(Bloomberg) — Felix Patrascanu’s courier service has been thriving. The government pushed up salaries and pensions so his customers had more money to spend. It built new roads that kept his fleet of vans moving and his business growing into the largest of its kind in Romania.

Most Read from Bloomberg

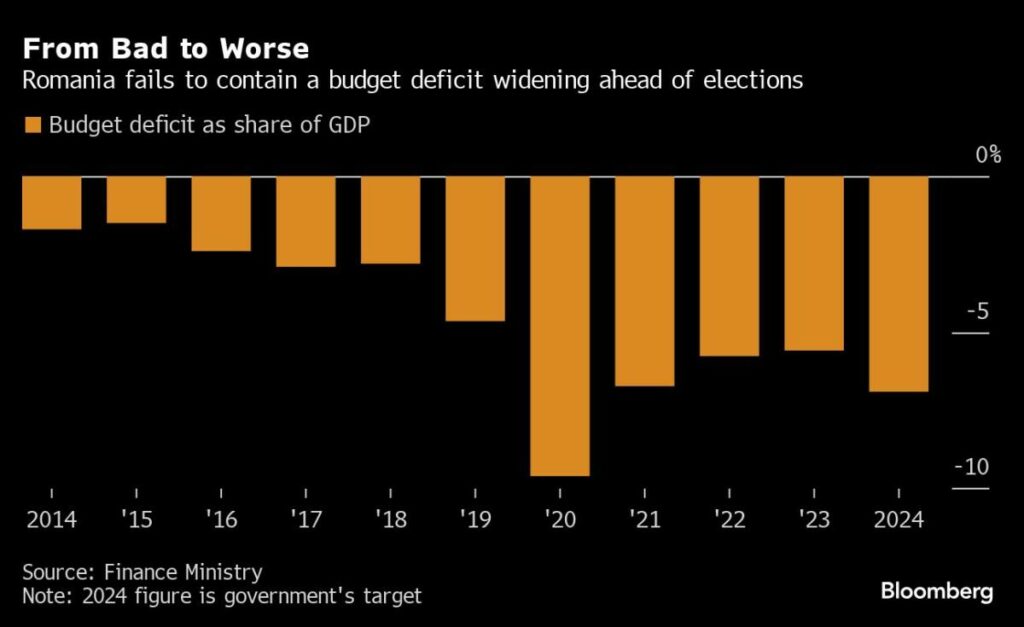

Yet the fallout from that largesse has now become his biggest concern as the country holds back-to-back elections starting this weekend: Romania has the widest budget deficit in the European Union, and addressing it is going to hurt.

The campaigns for the presidential and parliamentary votes have split the governing coalition and polarized citizens to the benefit of an ultra-nationalist party. Whoever takes charge will face the challenge of fixing Romania’s finances after the pandemic, rampant inflation, the war in Ukraine and government spending put the country on course for a painful reckoning.

In a three-hour debate earlier this week on Digi24 television among candidates for president, all of them vowed to take measures to halt the fiscal deterioration, and most of them promised to push for a cut in spending should they be elected.

Top of Patrascanu’s concerns is that the retrenchment will jeopardize already fragile economic growth, with investments delayed or halted and ultimately his profit at risk. His company, FAN Courier, has annual revenue of more than $250 million and has expanded into Hungary and Poland, among others.

“For us, any legislative change that triggers a decline in profitability means lower investments,” said Patrascanu, who founded FAN almost three decades ago with two friends. “That translates into lower revenue for the state budget and less value added for the economy. It’s not a complicated equation.”

Romanians vote in the first round of the presidential election on Nov. 24, followed by the parliamentary vote a week later and the likely runoff for head of state on Dec. 8.

(Sign up to our Eastern Europe Edition newsletter, delivered every Friday.)

The ballots come after relative calm in Romanian politics following an agreement three years ago by the two biggest rivals, the Liberal Party and Social Democrats, to form a grand coalition.

The pact drew a line under a decade marked by political turmoil and mass protests. It also heralded what officials and executives have called a “golden age” of economic development, albeit at a cost. The budget deficit is expected to soar to more than 7% of gross domestic product versus the 3% threshold set for EU members.

Now the two parties are vying to replace Klaus Iohannis as president and win power, with Prime Minister Marcel Ciolacu of the Social Democrats ahead in the polls and wanting to restore the coalition to keep out the nationalists who want to end military support for Ukraine. Their leader, George Simion is currently second, behind Ciolacu.

The Liberals, meanwhile, could team up with the anti-corruption Save Romania Union led by another presidential candidate, Elena Lasconi.

The one sure thing is that Romania will have to confront its fiscal hole, regardless of who prevails. “If we cannot form a right-wing coalition, there’s an option to agree on a government run by specialists to help steer the country next year, which is going to be a very tough one,” Lasconi said in an interview. “Everybody expects tax increases.”

Romania’s public debt is expected to break record after record in the coming years, forcing the country of 19 million people to continue to borrow heavily from both the local and international markets. That’s already translating into the highest borrowing costs among regional peers, putting pressure on the country’s credit rating.

The political wrangling over how to raise revenue is focused on how to improve tax collection and simplify the system. The current flat rate has multiple exemptions and Romania lags behind the rest of the EU when it comes to the share of budget revenue derived from taxation.

“Romania will meet its commitments regarding the country’s finances,” Ciolacu said by email in response to questions. “There are measures that can be taken to improve revenue, without raising taxes, through better collection, digitalization and a more efficient state.”

The biggest issue for companies is that the effort to right Romania’s finances could deter future investment, according to Christian von Albrichsfeld, who runs the Romanian business of German automotive parts producer Continental AG. The country needs to create jobs in regions where multinationals aren’t present, and that takes money, he said.

“For the next government, we just need to make sure Romania remains competitive,” von Albrichsfeld, who is responsible for about 20,000 employees in Romania, said in an interview in Bucharest. “We need to have some small, Romanian companies, which are supported by the state, because if more people are working, more people are paying taxes and social contributions and that’s how you solve the budget problem.”

Ciolacu said the splurge in spending that blew out the budget was needed to revive the country. Romania had the fastest convergence toward Western European living standards and surpassed EU members such as Greece and Hungary in terms of purchasing power.

The focus on improving some of the continent’s worst roads has also borne fruit in the past two years, with Ciolacu opening several new highway sections and showing up in person to check ongoing works.

“We put our ego aside and we worked together,” he said by email. “We managed to restart the economy, we raised incomes and put things in order. It hasn’t been easy, but we managed to ensure stability and take the country out of the crisis.”

But times have changed. The $350 billion economy barely avoided recession in the past two quarters, while the government has asked the European Commission to give it seven years to comply with the 3% budget deficit limit to avoid further deterioration.

The country is also still home to the poorest regions in the EU and has the largest share of any population exposed to the risk of poverty. Rapid increases in the minimum wage, promoted by all the governments in the past decade, only had limited impact. Companies were hit by higher workforce costs and shrinking pool of skilled workers.

Faced with the state of the public finances and the fragmented political landscape, voters will have one eye on their own pockets and the other on the longer-term stability of the country. For Patrascanu at FAN Courier, that’s also complicated by the return of Donald Trump to the White House and increase in tension in Ukraine.

“We used to ask for predictability,” he said. “But we let that go recently because with a war at the border and with everything else that’s happening in the world, we all feel that we’re sitting on a gunpowder barrel.”

–With assistance from Patrick Donahue.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=674056edb3454644a7f9d0b6d05f789c&url=https%3A%2F%2Fwww.yahoo.com%2Fnews%2Flooming-financial-pain-casts-shadow-050009675.html&c=7826594961655324283&mkt=de-de

Author :

Publish date : 2024-11-21 23:35:00

Copyright for syndicated content belongs to the linked Source.