(Bloomberg) — Sovereign bonds in eastern Europe are having a weak start to the year as a potent mix of economic and political risks weighs on the asset class.

Most Read from Bloomberg

A strong dollar, jumping global yields, sluggish economic growth and renewed inflation fears are putting investors from Poland to the Balkans on edge just as Donald Trump prepares to take over the presidency in the US.

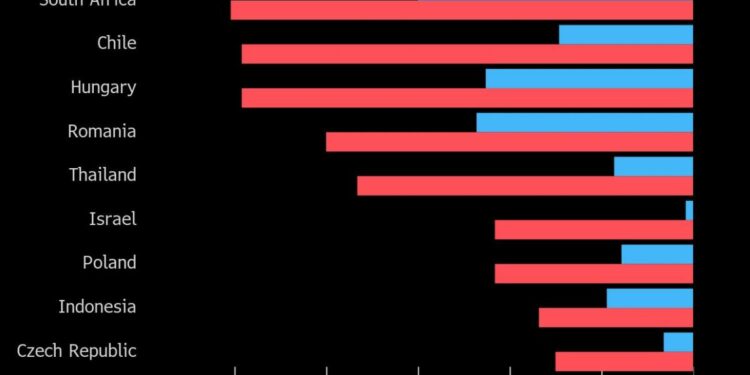

In dollar terms, local-currency bonds from Hungary, Romania, Poland and the Czech Republic have all been among the 10 worst performers in emerging markets so far this year, according to data compiled by Bloomberg. Hungary stood out with a total negative return of 2.5% through January 10, followed by Romania with a 2% negative return.

Poland, Hungary and Slovenia kicked off the year with another rush in eurobond sales, bringing in a total of €6.5 billion ($6.6 billion) between them. Overall, EM issuance has increased 10% to $34 billion year to date, with other deals ranging from Saudi Arabia to Mexico.

As that initial dash to sell winds down, finance ministry chiefs, heads of treasuries and central bankers are gathering in Vienna Tuesday for Invisso’s CEE Forum to discuss the issuance and market outlook ahead.

“Central and Eastern European bond markets are facing challenges at the beginning of the year due to rising inflation concerns in core Europe and uncertainty in relation to potential tariffs by President-elect Trump on day one,” said Anders Faergemann, co-head of emerging-markets global fixed income at Pinebridge Investments in London.

Romania’s election turmoil has brought turbulence in the fixed income market, and there are more key ballots ahead, with the Czech Republic set to vote in September.

“Across countries, we see risks of more right-wing shifts with implications for relationship of these countries with the EU, and for foreign policy positions, especially with regards to Russia,” Deutsche Bank analysts wrote in a Jan. 10 newsletter. “Increased political fragmentation could lead to greater support for economic populism across the political spectrum, and complicate the macro outlook for the region.”

Campaign Mode

Hungary is already in campaign mode for next year’s ballot, with investors fretting Prime Minister Viktor Orban may loosen the purse strings to help him stay in power in the face of a newly popular adversary.

Against the uncertain economic and geopolitical backdrop, central bankers in several of the biggest economies are debating whether they can afford to resume rate cuts this year in light of the risks.

Story Continues

“Monetary policy challenges in combination with a persistently stronger US dollar make CE4 local bonds less attractive in the first quarter,” Faergemann said, adding Hungary and Romania are the most vulnerable due to political uncertainty at home.

Not all news is grim, though. Trump’s promise to take steps toward ending the war in Ukraine has held out the promise of an economic revival on Europe’s eastern flank.

Tariff Threat

The stock market in Hungary, whose leader Orban has kept close ties to both Trump and Russia, has been outperforming most global peers after the US election and is reaching new records.

The region’s most liquid currencies — the zloty, forint and koruna — have also been relatively resilient to the dollar’s strength, supported by cautious central bank rhetoric in the region.

With just days to go until Trump’s presidency, the wider issues facing eastern European assets are unlikely to go away soon.

“The risk of broad-based US tariffs is a significant risk as the incoming US administration assumes power,” said Rajeev De Mello, a global macro portfolio manager at Gama Asset Management SA. “For EM local currencies and for eastern European currencies and bonds, the combination of higher global yields amid the tariff threat is a significant headwind.”

–With assistance from Srinivasan Sivabalan and Selcuk Gokoluk.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=6786193c7f4a4d119a1c5623f104df86&url=https%3A%2F%2Ffinance.yahoo.com%2Fnews%2Fbond-risks-pile-east-europe-063000345.html&c=11987676221094408057&mkt=de-de

Author :

Publish date : 2025-01-13 22:30:00

Copyright for syndicated content belongs to the linked Source.