Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

European politicians pay lip service to the need to consolidate the continent’s fragmented banking sector. Faced with actual or potential bids — mostly emanating from ambitious Italian lender UniCredit — their instincts run in the opposite direction.

For an idea of the scale of political foot-dragging, just think that Italy’s finance minister Giancarlo Giorgetti has suggested he may call in UniCredit’s €10bn bid for Banco BPM under “golden power” rules, ordinarily used to shield strategic industries on national security grounds. Meanwhile, the outgoing German government has reacted to its approach for Commerzbank by saying ‘‘nein, danke”.

Such noise is unhelpful — not least for investors in European banks, whose discount to US peers has recently widened.

After a big rally this year, the Euro Stoxx banks index has fallen 6 per cent over the past month. Over the same period, the KBW index of US banks is up 11 per cent. As a consequence, a valuation gap has yawned. European banks now trade at 6.5 times forward earnings, according to Bloomberg, less than half the 14 times that US banks command.

In part, this reflects the fact that US lenders are just better businesses. European banking is complex. Its lenders are smaller. It serves customers that operate in a low-growth environment. Since Donald Trump won the US presidential election this month, Europe’s future looks bleaker still. The impact of the president-elect’s threatened tariffs may be hard to gauge, but it does not bode well for the European economy and its lenders. All this is reflected in consensus estimates, which see net income at European banks declining 1 per cent next year, while at US banks it is expected to grow 8 per cent.

Yet improving prospects at US banks only tell part of the story. Looking forward a year or two, the valuation gap to European lenders narrows, rather than closes. The rest appears to be a combination of habit, sentiment and a general dislike of what is considered a politically fraught sector.

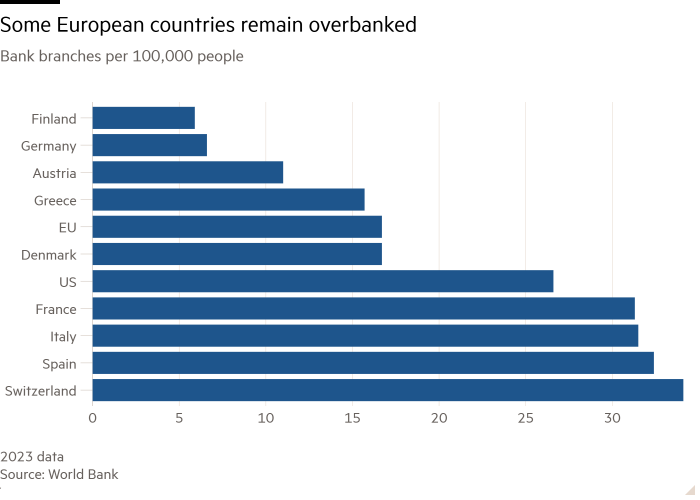

Any evidence of consolidation would help. For one, it would create value. Some European countries are still overbanked. Italy, for instance, has more than 31 bank branches for each 100,000 people, says the World Bank — or 15 per cent more than the US. In this context, tie-ups between lenders can cut heaps of costs: UniCredit has identified savings equivalent to a third of BPM’s cost base.

Dealmaking would serve another purpose. Consolidation could ease fears that this is a sector forever bedevilled by political meddling — a major cause of the valuation gap in the first place.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=6747e2f2be6d4beeb67f63272e7a86b0&url=https%3A%2F%2Fwww.ft.com%2Fcontent%2Fc06a27d8-0736-4788-95f3-a8b99d62df74&c=12627795942276866943&mkt=de-de

Author :

Publish date : 2024-11-27 08:30:00

Copyright for syndicated content belongs to the linked Source.