Data Source: PDMA.gr – Greek National Debt Composition by Funding Instrument

Among these sources are traditional methods that most governments use to raise finance:

Benchmark Bonds: long-term debt instruments that have maturity dates of more than a year. They pay an interest rate that is written on the bond certificate and the Greek government promises to repay the full amount of the loan on the maturity date of the bond.Treasury Bills: short-term debt instrument that has a maturity of less than a year. These do not pay any interest, but are sold at a discount and redeemed at full face value.

Despite problems with debt, the Greek government still issues both bonds and Treasury bills.

Both devices are tradeable and can be bought and sold on the open market.

Has Debt Restructuring Reduced the Greek National Debt?

Despite Greece getting €100 billion of its debts cancelled, the debt has continued to increase.

The haircut removed the need for the Greek government to reduce its generous social security system, which was the major cause of its permanent budget deficit.

Furthermore, the Greek constitution bans parliamentary scrutiny of the national defense budget, which means many expenses of the government can be hidden and run through the military.

It turned out that the defense budget incurred massive unpaid debts, including a withheld payment to a German manufacturing syndicate for four submarines that didn’t work.

Were There Any Other Hidden Debts In Greece?

Once more hidden spending was revealed, the official national debt figure increased.

The IMF and the ECB insisted on the government ceasing to offer subsidies to state-owned enterprises. The result of these measures was a collapse in infrastructure investment and an increase in charges for utilities.

These two factors both increased the figure of the national debt and reduced the country’s GDP.

How Are Greece’s Debt-GDP Ratios Measures?

Economists are not so interested in the absolute value of a country’s debt, but examine debt as a proportion of the nation’s income, which is called Gross Domestic Product, or “GDP.”

To learn about Greece’s GDP health, their most exported and imported products, and how the nation’s economy stands on a global scale, see our Economic Overview Of Greece.

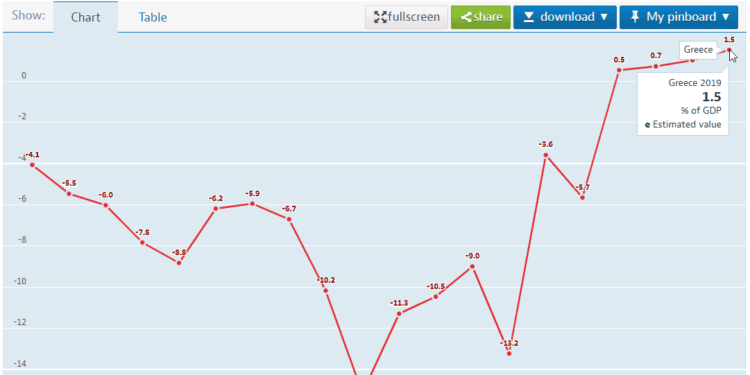

Higher debt, combined with lower GDP greatly increased Greece’s debt-to-GDP ratio. The graph below shows how the Greek debt-to-GDP ratio has risen since the “bail out” began.

Source: OECD (2019), General Government Debt, Data (accessed on 12/8/20)

In 2007, before the crisis struck, the nation’s debt to GDP ratio was 103.7%. This could be considered high.

However, after the creditor haircut, the IMF assistance, and the ECB loans, Greece’s debt to GDP ratio reached 178.6%, having reached 180.8% in 2016.

Who Does Greece Owe The Most Money To?

Now, the majority of Greece’s national debt is owed to the IMF, the ECB, and various EU schemes. One condition of these loan contracts was that the Greek government will not be allowed to demand a haircut from those creditors.

The Greek bailout didn’t offer the country a way out of its debt, which, in terms of a percentage of GDP is now the second-highest in the world after Japan.

What facts should you know about Greece’s national debt?

You could wrap $1 bills around the Earth 1,991 times with the debt amount.

If you lay $1 bills on top of each other they would make a pile 55,865 km, or 34,713 miles high.

That’s equivalent to 0.15 trips to the Moon. Interested in Trading Commodities?

Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Further Reading

To see the live debt clocks of other countries with information on debt management, see our guides on:

Or, you can explore the economic profiles of countries like Sweden, Australia, Austria, Spain, Indonesia, and Poland.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=67122df30ebe485bb9358a81e83c9567&url=https%3A%2F%2Fcommodity.com%2Fdata%2Fgreece%2Fdebt-clock%2F&c=545067083067523320&mkt=de-de

Author :

Publish date : 2024-10-15 16:59:00

Copyright for syndicated content belongs to the linked Source.