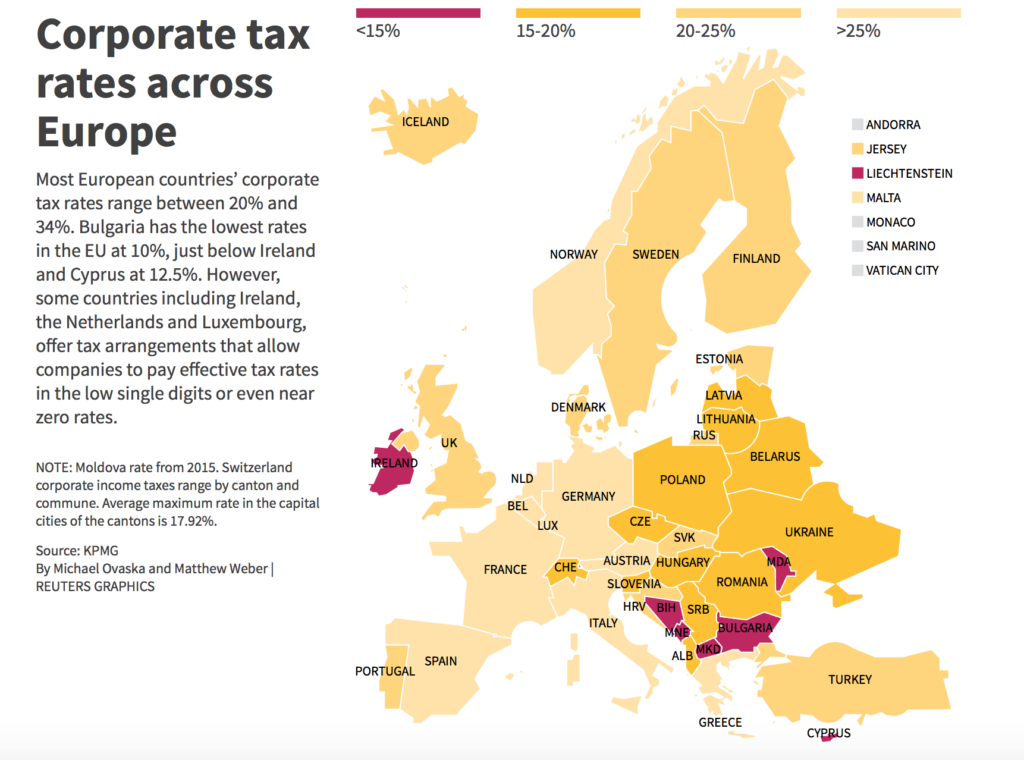

NOTE: Moldova rate from 2015. Switzerland corporate income taxes range by canton and commune. Average maximum rate in the capital cities of the cantons is 17.92%.

NOTES: Moldova rate from 2015. Switzerland corporate income taxes range by canton and commune. Average maximum rate in the capital cities of the cantons is 17.92%.

Source: KPMG

By Matthew Weber | REUTERS GRAPHICS

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=67543098e4864ed9899bc9c0278716c7&url=https%3A%2F%2Fwww.reuters.com%2Fgraphics%2FEU-APPLE%2F010021JR3SJ%2F&c=2967045445665237391&mkt=de-de

Author :

Publish date : 2024-12-06 20:47:00

Copyright for syndicated content belongs to the linked Source.