Introduction

One of the key decisions issuers will face when launching an ETF in Europe is where it should be domiciled.

While there are several jurisdictions asset managers can choose from, Ireland and Luxembourg are seen as the primary locations given their regulatory competence and market expertise.

In recent years, Ireland has grown to become the dominant country in which to house ETFs in Europe. This is down to several factors that the two areas have diverged on, but mainly concerns the favourable Double Taxation Treaty between Ireland and the US.

Tax divergence

The Double Taxation Treaty between Ireland and the US means ETFs with US equity exposure are subject to a 15% rather than a 30% withholding tax on dividends.

This is also the case for global equity funds, where the US accounts for roughly 68% of the MSCI World index.

The amount investors benefit from the withholding tax depends on the current dividend yield of the ETF they have invested in.

For example, if the dividend yield on the S&P 500 is 2%, investors will benefit from an annual tax saving of 30 basis points (bps).

ETFs in Luxembourg also have tax advantages due to their exemption from paying an annual subscription tax of five bps, which still applies to mutual funds.

Tax advantages have become a powerful driving force behind where ETFs have been domiciled in recent years and helped Ireland become Europe’s dominant jurisdiction for the wrapper.

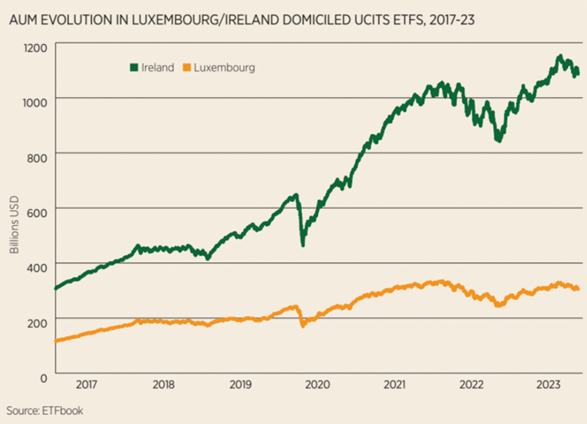

For example, at the start of 2017, there were 199 exchange-traded products (ETPs) with $305bn assets under management (AUM) domiciled in Ireland, ahead of Luxembourg which had 146 ETFs with $115bn AUM, according to data from ETFbook.

This has risen to 2,722 ETPs with $1.1trn AUM in Ireland versus 1,364 ETPs across $305bn in Luxembourg, as at the end of October 2023.

Regulatory divergence

Notable differences have also arisen between the way the Central Bank of Ireland (CBI) and the Luxembourg regulator, the Commission de Surveillance du Secteur Financier (CSSF), interpret regulatory guidance from the European Securities and Market Authority (ESMA).

The CBI has taken a more literal approach to transposing ESMA’s ETF rules while the CSSF has been more flexible in its application.

One such example is the UCITS naming convention. Under the convention, asset managers are required to use ‘UCITS ETF’ in the fund name if it offers an ETF share class alongside its mutual fund share classes.

However, several issuers have created listed share classes of their Luxembourg-domiciled mutual funds without changing the name to ETF.

Conversely, HSBC Asset Management was required to relabel four global index funds to ETFs when it became the first issuer to offer listed and unlisted share classes within an Irish Collective Asset Management Vehicle (ICAV).

Another topic on which the two jurisdictions diverge is portfolio transparency. The most recent International Organisation of Securities Commission’s (IOSCO) ETF Good Practices highlighted Luxembourg’s approach to portfolio disclosure on a “lagged basis”, typically monthly.

Ireland on the other hand requires ETFs to publish their portfolios daily, offering more transparency for investors.

With tax and regulatory differences between the two, there is plenty to consider when launching an ETF via an ICAV in Ireland, or a Société d’Investissement à Capital Variable (SICAV) in Luxembourg.

Key takeaways

Ireland’s favourable US tax treaty makes it the dominant domicile for US equity ETFs

Ireland’s stricter adherence to ESMA ETF rules leads to clearer naming conventions and daily portfolio transparency while Luxembourg offers more flexibility in the interpretation

ETF issuers must weigh tax benefits against regulatory differences when deciding between Ireland’s ICAV and Luxembourg’s SICAV structures for domiciling ETFs

Source link : https://www.etfstream.com/education/regulation/ireland-vs-luxembourg-domiciling-etfs-in-europe

Author :

Publish date : 2024-03-01 08:00:00

Copyright for syndicated content belongs to the linked Source.