(Bloomberg) — Northvolt AB filed for bankruptcy protection in the US after a desperate bid to secure rescue funding fell short, leaving the struggling battery maker with just one week’s cash in its accounts.

Most Read from Bloomberg

The Swedish electric vehicle supplier will seek to restructure under Chapter 11 of the bankruptcy code, it said in a statement on Thursday. Northvolt had about $30 million in available cash, it said in a filing, and $5.84 billion in debt.

The company decided to take the US legal route to provide a well-known framework for existing investors and third parties that have shown interest in providing financing, a person familiar with the matter said.

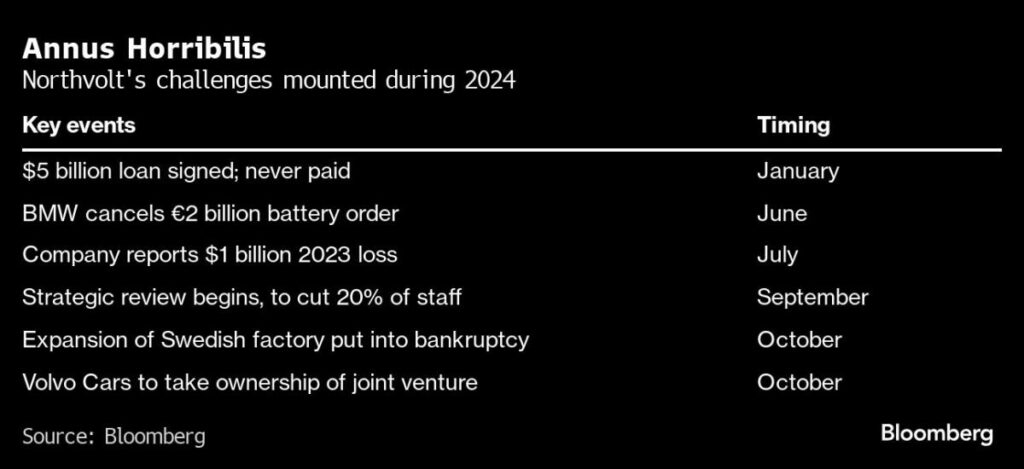

The move caps months of talks with owners, customers and creditors to find a way for Europe’s rare homegrown maker of EV batteries to move forward after funds ran short. The company slashed jobs and nixed expansion plans in a bid to overcome a cash squeeze that intensified over the autumn, after it lost a key contract and was unable to access $1.5 billion in loan guarantees.

Northvolt said its main factory near the Arctic Circle in Sweden will operate as usual during the reorganization. “The company will continue to make deliveries to customers, while fulfilling obligations to critical vendors and payment of wages to employees,” according to the statement.

Through the court process, Northvolt will have access to about $145 million in cash collateral, the company said. Scania CV AB, the truckmaking unit of Volkswagen AG and a key Northvolt customer, told Bloomberg separately that it will provide $100 million in debtor-in-possession financing.

Northvolt subsidiaries responsible for planned factories in Germany and Canada remain outside of the Chapter 11 process, though the company said in court filings that they will be postponed.

European Independence

While Northvolt is privately held, it was seen as a standard bearer for European hopes to stand up an independent supply chain for electric vehicles, countering the dominance of well-established Chinese and South Korean battery makers.

In recent weeks, Northvolt held intense negotiations involving lenders, shareholders and customers over a more than $300 million rescue proposal meant to tide the company over as it sought longer-term funding. When no deal materialized, the battery maker was left to seek protection from creditors.

Story continues

The company’s court filings showed how reliant Northvolt had become on key customers. Its debts include a $330 million convertible instrument from Volkswagen, its biggest shareholder, that’s due in December 2025.

The company lost $1.2 billion in in 2023, which it attributed to Asian manufacturers driving down prices.

Its hopes are now pinned to one overarching objective, it said: “To partner with one or more long-term strategic or financial investors,” according to Scott Millar, a senior managing director at Teneo, Northvolt’s financial adviser.

Some Northvolt investors had been willing to go along with the rescue plan. Sweden’s 4 to 1 Investments said in a statement that it was prepared to support Northvolt with additional capital, but “there was not support from a sufficiently broad group of the company’s key stakeholders.”

The state-owned pension funds had invested about 5.8 billion kronor ($520 million) in Northvolt shares and convertible debt.

Northvolt opened its main plant in Skelleftea, near the Arctic Circle, in 2021, but was unable to meet targets for ramping up volumes. Meanwhile, its EV end market weakened, while stronger competitors drove down battery prices. In June, shareholder BMW AG canceled a $2 billion battery order over quality issues.

Northvolt soon launched a review of its sprawling growth plan. It decided to slash 20% of its global work force, replaced the CEO of the flagship plant and bankrupted a unit dedicated to expansion in Skelleftea.

Volvo Car AB initiated proceedings last month to take over their joint venture, while the representative from Volkswagen stepped down in November.

Sweden’s government, which for weeks rebuffed any suggestions of providing cash aid to Northvolt, “continues to support a viable battery industry and the green transition,” Deputy Prime Minister Ebba Busch said in a post on X, adding that she “hopes that the Chapter 11 process allows for a possibility to find a long-term solution” for Northvolt.

The German government said it stands by its support for Northvolt and the project in Heide, and will keep up a dialogue with the company, the Swedish government and other key players.

Northvolt Chief Executive Officer Peter Carlsson said this month that the company needed more than $900 million to permanently secure its finances, and that the company was looking for partnerships, including in Asia.

Northvolt took in some $10 billion in debt and equity financing since its founding, including support from the European Investment Bank, Sweden’s Export Credit Corporation and the Nordic Investment Bank.

“We strongly believe in Northvolt’s ability to navigate through this period,” founding shareholder Vargas Holding AB said in a statement. “A Chapter 11 reorganization will provide stability to turn around this challenging situation.”

Northvolt is being advised by Teneo as its restructuring and communications advisor. Kirkland & Ellis LLP, A&O Shearman and Mannheimer Swartling Advokatbyra AB are serving as legal counsel. The company has also engaged Rothschild & Co to run its marketing process.

The case is Northvolt AB, 24-90577, US Bankruptcy Court, Southern District of Texas.

(Updates with cash, other details from bankruptcy filing.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=673fa4c85256416aac2a9949fbfc7a57&url=https%3A%2F%2Fuk.finance.yahoo.com%2Fnews%2Fnorthvolt-files-bankruptcy-blow-europe-174730086.html&c=2475792779103775883&mkt=de-de

Author :

Publish date : 2024-11-21 10:23:00

Copyright for syndicated content belongs to the linked Source.