Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

US investors have stepped up funding in European defence technology start-ups, accounting for the largest chunk of private capital flowing to the burgeoning sector this year amid a rise in global conflicts.

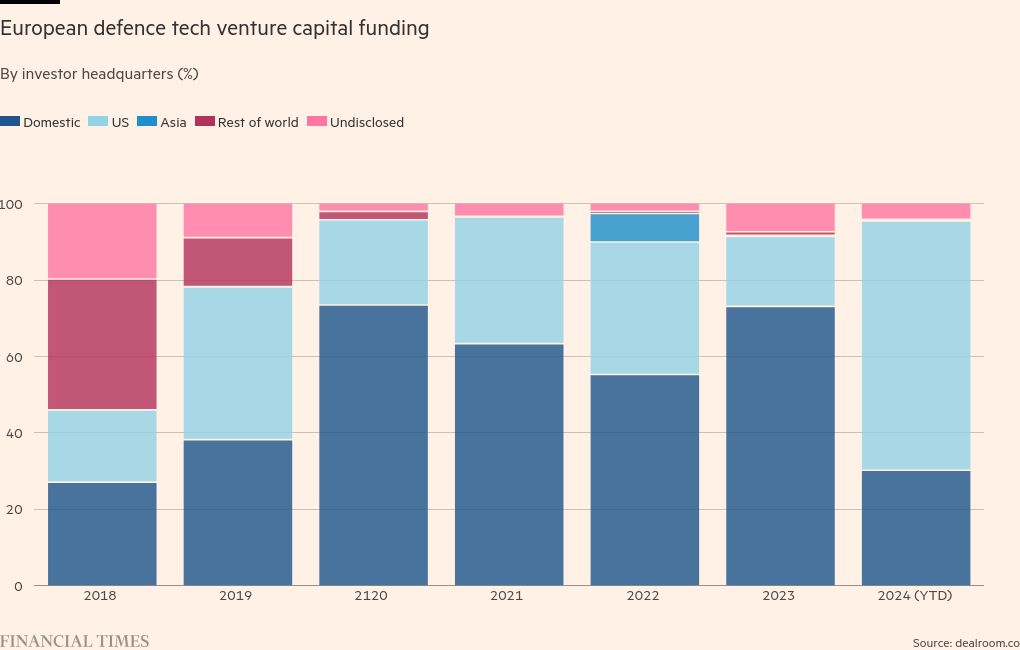

The US provided more than 65 per cent of venture capital defence tech investment in Europe so far this year, according to Dealroom data, up from 18 per cent in 2023. The increase marks a sharp reversal from the previous year, when more than half of VC funding for defence tech in Europe came from domestic investors.

US venture capital firms have provided $458mn to European defence start-ups in the year to date, more than three times higher than the sum invested any other year, according to Dealroom. Overall, VC investments into Europe have grown nearly fivefold since 2018 and are set to hit $1bn this year.

The largest US-led deal included a €450mn fundraising for Munich-based Helsing this summer, which was led by General Catalyst and included Accel and Lightspeed Venture Partners.

The increase, said Lorenzo Chiavarini, who leads research into VCs and start-ups at Dealroom, was a sign that the European start-up sector was maturing, with some companies raising larger rounds where US investors are better placed to contribute more.

Venture investors, in particular in Europe, had long been wary of backing defence tech companies over ethical concerns but that has begun to change since Russia’s full-scale invasion of Ukraine in February 2022.

Although concerns among some investors over the sector’s environmental, social and governance properties are still limiting investment, entrepreneurs and venture capitalists said there was evidence that more European capital was beginning to flow.

There has been a “fundamental step change in Europe because of the emergency we are facing”, according to Khaled Helioui, a partner at Plural, an early-stage investment fund set up two years ago with the aim of helping European founders develop a range of technologies, including defence. Plural has raised €760mn in two fundraisings, with European investors dominating the second round.

“We really care about the sovereignty of Europe and to bring more industrial muscle to the continent,” said Helioui.

Alex Kehoe, founder and chief executive of British start-up Vizgard, which makes AI camera automation software, said access to capital had changed in the past three years. The company’s recent fundraising was not only oversubscribed but was also much more rapid than its previous round in 2021. Vizgard had raised more than £1mn and “very quickly”, he said.

More investors, said Kehoe, had recognised that there was an “urgent need to fund these emerging technologies” with a greater focus on “how quickly it needs to get into the hands of operators”.

Total venture capital raised in Europe since 2018 for defence tech ventures has reached $3bn, according to the Dealroom data, with Germany, the UK and France attracting 87 per cent of this.

Munich captured the most VC funding in Europe, primarily driven by Helsing, the AI-focused start-up seen by some as Europe’s answer to Anduril, the California-based defence tech company. Helsing’s latest fundraising valued the company at about €4.95bn.

The defence tech sector now makes up 1.8 per cent of European VC funding. This has more than tripled since 2022 as the ecosystem across the region has matured.

Despite the higher inflows of capital, industry experts cautioned that challenges remain for European start-ups.

Nicholas Nelson, a partner at MD One Ventures, said he remained doubtful whether a European “Anduril” would emerge, given the fragmented nature of the market, different national requirements and also different views of defence tech across countries.

“Until there are one set of requirements across these countries, it will be difficult and expensive [for a company] to scale,” he said. “It doesn’t mean you can’t do a European one but it will be across certain markets.”

Eric Slesinger, founder of 201 Ventures, cautioned that “capital alone is not the answer”.

Investors, he said, “need to show start-ups they can help navigate the extra difficulties of the defence sector — procurement, lobbying, export controls, or security-cleared talent, for instance — across multiple countries and languages”.

Paul Kwan, managing director at General Catalyst, one of the main backers of Helsing, echoed Slesinger. “The awareness is high, the capital is there, the innovators are there, but capital is not the same as contracts.

“Everyone is focused on capital including the governments but . . . what you need to do is to start buying modern technologies to support these innovators.”

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=6703544195a6442fadfb3768bcd50344&url=https%3A%2F%2Fwww.ft.com%2Fcontent%2Fbcad7a94-8362-4a5a-b2a6-ba0c2757be33&c=3802723405567338686&mkt=de-de

Author :

Publish date : 2024-10-06 20:00:00

Copyright for syndicated content belongs to the linked Source.