On the lower end, Ireland posted an annual rate of just 0.5%, followed by Lithuania and Luxembourg, both at 1.1%.

Compared with October 2024, annual inflation fell in four Member States, remained stable in three and rose in 20, Eurostat said.

Core inflation, which excludes volatile items such as food and energy, remained steady in the month at 2.7%.

In November, the highest contribution to annual euro area inflation rate came from services, up by 1.74 percentage points, followed by food, alcohol and tobacco which rose by 0.53 percentage points.

The European Central Bank (ECB) has cut rates four times since June this year in a bid to help the faltering economy as the threat of inflation continues to fall.

The bank’s main lending rate is now at 3%, falling by 0.25% last week at the Governing Council’s most recent meeting.

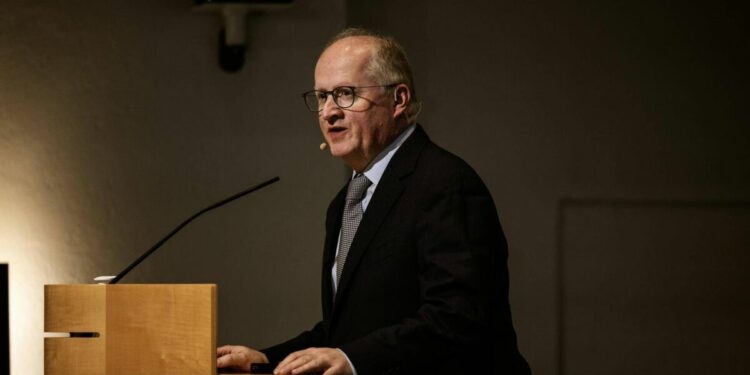

However, speaking on Thursday, ECB chief economist Philip Lane said the bank must keep an open mind about the pace of interest rate cuts as lingering risks in the global economy could still shift the outlook for inflation.

“In the current environment of elevated uncertainty, it is prudent to maintain agility on a meeting-by-meeting basis and not pre-commit to any particular rate path,” said Mr Lane.

“In the event of downside shocks to the inflation outlook and/or to economic momentum, monetary easing can proceed more quickly,” he added.

Following last week’s rate reduction, ECB officials across the spectrum have signalled further cuts, with most indicating that they’re willing to bring borrowing costs to a neutral level and that neither restricts or stimulates economic activity.

Additional reporting from Bloomberg.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=6762c476e9e04b329c7169ce0bbbc760&url=https%3A%2F%2Fwww.irishexaminer.com%2Fbusiness%2Feconomy%2Farid-41539067.html&c=7341960892373193893&mkt=de-de

Author :

Publish date : 2024-12-18 03:38:00

Copyright for syndicated content belongs to the linked Source.