Belgiums Shift In direction of E-Invoicing: What Companies Must Know

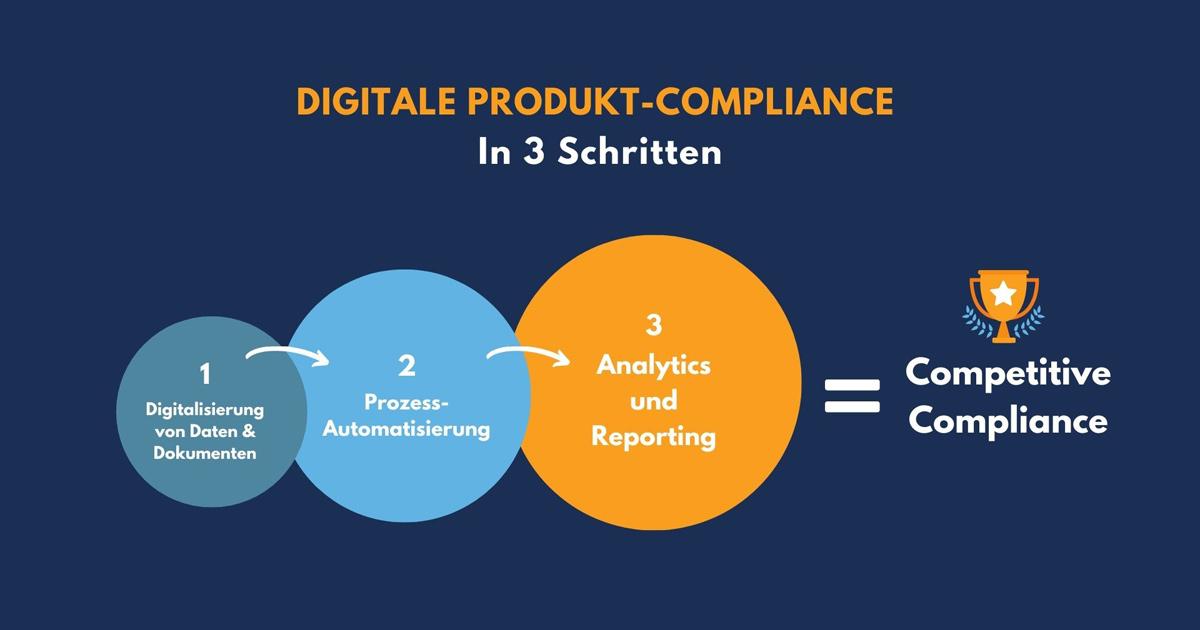

As Belgium transitions in direction of obligatory e-invoicing in B2B transactions by 2026, companies should perceive the implications of this digital shift. E-invoicing not solely streamlines billing processes however additionally enhances compliance with tax laws.the necessity for corporations to adapt is important, given that e-invoicing can reduce errors, cut back processing time, and minimize operational prices. To efficiently navigate this shift, companies ought to deal with the next facets:

Know-how Adoption: spend money on e-invoicing software program that integrates easily with current accounting methods.Compliance Readiness: Keep up to date on Belgian laws and guarantee adherence to the e-invoicing specs set by the authorities.Coaching and Help: Present essential coaching for employees to deal with new methods and processes successfully.

Moreover, the upcoming rollout of real-time e-reporting by 2028 provides one other layer of complexity. This initiative goals to enhance tax transparency and fraud prevention, compelling companies to report transactions in actual time. To organize for this development, corporations ought to:

improve Knowledge Accuracy: Implement sturdy information administration practices to make sure accuracy in reporting.Perceive Reporting Necessities: Familiarize themselves with the kinds of transactions that may require real-time reporting.Have interaction with Service Suppliers: Collaborate with invoicing and reporting service suppliers for seamless integration and assist.Key DatesEventBusiness Action2026Mandatory B2B E-InvoicingImplement e-invoicing systems2028Real-Time E-Reportingprepare for real-time transaction reporting

Understanding the 2026 B2B E-Invoicing Laws in Belgium

With the expansion of digitalization within the enterprise panorama, the Belgian authorities is ready to implement new e-invoicing laws in 2026, which is able to revolutionize the method companies handle their invoicing processes. As a part of a broader initiative to streamline operations and improve VAT compliance, these laws intention to introduce a standardized format for B2B invoices. Companies will want to make sure they’re outfitted with the proper instruments to generate,ship,and obtain e-invoices that adjust to these new requirements. Key facets of the laws embody:

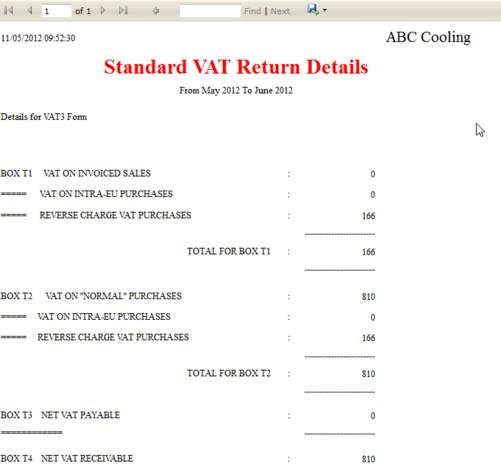

Necessary e-invoicing: All B2B transactions would require digital invoices, transferring away from paper billing.Standardized codecs: Invoices should adhere to particular digital codecs, comparable to XML, to facilitate simpler processing and integration.Actual-time reporting obligations: Corporations shall be anticipated to report bill information to the tax authorities in actual time, enhancing transparency and compliance.

In planning for these modifications, companies ought to contemplate investing in sturdy e-invoicing options that not solely adjust to the upcoming laws but in addition enhance effectivity and cut back errors in monetary reporting. Moreover,the implementation of real-time e-reporting by 2028 requires corporations to modernize their IT infrastructure and guarantee information accuracy. The next desk summarizes the important thing dates and milestones companies ought to pay attention to:

YearmilestoneAction Required2026Mandatory B2B e-invoicingImplement e-invoicing systems2028Real-time e-reportingEnsure information reporting compliance

The Implications of Actual-Time E-Reporting for Companies by 2028

The transfer in direction of real-time e-reporting is poised to revolutionize how companies function,particularly within the context of compliance and monetary operations. By 2028, corporations might want to adapt to enhanced regulatory necessities that may streamline reporting processes and cut back lead occasions considerably. This shift not solely calls for a re-evaluation of present accounting methods but in addition emphasizes the want for sturdy information administration and safety practices.Key implications embody:

elevated Effectivity: Automating tax compliance and reporting minimizes handbook work and accelerates the invoicing cycle.Actual-Time Analytics: Companies can leverage information insights immediately, permitting for proactive decision-making.Enhanced Compliance: With automated checks and balances, the danger of non-compliance decreases considerably.

Furthermore, companies may additionally face challenges associated to implementation and expertise adoption. Reaching seamless integration of real-time e-reporting options with current ERP methods might require appreciable investments and worker coaching.To navigate these complexities, organizations ought to contemplate the next methods:

StrategyDescriptionInvest in TechnologyAllocate assets for the newest e-reporting instruments that facilitate real-time information transmission and analytics.Upskill EmployeesProvide coaching on new methods to make sure that employees can effectively handle the transition.Seek the advice of ExpertsEngage with consultants to tailor options that match particular enterprise wants and compliance requirements.

Navigating compliance: Finest Practices for VATCalc Customers

As companies put together for the upcoming B2B e-invoicing mandated by the Belgian authorities in 2026, it’s essential for VATCalc customers to undertake sturdy compliance practices. Familiarizing your self with the e-invoicing requirements set forth by authorities won’t solely streamline invoicing processes however additionally reduce errors that may result in vital fines. Key motion factors embody:

Understanding E-invoicing Necessities: Keep knowledgeable concerning the particular codecs and protocols required for e-invoices, together with information components and transmission strategies.Integrating with VATCalc: Guarantee your VATCalc system is ready up to deal with e-invoicing capabilities seamlessly, together with validations and error-checking capabilities.Common Coaching: Conduct coaching periods for employees to make sure everyone seems to be conscious of compliance requirements and the expertise concerned.

Waiting for 2028, companies will want to adapt to real-time e-reporting, a major shift that requires environment friendly information dealing with and reporting practices. VATCalc customers ought to prioritize the next methods:

Automating Reporting Processes: Leverage VATCalc’s automation options to get rid of handbook information entry and cut back reporting errors.Monitoring Legislative Modifications: Maintain abreast of updates in laws relating to e-reporting to make sure ongoing compliance.Establishing Knowledge Integrity Protocols: Implement methods to recurrently audit and confirm the info generated by VATCalc for accuracy and completeness.YearCompliance RequirementAction Item2026B2B E-invoicingunderstand and implement e-invoicing requirements.2028Real-time E-reportingAutomate reporting processes to make sure compliance.

Making ready Your Enterprise for Digital transformation in Finance

As companies in Belgium gear up for the approaching wave of e-invoicing and real-time e-reporting necessities, it’s essential to implement a sturdy digital transformation technique in finance. This features a complete evaluation of current processes and applied sciences to determine gaps and areas for development.Corporations ought to contemplate the next important steps:

Embrace Automation: Combine automated options to streamline invoicing processes and improve accuracy.Make investments in Know-how: Improve current methods or undertake new monetary software program to assist compliance with e-invoicing and reporting mandates.Prepare Workers: Present essential coaching for workers on new digital instruments to guarantee a clean transition and full utilization.

Furthermore, because the tax panorama evolves, organizations should keep knowledgeable concerning the particular necessities set to be carried out by 2028. This will contain carefully monitoring regulatory updates and adapting methods to keep compliance. Right here’s a short overview of the anticipated modifications to think about:

YearChangeDescription2026E-invoicingMandatory use of digital invoices for B2B transactions.2028Real-time ReportingIntroduction of real-time VAT reporting for companies.

The way forward for VAT Reporting: Insights and Strategic Suggestions for 2028

The panorama of VAT reporting is ready for monumental modifications by 2028, notably inside the context of Belgium’s B2B e-invoicing framework. With the federal government aiming to streamline compliance and improve transparency, companies should put together for vital shifts. Key issues embody:

Integration of Actual-Time reporting: The transfer in direction of real-time e-reporting will necessitate companies to undertake refined applied sciences that can generate and transmit VAT information immediately.Enhanced information Analytics: Corporations ought to spend money on analytics instruments to derive actionable insights from their VAT information, thus enabling proactive decision-making.Collaboration with Know-how Companions: Establishing partnerships with tech suppliers shall be very important for facilitating seamless transitions, making certain compatibility with evolving laws.

Furthermore, companies want to remain knowledgeable about the regulatory panorama to mitigate dangers related to non-compliance. Strategic measures ought to entail:

Steady Coaching: workers should be saved abreast of recent methods and necessities by way of ongoing coaching initiatives.Monitoring Legislative Updates: A sturdy mechanism for monitoring modifications in VAT legal guidelines will assist organizations adapt swiftly with out disrupting operations.Flexibility in Operations: Growing adaptable frameworks and agile processes will permit companies to answer the dynamic nature of VAT reporting necessities.Strategic focusAction StepsTechnology AdoptionImplement cloud-based invoicing systemsTalent DevelopmentConduct month-to-month VAT compliance workshopsRegulatory AlignmentCreate a compliance calendar for updates

to Wrap It Up

the developments in Belgium’s e-invoicing and real-time e-reporting frameworks for 2026 and 2028 signify a major shift towards better effectivity and compliance in the B2B sector. As companies put together to navigate this evolving panorama, staying knowledgeable and proactive will be essential to seamlessly integrating these digital processes. VATCalc will proceed to offer insights and assist,making certain that corporations can adapt to those regulatory modifications successfully. As we look forward, the emphasis on automation and transparency will not solely streamline operations but in addition foster a tradition of accountability inside the Belgian enterprise ecosystem. Companies should now gear up for these transitions, embracing the way forward for invoicing and reporting that’s set to outline the subsequent chapter of economic interplay in Belgium.

Source link : https://europ.info/2025/03/25/belgium-2/belgium-b2b-2026-e-invoicing-2028-real-time-e-reporting-update-vatcalc/

Creator : Mia Garcia

Publish date : 2025-03-25 12:50:00

Copyright for syndicated content material belongs to the linked Source.