Inflation Developments: Understanding the Latest Shift in Frances Financial Panorama

The current decline in inflation charges throughout France marks a major turnaround within the nation’s financial local weather.Following a chronic interval of elevated costs, shoppers are now experiencing some reduction as inflation sharply decreases. Components contributing to this shift embody:

International Provide Chain Restoration: Improved logistics and lowered delivery delays have helped stabilize costs.Lower in Power prices: A dip in world oil costs has eased the burden on family budgets.Authorities Interventions: Varied fiscal measures have been carried out to management inflation, offering each short-term and long-term reduction.

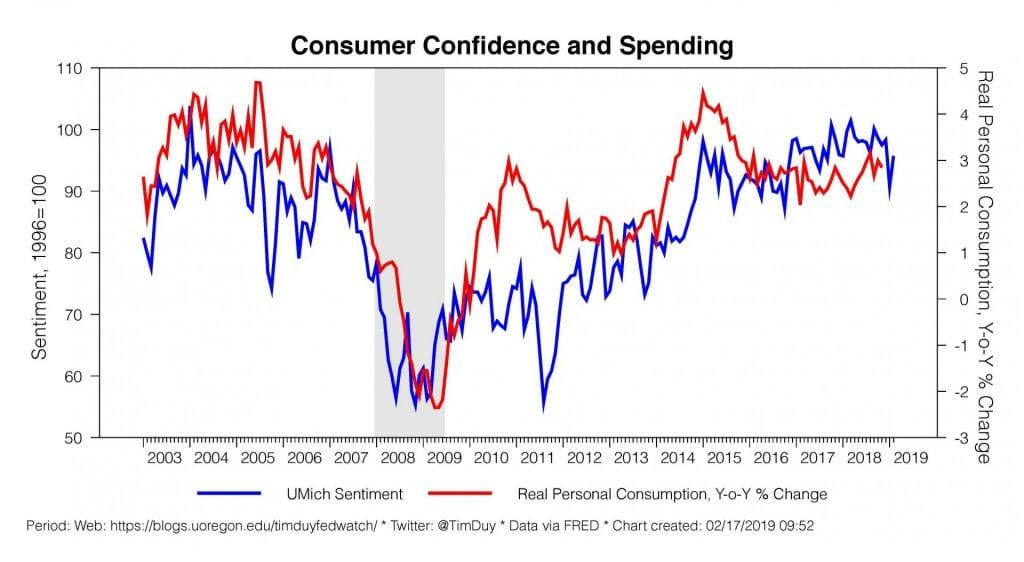

Nonetheless, this downturn in inflation comes alongside a noticeable contraction in shopper spending. Many households, nonetheless recovering from the financial shocks of the pandemic, are exercising warning and prioritizing financial savings over expenditures. This development highlights a posh interaction between financial elements as spending patterns shift. Key observations embody:

A Shift In the direction of Necessities: Shoppers are focusing their spending on important items, main to lowered gross sales in non-essential sectors.Rising Financial savings Charges: Elevated warning has resulted in greater financial savings charges amongst French households.Impression on Retail and Companies: Many companies are experiencing slower development, prompting discussions on the sustainability of the present financial restoration.IndicatorsCurrent Charge (%)earlier Charge (%)Inflation Rate2.15.4Consumer Spending Development-0.51.2Savings Rate1510

Client Spending Decline: Analyzing the Impression on French Households

The current downturn in shopper spending has important implications for French households, as rising prices proceed to have an effect on buying conduct. Households are actually dealing with a local weather the place inflationary pressures have prompted them to prioritize important items over discretionary gadgets. Because of this, many households are adjusting their budgets, resulting in a pronounced shift in spending patterns characterised by:

Elevated financial savings: Many households are opting to save extra as a precaution in opposition to future monetary uncertainties.Diminished discretionary spending: Non-essential purchases, comparable to eating out and leisure, have seen marked reductions.Shift in direction of value-focused consumption: Shoppers are more and more prioritizing high quality and affordability of their purchases.

this contraction in shopper spending not solely impacts particular person households but additionally poses broader dangers to the French financial system. Companies reliant on shopper gross sales are witnessing decreased revenues,resulting in potential cuts in workforce and investments.Right here’s a snapshot of the important thing developments noticed in shopper conduct impacting the financial system:

Client Spending TrendImpactShift to important goodsHigher demand for requirements ends in stronger gross sales in supermarkets.Decline in luxurious purchasesLuxury retailers face stress, presumably main to cost reductions or promotions.Native vs. Worldwide BrandsIncreased patronage of native manufacturers as shoppers favor sustainability and assist for native economies.

Authorities Response: Coverage Measures to Fight Financial Downturn

The French authorities has initiated a collection of strategic coverage measures in response to the financial downturn, particularly in mild of the sharp decline in shopper spending. Key initiatives embody:

Fiscal stimulus Packages: To bolster shopper confidence and spending energy, the federal government has unveiled focused fiscal stimulus packages geared toward low- and middle-income households.Infrastructure Investments: Important investments in infrastructure initiatives are being prioritized to create jobs, improve public providers, and stimulate financial exercise in numerous sectors.Help for Small Companies: Monetary assist and grants are being prolonged to small and medium-sized enterprises (SMEs) to ease cash-flow challenges and foster financial resilience.

In an effort to mitigate inflationary pressures whereas stimulating development, the authorities has additionally carried out financial coverage changes in collaboration with the central financial institution. These changes are characterised by:

Curiosity Charge Administration: A cautious evaluate of rates of interest is being carried out to encourage borrowing and funding.Quantitative Easing Applications: The central financial institution could interact in expanded asset buy applications to inject liquidity into the financial system.Regulatory adaptability: Regulatory frameworks are being reassessed to take away limitations for companies and improve their means to answer altering market situations.Coverage MeasureDescriptionExpected OutcomeFiscal Stimulustargeted monetary assist for householdsIncreased shopper spendingInfrastructure InvestmentFunding for public projectsJob creation, financial activitySupport for SMEsGrants and loans for small businessesEconomic resilience

Funding Methods: Navigating Market alternatives Amid altering Circumstances

As the newest knowledge unveils a major drop in inflation charges in France, traders are confronted with a pivotal second that requires astute navigation by means of shifting financial situations. The contraction in shopper spending, a direct results of heightened cost-of-living pressures, raises questions in regards to the resilience of assorted market sectors.Traders ought to rigorously think about the implications for sectors such as shopper discretionary, wich could face headwinds as a result of lowered family spending energy, whereas areas like utilities and necessities could current extra steady funding prospects.

To successfully modify methods in response to those developments, stakeholders can discover a variety of alternatives:

diversification: Reassess portfolios, guaranteeing a mix of defensive shares and development alternatives.Sector Rotation: shift focus in direction of sectors poised for stability or restoration in a low-inflation habitat.International Publicity: Take into account investments in markets much less impacted by native financial fluctuations.SectorGrowth PotentialRisk AssessmentConsumer DiscretionaryModerateHighUtilitiesLowLowHealthcareModerateModerate

Future Outlook: Predictions for Frances Economic system and Inflation Charge

As France navigates the aftermath of sharply falling inflation charges, a cautious optimism emerges concerning the financial panorama. Forecasting the future, a number of key indicators counsel a complicated interaction between shopper confidence and spending habits. Specialists predict that whereas inflation could stabilize, it’s unlikely to rebound dramatically within the quick time period. The persevering with impression of decreased shopper spending,influenced by rising residing prices and cautious conduct,performs a pivotal function in shaping financial restoration. Components to think about embody:

Unemployment Charges: Ongoing fluctuations could dictate shopper confidence and spending energy.Authorities Insurance policies: Fiscal measures geared toward stimulating development may ease inflationary pressures.International Financial Developments: The state of the worldwide market will affect France’s financial rebound.

Trying forward, projections point out potential stabilization in inflation, settling at ranges that may foster a extra predictable financial atmosphere. Analysts emphasize that improvements in sectors like expertise and sustainability may catalyze development, creating new job alternatives and enhancing productiveness. Compelling knowledge suggests a gradual improve in shopper spending as inflation moderates, fostering an environment conducive to financial restoration. Key projections for the approaching years embody:

YearProjected Inflation Charge (%)GDP Development (%)20242.52.120252.02.520261.82.8

Professional Suggestions: How Shoppers Can Adapt to the New financial Actuality

As inflation charges decline in France, shoppers should come to phrases with shifting financial dynamics that impression their buying energy and life-style. Adapting to these modifications entails strategic planning and knowledgeable decision-making. Listed here are a number of suggestions that can assist shoppers navigate this new panorama:

Prioritize Important Purchases: Concentrate on shopping for requirements and restrict discretionary spending to keep up monetary stability.comparability Store: make the most of worth comparability instruments and apps to discover one of the best offers, guaranteeing that each euro spent counts.Embrace Native Merchandise: Help native economies by selecting locally-sourced items, which may ofen be extra inexpensive and more energizing than imported gadgets.Plan Meal Budgets: Create weekly meal plans and procuring lists to reduce impulsive purchases and cut back waste.

To additional streamline monetary administration,think about analyzing important bills and figuring out areas for potential financial savings. Maintaining observe of month-to-month budgets can illuminate spending habits and inform necesary changes. Beneath is a simplified instance:

Expense CategoryMonthly Price range (€)Precise Spending (€)Variance (€)Groceries300280+20Utilities150160-10Entertainment10080+20

By constantly evaluating and adjusting their spending habits, shoppers can higher align their monetary methods with the present financial actuality, fostering resilience and long-term stability.

The means Ahead

the current sharp decline in inflation charges in France marks a major shift within the financial panorama of the nation. Whereas this lower could supply some reduction to shoppers, the accompanying contraction in shopper spending raises issues about future development prospects. Analysts counsel that the interaction between inflation developments and shopper conduct will probably be essential in figuring out the trajectory of the French financial system within the coming months. With policymakers and companies intently monitoring these developments, the main target will stay on fostering a steady financial atmosphere that balances inflation management with shopper confidence. As we proceed to navigate these difficult financial instances, the implications of those developments will undoubtedly resonate not solely inside France however throughout the broader European market. traders and financial stakeholders are inspired to remain knowledgeable because the state of affairs evolves.

Source link : https://europ.info/2025/02/28/france-2/inflation-falls-sharply-in-france-as-consumer-spending-contracts-seeking-alpha/

Writer : Victoria Jones

Publish date : 2025-02-28 18:03:00

Copyright for syndicated content material belongs to the linked Source.