(Bloomberg) — The Czech economy is confronting a series of potential inflationary risks that warrant a consideration of pausing interest-rate cuts, a top central banker said.

Most Read from Bloomberg

Vice Governor Eva Zamrazilova said she’ll weigh whether to keep the benchmark rate unchanged at the Nov. 7 meeting or to back another quarter-point reduction. While several rate setters, including Governor Ales Michl, have urged caution on further policy easing, Zamrazilova is the first board member to consider a no-change on rates as early as the next meeting.

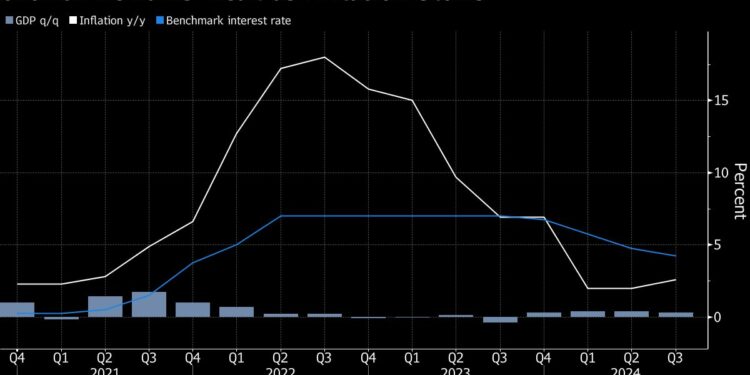

The Czech Republic’s $330 billion economy has lagged European Union peers in the region’s recovery from the pandemic and the regional energy crisis. The Czech National Bank has responded by slashing borrowing costs by a cumulative 275 basis points over the last year to 4.25%. Policymakers have slowed the pace of monetary easing at the last two meetings.

“I still see room for rates to decrease further, but I’m evaluating how to spread the rate cuts in time,” Zamrazilova said in an interview in Prague on Wednesday. Her decision will hinge on discussions with board members, a review of new forecasts and policy action abroad, she said.

Market pricing has implied another quarter-point cut next week, though investors have scaled back bets on further easing in December after inflation temporarily picked up speed last month.

Zamrazilova has long called for careful steps. She was in the minority of board members who urged a slower pace in June, warning that a drop in food prices could go into reverse. While more robust food prices now may not threaten the inflation goal, she said stubborn cost-of-service growth and a rebounding housing market may add longer-term pressure.

“The inflationary risks to fulfilling the target next year are prevailing at the moment, and I see that as a reason for caution,” Zamrazilova said.

While many emerging markets have experienced increased volatility as investors position for the US presidential election, the Czech currency shouldn’t face significant turbulence, according to the vice governor.

“I’m not expecting any dramatic impact on the koruna, and if there is some reaction, it shouldn’t last for too long,” she said.

The latest economic growth data confirmed the picture of a gradual recovery in household consumption, while investment activity is subdued and foreign demand remains affected by economic woes in Germany, the key market for Czech exporters, Zamrazilova said.

Story Continues

Still, retail sales and consumer-sentiment data point to stronger household spending than in the first half of the year, while energy prices — which affect shopping behavior — have “calmed down” and show a more positive trend than last year or at the beginning of this year, according to the vice governor.

Household consumption will probably accelerate further next year, helped by growing real wages, but the central bank’s next forecast will likely register slower growth, mainly because of a worsening global outlook than previously expected, Zamrazilova said.

But the Czech economy will hopefully experience a calmer period in 2025 — and the central bank’s policy won’t have to respond to major crises, the vice governor said.

“We have managed to bring inflation down and stabilize it in the desired range, and now it’s about the fine-tuning of monetary policy,” she said. “It’s about how many cuts are still possible and about finding the right timing for them.”

(Updates with comments on the koruna starting in the eighth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=672348112ada4cdfbe69359945d69ad2&url=https%3A%2F%2Ffinance.yahoo.com%2Fnews%2Fczech-central-banker-says-risks-040000672.html&c=15847778407991351365&mkt=de-de

Author :

Publish date : 2024-10-30 22:50:00

Copyright for syndicated content belongs to the linked Source.