Recommended

European investors were now not only reluctant to speak out about US companies but were also “being more cautious about European companies”, the senior executive added.

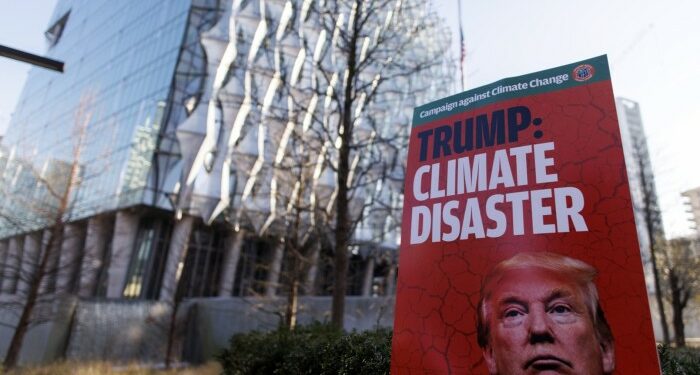

They are also less willing to back climate resolutions at annual meetings. Support for such proposals globally among Europe’s biggest asset managers fell from 84 per cent in 2022 to 69 per cent in 2024, according to data from FTI, the consultancy.

Yet several top European asset managers say a focus on climate will continue to be a priority, as they try to balance the conflicting climate backlash in the US with institutional client demand for risk control and tighter regulations in Europe.

Those asset managers were “not adjusting their investment strategy to a four-year political cycle”, one chief investment officer of a leading European fund manager said, but instead were taking steps to “protect themselves from open criticism” by not putting a spotlight on their actions.

Behind the scenes, some leading asset managers continue to push for action to reduce climate risk at the companies they invest in, they added.

Stephen Beer, head of responsible investment strategic relationships and integration strategy at Legal and General Investment Management, the UK’s largest asset manager, said interactions with companies over climate change were now “harder edged”.

“We are talking about business strategies, progress towards transition, decisions that companies have to make” he said. “And that is exactly where we want to be in conversations with companies, because we want them to be profitable and sustainable.”

At the same time, European pension funds were doubling down on their climate efforts, said Jon Johnson, chief executive of PKA, the big Danish pension fund, leaving asset managers who retreated at risk of losing clients.

Recommended

“We as asset owners will have to take the lead right now [on driving action on climate from the finance sector] . . . If we keep on pushing for the green transformation, I am sure from a business perspective, [asset managers] will want to keep that growth.”

He added: “A lot of asset managers, both in the US and Europe, are tiptoeing around how to do this right.”

Such calls from asset owners — and more supportive politics in Europe — meant the continent’s asset management industry would continue to focus on climate change, said Sonja Laud, chief investment officer at LGIM.

“Climate is a financially material aspect in understanding a company’s future success and we will continue to include it in our investment process. To identify the right investment opportunities for our clients, climate risk has to be an integral part of the analysis,” she added.

Landell-Mills at Sarasin said the industry could not ignore climate change, despite the political pressures and regulatory burden.

“Ultimately, the fundamentals haven’t changed. Climate change is still happening. Ignoring the risks doesn’t make them go away. But it delays action to tackle them,” she said. “Climate change is going to have massive economic impact, a massive geopolitical impact — and that will affect returns.”

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=678f3bf02fda4327ad86e69070162054&url=https%3A%2F%2Fwww.ft.com%2Fcontent%2Fe2bc352b-aa8c-41fc-87b4-b61b676cfcbf&c=961133036818338130&mkt=de-de

Author :

Publish date : 2025-01-20 21:00:00

Copyright for syndicated content belongs to the linked Source.