German Lawmakers Take into account Implications of Stress-free Debt Restrictions

As Germany confronts a difficult financial panorama,lawmakers are weighing the potential results of easing current debt limits. Advocates argue that stress-free these fiscal constraints may allow the federal government to speculate extra in very important areas resembling infrastructure, training, and healthcare, which are essential for fostering long-term development. They consider that elevated public spending may stimulate client confidence and doubtlessly result in larger financial resilience. Key factors of debate embrace:

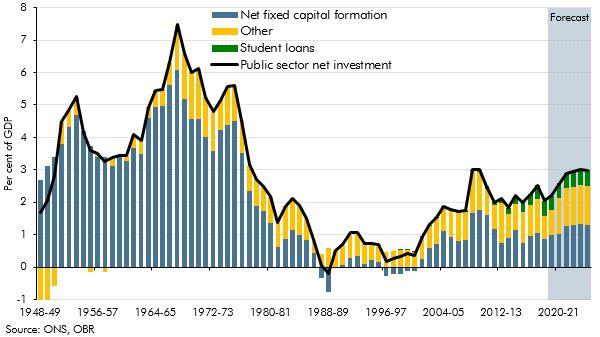

financial Progress: Will increased public funding result in sustainable development?Fiscal Accountability: Can the authorities preserve a stability between spending and financial stability?Debt Administration: How will this have an effect on Germany’s worldwide obligations and credit score rankings?

Conversely, opponents warning that loosening debt restrictions might result in extreme borrowing and monetary instability. Critics are particularly involved concerning the long-term implications for the nation’s fiscal well being and its capacity to reply to future crises.They warn that growing reliance on debt may undermine the arrogance of buyers and result in increased rates of interest. To research these arguments,a easy desk evaluating the views of each sides can make clear their positions:

PerspectiveArguments ForArguments AgainstSupportersBoosts public funding,stimulates economyRisks long-term monetary instability,encourages extreme borrowingCriticsMaintains fiscal accountability,safeguards debt levelsRestricts development potential,reduces public welfare funding

Financial Views on Debt Flexibility and Fiscal Accountability

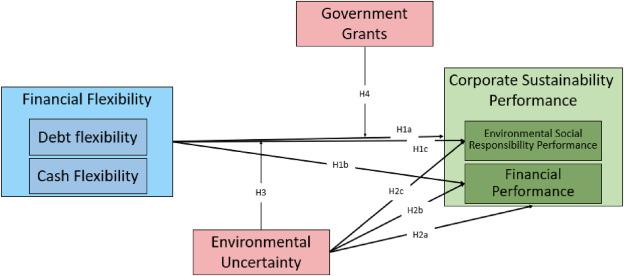

As German lawmakers have interaction in discussions relating to the potential loosening of debt limits, financial views on flexibility and accountability are coming to the forefront. Debt flexibility can function a very important instrument in a nation’s financial technique, notably in instances of disaster when quick fiscal help is important. By permitting governments to adapt their monetary frameworks, it turns into attainable to stimulate development and handle urgent social wants. Nevertheless, this flexibility comes with its personal set of challenges, notably in sustaining long-term fiscal accountability and stopping unchecked borrowing that might undermine monetary stability.

The continued debate highlights a delicate stability between enabling investments in infrastructure and social packages and making certain that such measures don’t result in unsustainable debt ranges. Key factors within the dialogue embrace:

Financial Progress: Encouraging investments that improve productiveness and job creation.Stability: Making certain that fiscal insurance policies don’t jeopardize the nation’s credit score rankings.public Providers: Assessing the affect of debt on funding for important public companies.

In exploring these views, a better take a look at the implications is important. The next desk summarizes how totally different economists view debt flexibility and financial accountability:

EconomistViewpoint on Debt flexibilityViewpoint on Fiscal ResponsibilityDr. Anna schmidtSupports flexibility for emergency spendingAdvocates for stringent debt ceilingsProf.Hans MüllerBelieves in adaptive fiscal policiesStresses long-term sustainabilityMs. Clara BeckerChampions sensible investments by means of debtRecommends cautious borrowing practices

Balancing Progress and Sustainability in Germanys Monetary Panorama

As Germany grapples with the problem of stimulating financial development amid essential world uncertainties,the controversy surrounding the comfort of debt limits has turn out to be more and more pertinent. Lawmakers are divided over the implications of such measures, weighing the potential advantages of elevated public funding towards the danger of fiscal irresponsibility. Proponents argue that loosening these constraints may allow very important funding for infrastructure initiatives, inexperienced power initiatives, and digital conversion efforts, that are important for holding tempo with different main economies. They spotlight that these investments not solely drive quick financial development but additionally contribute to a sustainable and resilient monetary panorama in the long term.

Conversely, critics warn that extreme borrowing may jeopardize Germany’s fiscal well being and sustainability.They level out that irresponsibly excessive ranges of debt might lead to elevated rates of interest, lowered funding for important public companies, and a diminished capability to reply to future financial crises. To navigate this delicate stability, key elements want cautious consideration, together with:

Lengthy-term financial stability: Making certain that any new debt is utilized in a way that promotes sustainable development.environmental affect: Allocating funds towards inexperienced initiatives that align with Germany’s dedication to local weather objectives.Public opinion: Reflecting the views and issues of residents about fiscal accountability and environmental sustainability.FactorPro Loosening Debt LimitsCon Loosening Debt LimitsInvestment PotentialIncreased infrastructure and innovation fundingRisk of extreme borrowingSustainabilitySupporting inexperienced power initiativesPotential neglect of fiscal sustainabilityPublic ServicesFunding for urgent social needsCompromised funding for important companies

Potential Impression on Public Funding and Social Packages

The ongoing discussions amongst German lawmakers about stress-free debt limits may considerably reshape public funding methods and the longer term of social packages throughout the nation. Proponents of loosening these constraints argue that elevated borrowing would allow the federal government to funnel much-needed sources into very important sectors resembling infrastructure, training, and healthcare. This, in flip, may result in enhanced public companies that purpose to uplift economically deprived communities and promote social cohesion.

Although, critics warn that the potential for elevated public debt may jeopardize long-term fiscal stability, creating an habitat of uncertainty that will affect financial development. Ought to lawmakers transfer ahead with these proposed modifications, the outcomes may embrace:

Elevated funding for social welfare packages: A spotlight on housing, healthcare, and unemployment advantages.Strengthened public infrastructure: Investments in transportation and inexperienced power initiatives.Potential dangers of inflation: The stability between stimulating the financial system versus overspending may turn out to be vital.

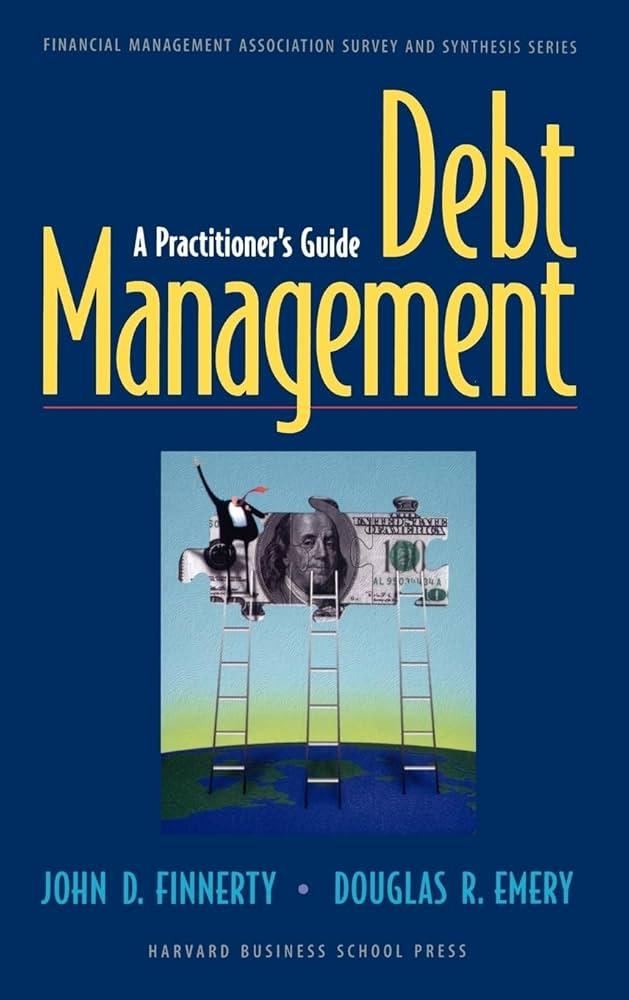

Professional Suggestions for a Pragmatic Method to debt Administration

Because the dialogue round Germany’s debt limits unfolds, specialists emphasize the significance of a realistic method to managing nationwide debt.Slightly than in search of a one-size-fits-all answer, lawmakers are inspired to contemplate tailor-made methods that replicate the distinctive financial realities confronted by the nation. Key suggestions embrace:

Diversifying Funding Sources: Increasing past conventional bonds to incorporate inexperienced investments and public-private partnerships.Implementing Fiscal Accountability: Establishing clear tips for spending that prioritize long-term development over short-term beneficial properties.Prioritizing Financial Resilience: Fostering an financial local weather that may face up to shocks, together with constructing adequate fiscal buffers.

furthermore, specialists recommend leveraging expertise to reinforce decision-making processes associated to debt administration. By using superior analytics and modeling instruments, policymakers can higher predict the implications of assorted debt eventualities. A holistic view of debt incorporating each macroeconomic indicators and public sentiment might show important in informing sustainable fiscal insurance policies. Extra elements to contemplate embrace:

Engagement with Stakeholders: Common consultations with companies, labor organizations, and residents to gauge the affect of debt insurance policies.Training and Consciousness Initiatives: Implementing packages to advertise understanding of debt implications among the many public and policymakers alike.Monitoring and Analysis: Establishing strong techniques for assessing the effectiveness of debt administration methods over time.

Insights and Conclusions

As the controversy on loosening Germany’s debt limits unfolds, lawmakers are grappling with the stability between fiscal accountability and the want for funding in vital areas resembling infrastructure, local weather change, and social welfare. Opinions amongst political factions range, reflecting broader issues about financial stability and the nation’s monetary future. The discussions are anticipated to proceed, with implications not just for Germany’s fiscal coverage but additionally for its function throughout the European Union.As the result of those deliberations turns into clearer, stakeholders from all sectors will likely be intently monitoring the potential shifts in coverage that might redefine the nation’s method to public funds within the years to return. The path ahead would require cautious consideration of each quick financial wants and long-term sustainability.

Source link : https://europ.info/2025/03/14/germany-2/german-lawmakers-debate-loosening-debt-limits-dw-english/

Writer : Jackson Lee

Publish date : 2025-03-14 07:31:00

Copyright for syndicated content material belongs to the linked Source.