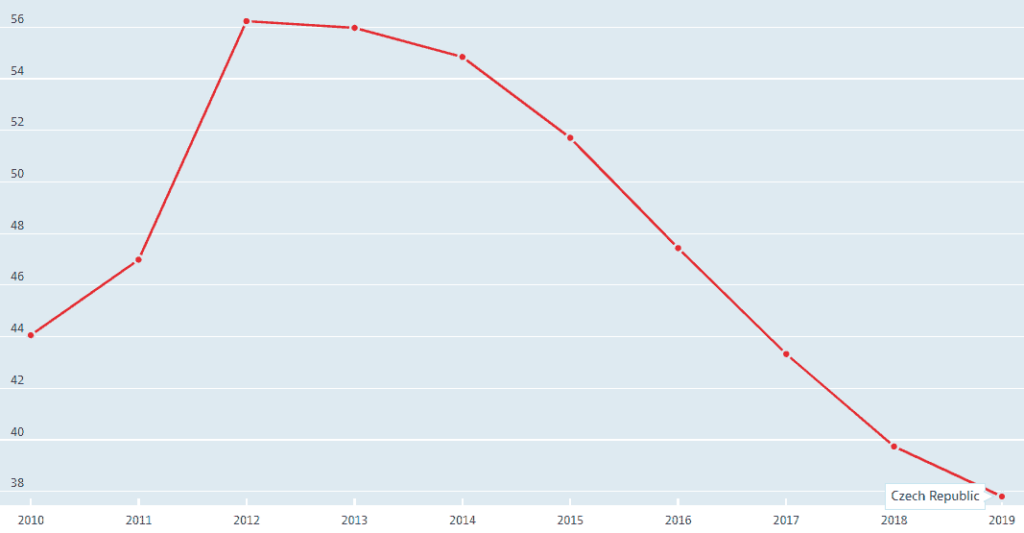

Source: OECD (2019), General Government Deficit, Data (accessed on 12/8/20)

The Czech Republic’s debt to GDP ratio continued to grow until 2013, when it peaked at 44.9%. Since that date, the national debt has declined down to 34.6% by Eurostat measurements.

The government managed to bring its budget deficit above 3% of GDP in 2013 and continued to improve its saving. The Czech government posted budget surpluses for 2016 and 2017.

What Is Czechia’s Credit Rating?

The government of the Czech Republic’s debt management skills has earned it a good credit rating.

All of the major credit rating agencies give the country A-grade ratings both for foreign and domestic currency securities.

The country doesn’t have the very best credit rating, however, it is in the top division.

France and the United Kingdom are only one rung higher than the Czech Republic in the Standard & Poor’s league table.

How Does The Czech National Bank Raise Loans?

The Czech National Bank runs the primary market for Czech government securities and it also oversees the secondary market for those instruments, which is called MTS Czech Republic.

Government securities are sold only to primary dealers by auction. The primary dealers are pre-approved agencies that are expected to sell on their allocations by placing them on the secondary market.

What Securities Does The Czech Government Sell?

The Ministry of Finance, through the Czech National Bank sells Treasury bills to feed short-term financing needs and bonds to cover long-term finance.

The Treasury bills do not pay interest, but are sold at a discount and redeemed at face value. The government issues bills in maturities of 3, 6, 9, and 12 months.

The Czech government doesn’t issue index-linked bonds, which makes accounting a lot simpler because that makes the nominal and face values the same.

All bonds have either a fixed rate of interest or a floating rate. Floating-rate bonds represent 12% of all outstanding debt stock.

Interested in Trading Commodities?

Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Further Reading

Our team have put together live debt clocks for many other countries, including other European nations like Hungary, Austria, France, Switzerland, and Germany.

You can learn about the overall trade and economic health of these countries in our economic guides, along with which instruments you can trade the most imported and exported commodities with.

See our guides on CFDs, options, forex, cryptocurrencies, stocks, and bullion dealers.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=67122e2bae944215a62b6d6220137efa&url=https%3A%2F%2Fcommodity.com%2Fdata%2Fczechia%2Fdebt-clock%2F&c=11293438175792001909&mkt=de-de

Author :

Publish date : 2024-10-16 17:00:00

Copyright for syndicated content belongs to the linked Source.