Data via Cirium

I see five distinct segments for the airline. The British Isles has the steadiest amount of capacity year-round. During the winter when other markets fell off, the British Isles surged to more than 20 percent of total departures. During the summer when other markets grew, the share sagged toward 10 percent.

Scandinavia was good for another 15 percent of capacity, give or take, while bigger European cities added 20 percent. Those had more seasonal variation.

The other 45 to 55 percent (depending upon the season) was split between European leisure markets and the US/Canada. Those European leisure markets were primarily beach destinations along the Mediterranean, the usual Italy, Greece, Spain, etc. The US and Canada though, well, that was weirder.

For summer 2022, Play went into Baltimore in April with 1x daily, Boston in May with 1x daily, and New York/Stewart in June with 1x daily. Stewart shrunk to 2x weekly in winter.

By summer 2023, all three were still flying but two more cities were added. In April, Play inexplicably went into Washington/Dulles 1x daily followed by 1x daily to Hamilton (Ontario) in June.

Icelandair had been at Dulles, but it went back into Baltimore as well once Play announced it would fly there. Why Play decided to serve both, I have no idea. Of course, Icelandair was also in Boston, but Stewart was not even worth the fight since the airline already flew to both JFK and Newark where actual passenger demand existed. And while Icelandair was in Toronto, it was fine letting Play try to pick up scraps at nearby Hamilton.

All of these markets continued to fly in summer 2024 at 1x daily, but this winter the cuts have come earlier and gone deeper.

Baltimore, Boston, and Stewart all drop to 5x weekly this month, staying there at least through Feb. Hamilton goes to 4x weekly. Meanwhile, this last week, Play suspended Dulles from early Dec through Feb. I expect more cuts will be coming.

Why do I say that? Well, Play said so. But Play is trying to roll into its changes and not make them very disruptive to existing bookings. Here is how the airline describes it.

PLAY has decided to significantly cut back its capacity on its North Atlantic routes. This adjustment is already underway and will continue into 2025. The number of PLAY’s destinations in North America and Northern Europe will decrease by mid-year 2025, with a bigger emphasis being placed on the airline’s leisure markets in Southern Europe.

Now the only real question is whether ANY destinations remain in North America or whether it’s exited completely. Keep an eye on that summer schedule.

This focus on Southern Europe leisure means Play is no longer going to try to tap into the heavy demand from travelers looking to come to Iceland. Instead, it will focus on trying to scrap together warm-weather flying for as many of Iceland’s less than 400,000 people as it can. To my surprise, that’s a relatively untapped market.

Of course, there is Icelandair in the mix with its own flights but it doesn’t serve those sun destinations much. This winter it will have 1x daily split between two airports in the Canaries plus 4x weekly to Rome, 3x weekly to Barcelona, 2x weekly to Lisbon, and 1x weekly to both Alicante and Verona. That’s not much. Even in summer, the only additional sun destination is Nice.

There is very little service in these markets on other airlines too. Wizz focuses on its eastern European ethnic traffic, except for a couple weekly to Rome. Vueling had a summer seasonal Barcelona run that appears to be gone, though Iberia still does summer seasonal Madrid (which isn’t really a sun destination). Neos has a couple of weekly trips to places like the Canaries and Verona, but it’s pretty minimal.

The others are focused on bringing people into Iceland, like easyJet, Jet2, TUI, etc. They all fly from European cities to Iceland, not from warm weather vacation destinations. Ryanair isn’t in the market at all.

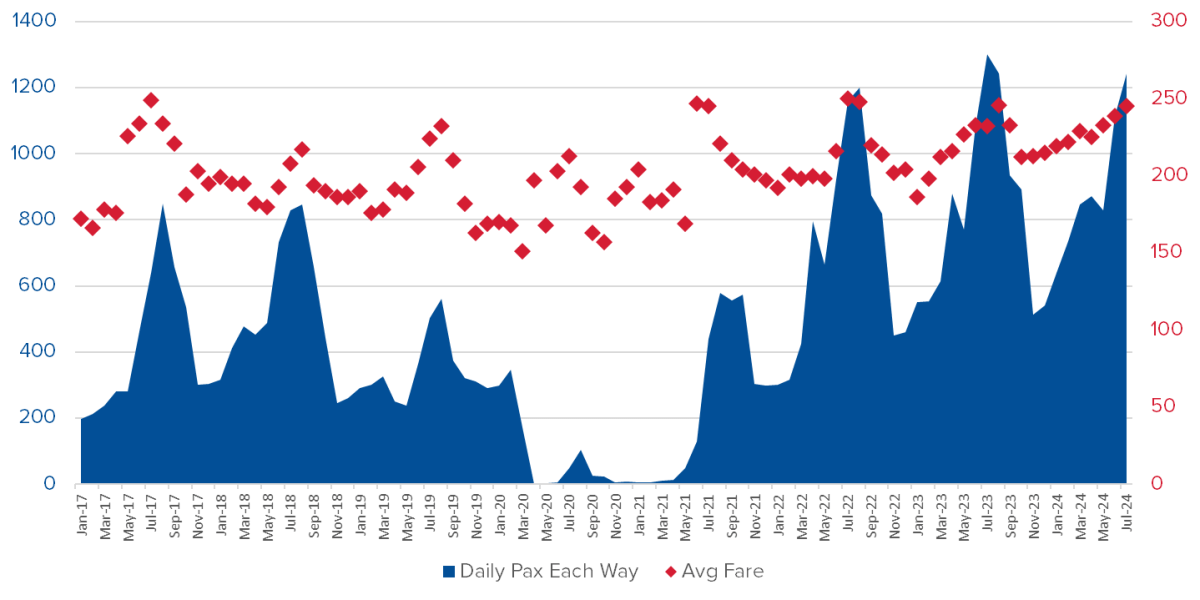

Meanwhile, the market size and average fares from Iceland down toward the Mediterranean have continued to grow.

Daily Passenger and Fare Data from Iceland to the Mediterranean

ARC/BSP data via Cirium

I can’t believe it, but it seems there might be a nice little niche for Play in this world. It’s never going to be huge with this strategy so now it just needs to resist overextending. Early signs are troubling… after all, the airline has decided to open a new operating airline based in Malta.

It looks Play has a wet-leasing deal with GlobalX where it will operate an airplane during the winter. And by basing the airplane in Malta it can probably find more favorable operating costs. But it also says it is looking to base a Maltese airplane in Tenerife next summer to operate to Iceland but also “other destinations.” In the end, the airline wants to have 6-7 airplanes on the Icelandic certificate and 3-4 on the Maltese one. It’s getting dangerously close to stepping outside the boundaries it should have.

For now, let’s see if Play can refocus on Southern Europe profitably and avoid doing anything dumb.

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=671a2f3e7b384fcc857582f8e80798b4&url=https%3A%2F%2Fcrankyflier.com%2F2024%2F10%2F24%2Fplay-airlines-plans-to-play-in-the-sand-instead-of-the-states%2F&c=17660941542248023308&mkt=en-us

Author :

Publish date : 2024-10-24 04:00:00

Copyright for syndicated content belongs to the linked Source.