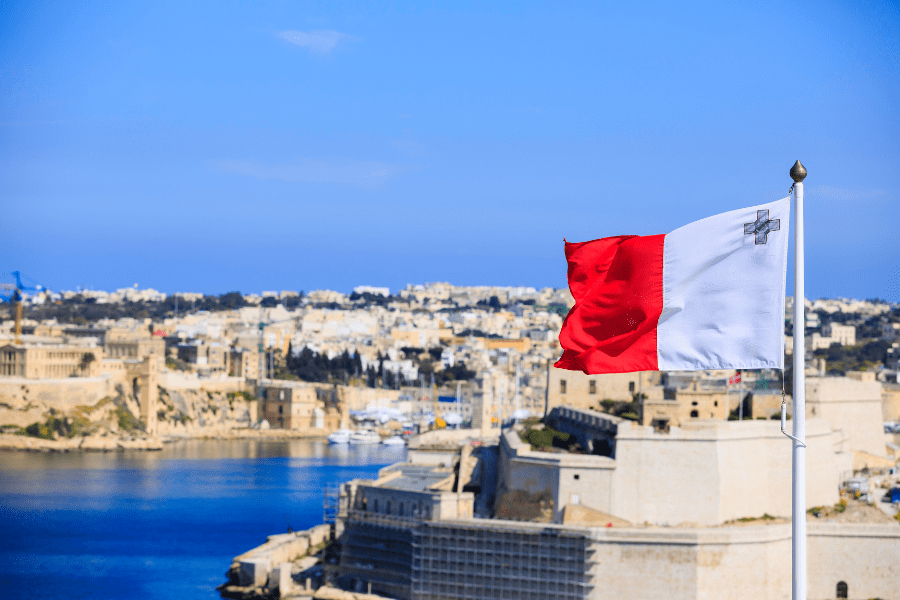

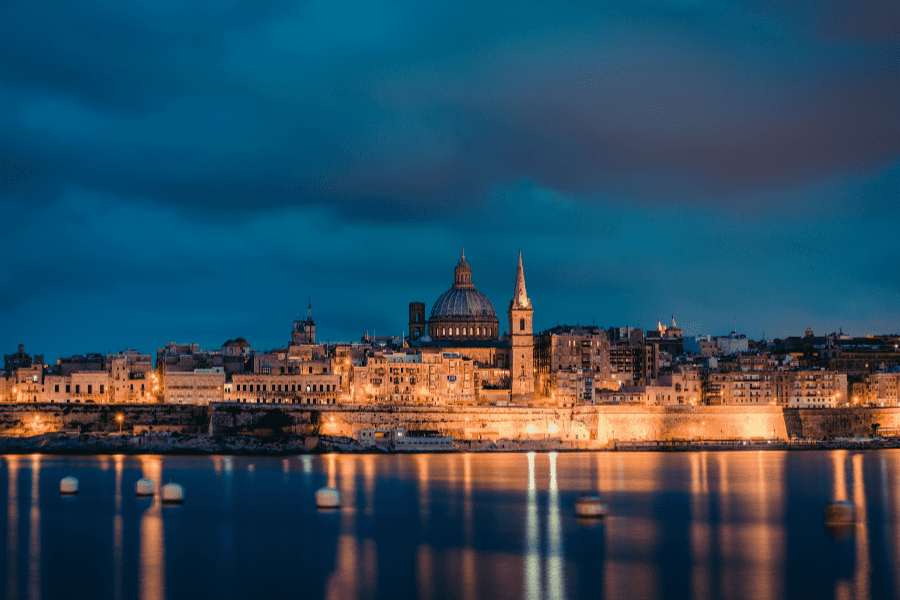

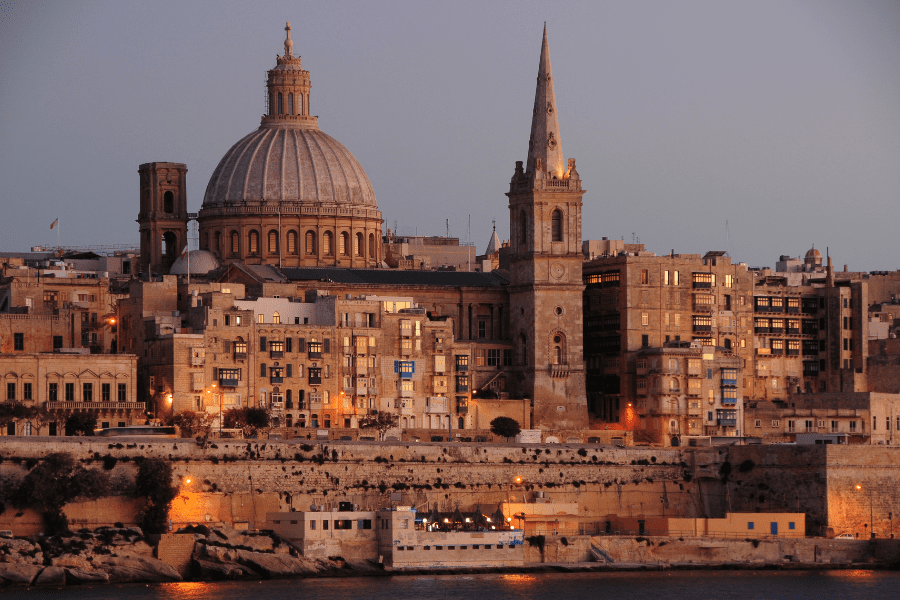

Is Malta Cheaper to Live in Than Other European Countries?

EU countries are considered some of the best in the world regarding living standards, healthcare and education systems, and safety. However, most relate them to high taxes and consumer prices as well.

Considering Malta’s perks, like foreign investment and business opportunities, its consumer prices are lower than some other countries, though not all.

The average salary in Malta is somewhere between €1500 to €2000. Moreover, a family of four generally needs €2700 per month to live in Malta (including all monthly costs but rent).

You can find cheaper jurisdictions, particularly in Eastern Europe, but don’t expect all of them to have the same perks as Malta’s.

How to Get a Residency in Malta?

Non-EU nationals can get Maltese residency through the following programs.

Malta Global Residence Programme (GRP)

The Maltese government introduced GRP to strengthen the Maltese property market, increase work opportunities for legal, tax, and financial professionals, and boost the leisure and hospitality sectors.

To qualify for GRP, you must have enough resources to support yourself and your dependents without relying on Malta’s social assistance system.

The most significant residency requirement for Malta’s GRP is that you must own or rent Maltese property.

If purchased on the central island of Malta, the property must be worth at least €275,000. Whereas, if you buy a property in Gozo and the Southern Region of Malta, it must be worth at least €220,000.

If you qualify, you can live in Malta as a long-term resident and enjoy tax benefits such as not being taxed on foreign-sourced income as long as it’s not remitted to Malta.

GRP holders are entitled to a work permit and have visa-free access to the EU and Schengen area.

Malta Permanent Residence Programme (MPRP)

Malta Permanent Residence Program (MPRP) enables non-EU nationals and qualifying family members to live indefinitely in Malta as permanent residents. It also allows visa-free travel within the Schengen area.

MPRP doesn’t impose a minimum stay requirement, but you must renew or update the residence permit annually.

The Malta Permanent Residence Program has stringent financial requirements – some of which are the following:

You must be able to show a minimum capital of €500,000, with €150,000 in financial assets.

You must pay the non-refundable government contribution worth €68,000 (if you’re buying a property) or €98,000 (if you’re renting a property).

You must buy a property worth at least €300,000 or more in the south of Malta and €350,000 for the rest of the island or rent a property with a minimum rental value of €10,000 in the south of Malta and €12,000 for the rest of the island.

You must donate €2,000 to a charity or a non-governmental organization (NGO).

For more details, you can check out our ultimate guide on how to get Malta residency.

How to Get Citizenship in Malta?

According to the Nomad Passport Index, the Maltese passport ranks 12th globally, providing visa-free and visa-on-arrival access to 171 countries.

You can become a Maltese citizen through the Malta citizenship-by-investment program. As a CBI applicant, you can get Maltese citizenship after one or three years of legal residency.

Some of the most notable requirements for Malta CBI are mentioned below:

Buy a €700,000 residential home in Malta or rent a house with a rental value of €16,000 per year.

Legal residents of three years must invest €600,000, while legal residents of one year must contribute €750,000.

Donate €10,000.

For more details, you can check out our ultimate guide on how to get Malta citizenship by investment.

Should You Consider Living in Malta?

Affordable cost of living, one of the finest citizenship by investment programs, high living standards, a favorable business environment, and thriving opportunities – Malta offers all and then some.

If living in a high-standard EU jurisdiction without breaking the bank piques your interest, set up a call with us today. We’ll handle all the complexities so you can sit back and enjoy your new and exciting life.

Cost of Living in Malta in 2024: The Ultimate Guide FAQ

Is the cost of living in Malta low?

Malta’s overall cost of living is significantly lower than in the UK, the US, and most Western countries.

Is Malta tax-free?

No, Malta is not tax-free. However, it is a tax-friendly jurisdiction with several tax incentives for investors and entrepreneurs.

Source link : https://nomadcapitalist.com/expat/cost-of-living-in-malta/

Author :

Publish date : 2024-01-10 08:00:00

Copyright for syndicated content belongs to the linked Source.