and simulate the macroeconomic impact of closing half the gap between Cyprus’s current status and the EU’s best performers in each area (see Malliaropoulos et al, 2022, and Pfeiffer, P., Varga, J. and Veld, J., 2023 for a similar exercise)

Predictions about the macroeconomic impact of sanctions.

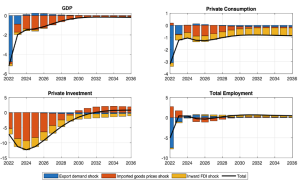

The reduction in exports of goods and services to Russia and the decline in inward FDI from Russia have a notable negative impact on aggregate demand. Collectively, our model indicates an average overall reduction in aggregate output of about 5.5% in the short term. The most substantial impact stems from the decrease in demand for exported and services to Russia, resulting in approximately a 4.5% loss in GDP. Furthermore, as import prices rise, leading to increased input costs, private investment decisions are being hit negatively, leading firms to likely transfer some of these costs to output prices which exerts significant long-lasting effects on aggregate output. Among the three scenarios examined, a reduction in inward FDI yields more enduring effects, persisting over multiple periods, albeit of a milder nature.

Figure 3: Impact of EU sanctions against Russia on selected macroeconomic variables of Cyprus (% deviations from the baseline year)

Note: We assume that the baseline year is 2022 (i.e. the first year of EU imposing sanctions on Russia)

Predictions about the impact of RRP investments and reforms

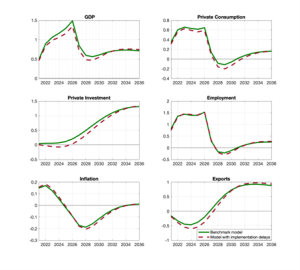

Our numerical results show that RRP investments can contribute to a maximum increase of up to 1.5% of GDP by 2026 fading away gradually (Figure 4). This is a combination of demand and supply driven effects mostly attributed to public investment projects and the buildup of public capital stock. Demand side effects enhance GDP and private consumption in the short-run along with mild crowding out effects on private investment and inflationary pressure. However, in the medium to long-run the effects of public investment materialize and the economy becomes more competitive as implied by the increase of exports.

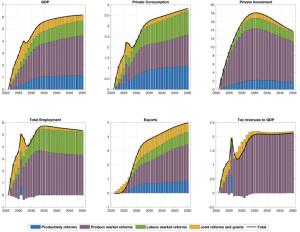

In turn, RRP reforms (Figure 5) aiming to reduce the gap with best EU performers in specific policy areas can yield significant long-term improvements in growth potential and key macroeconomic variables. As illustrated in Figure 5 their impact could reach a 3% increase in GDP in the short-run (i.e. by 2027) up to more than 5% in the medium to long run. We also examine the broader macroeconomic impact. For instance, reforms may boost tax revenues and reduce debt ratios. Significant increases in employment primarily result from reforms that stimulate labor force participation (illustrated by the bars in green) while enhancement of product market regulation (illustrated by the bars in purple) plays also a crucial role in driving private consumption growth and significantly encourages private investment. The joint implementation of RRP investments and reforms could produce over a 6% increase in the long run level (by 2050) of GDP.

Figure 4: Impact of RRP investments (grants and loans) on selected macroeconomic variables (% deviations from baseline)

Note: We assume that the baseline year is 2021 (i.e. the first year of RRP implementation)

Concluding remarks

Our analysis has indicated significant but short/medium-lived negative impacts from EU sanctions against Russia for the economy Cyprus. Perhaps this partly explains growth slowdown of the Cyprus’s growth in 2023. Uncertainties surrounding the duration of sanctions and the broader conflict, as well as Cyprus’s ability to pivot its export and FDI strategy away from Russia, play crucial roles in determining the overall effect in the near future. However, caution is warranted in interpreting our results. Timely absorption and monitoring of projects funded by the EU are vital for the success of the RRP, as Cyprus, like other EU member states, is already receiving substantial grants but must implement reforms more rapidly than in the past. Additionally, persistent inflationary pressures stemming from the current geopolitical tension in the Middle East may hinder the efficient implementation of the RRP, undermine its anticipated benefits and pose additional challenges, contrary to our study’s findings.

Figure 5: Impact of RRP investments on selected macroeconomic variables (% deviations from baseline year)

Note: We assume that the baseline year is 2021 (i.e. the first year of RRP implementation)

References

Ciapanna, E., Mocetti, S. and Notarpietro, A. (2022). The macroeconomic effects of structural reforms: An empirical and model-based approach.

Crozet, M. and Hinz, J. (2020). Friendly fire: The trade impact of the russia sanctions and counter- sanctions. Economic Policy, 35 (101), 97–146.

Garicano, L., Rohner, D. and Weder, B. (2022). Global Economic Consequences of the War in Ukraine Sanctions, Supply Chains and Sustainability. Centre for Economic Policy Research.

Hufbauer, G. C. and Jung, E. (2020). What’s new in economic sanctions? European economic review, 130, 103572.

Malliaropulos, D., Papageorgiou, D., Vasardani, M. and Vourvachaki, E. (2021). The impact of the recovery and resilience facility on the greek economy. Bank of Greece Economic Bulletin,

Pfeiffer, P., Varga, J. and Veld, J. (2023). Unleashing Potential: Model-Based Reform Benchmarking for EU Member States. Tech. rep., Directorate General Economic and Financial Affairs (DG ECFIN), European Commission

Pfeiffer, P., Varga, J. and Veld, J. (2022). Quantifying spillovers of coordinated investment stimulus in the eu. Macroeconomic Dynamics, pp. 1–23.

*The Hellenic Observatory hosted a research seminar on the topic on 12 March 2024. For more information please visit the event page.

Note: This article gives the views of the author, not the position of Greece@LSE, the Hellenic Observatory or the London School of Economics.

Source link : https://blogs.lse.ac.uk/greeceatlse/2024/04/18/cyprus-and-the-eu-sanctions-on-russia-macroeconomic-impacts-and-policy-recipes-for-a-sustained-recovery/

Author :

Publish date : 2024-04-18 07:00:00

Copyright for syndicated content belongs to the linked Source.