Source: Eurostat (sbs_sc_ovw)

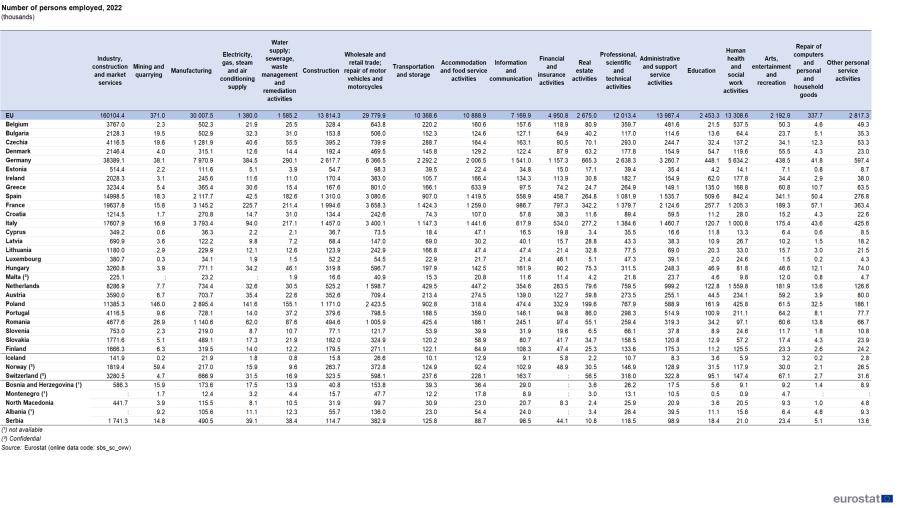

The business economy workforce (persons employed) reached over 160.1 million in 2022 in the EU, and generated a total of €10 047 billion of value added.

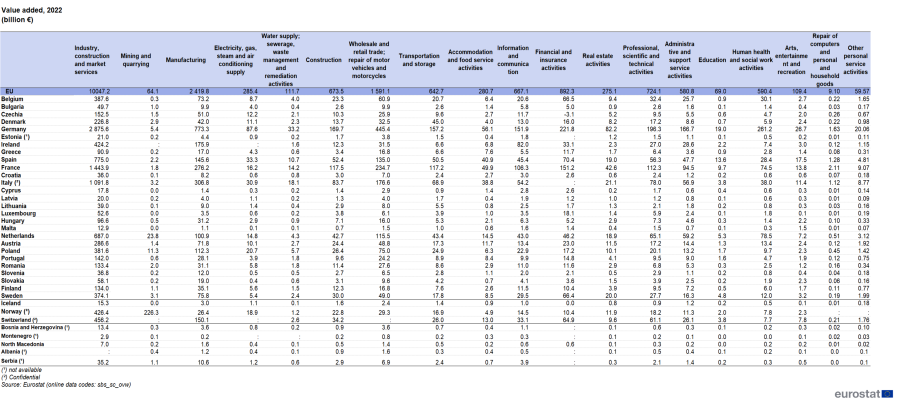

Among the NACE Rev. 2 sections within the business economy, manufacturing was the largest in terms of value added: about 2.2 million manufacturing enterprises in the EU generated approximately €2 420 billion of value added in 2022, while providing employment to 30.0 million persons. Distributive trade enterprises had the second largest share of employment: these enterprises provided employment to over 29.8 million persons and generated €1 591 billion of value added. Financial and insurance activities had the third highest value added (€892.2 billion) but only the tenth largest workforce (5.0 million persons). Professional, scientific and technical activities had the forth highest value added (€724.1 billion) and only the sixth largest workforce (12.0 million persons), behind administrative and support services (14.0 million persons), construction (13.8 million persons) and human health and social work activities (13.3 million persons).

Table 1: Value added, 2022 (€ billion)

Table 1: Value added, 2022 (€ billion)

Source: Eurostat (sbs_sc_ovw)

Table 2: Number of persons employed, 2022 (thousands)

Table 2: Number of persons employed, 2022 (thousands)

Source: Eurostat (sbs_sc_ovw)

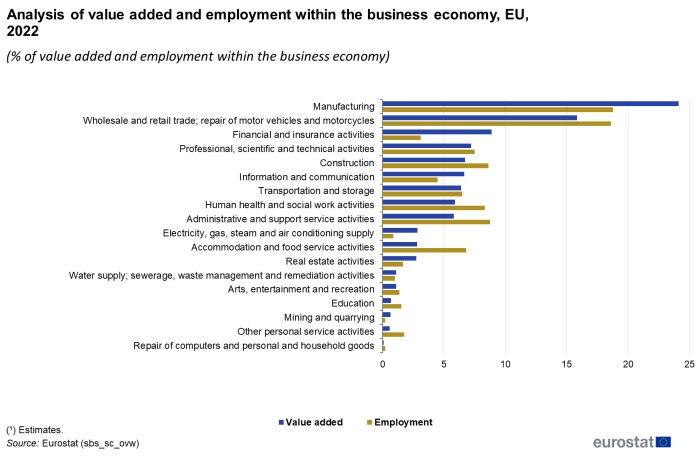

Figure 2 distinguishes the value added and employment contributions of the various sectors to the business economy totals. The industrial activities of manufacturing; electricity, gas, steam and air conditioning supply; water supply, waste and remediation and mining and quarrying contributed more in terms of value added than employment to the overall business economy, indicating an above average apparent labour productivity. This was also the case in some of the service activities, namely financial and insurance activities, which had the highest apparent labour productivity overall, as well as real estate activities and as information and communication services. By contrast, the construction sector and a number of services — notably accommodation and food services and administrative and support services (which includes cleaning and security services, as well as employment services such as the provision of temporary personnel)— reported relatively low levels of apparent labour productivity. Distributive trade also presents a lower share in value added than employment; however, it represents the second largest contributor after manufacturing in terms of both value added and employment. It should be noted that the employment data presented are in terms of head counts and not, for example, full-time equivalents, and there may be a significant proportion of persons working part-time in some of these service activities, which may explain, at least to some degree, their relatively low levels of apparent labour productivity.

Figure 2: Analysis of value added and employment within the business economy, EU, 2022(% of value added and employment within the business economy)

Figure 2: Analysis of value added and employment within the business economy, EU, 2022(% of value added and employment within the business economy)

Source: Eurostat (sbs_sc_ovw)

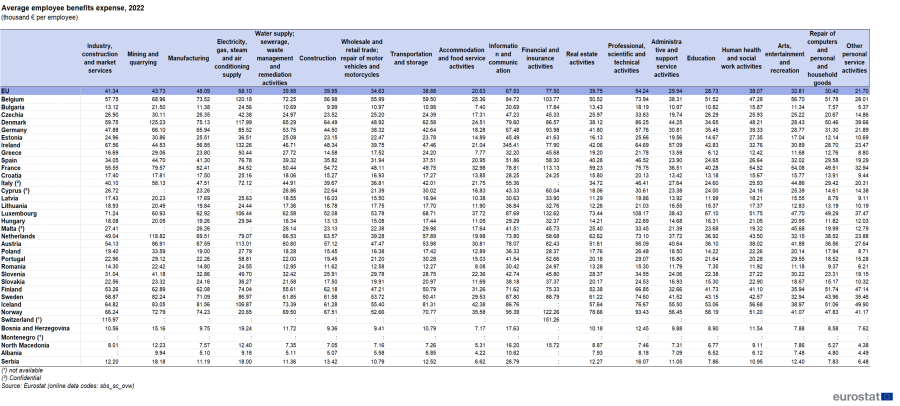

Varying rates of part-time work also help explain, in part, the considerable differences in average personnel costs within the business economy of the EU, as shown in Table 3. Average personnel costs in the EU was highest in the financial and insurance activities at €77 500 per employee in 2022 and were slightly lower for the electricity, gas steam and air conditioning supply sector (€68 100 per employee) and information and communication (€67 500 per employee). Average personnel costs for the financial and insurance activities sector were almost four times as those recorded for accommodation and food services (€20 600 per employee) and more than twice those recorded for education (€28 700 per employee), administrative and support service activities (€29 900 per employee), arts, entertainment and recreation (€32 800 per employee) and distributive trades (€34 600 per employee).

The variation in average personnel costs was even more marked between EU Member States: for example, for the information and communication sector average personnel costs ranged (among those EU Member States for which data are available) by a factor of more than 10, from a high of €345 410 per employee in Ireland to a low of €28 300 per employee in Croatia; within the manufacturing sector average personnel costs ranged by a factor of 7, from a high of €75 100 per employee in Denmark to a low of €11 400 per employee in Bulgaria.

Table 3: Average employee benefits expense, 2022 (€ thousand per employee)

Table 3: Average employee benefits expense, 2022 (€ thousand per employee)

Source: Eurostat (sbs_sc_ovw)

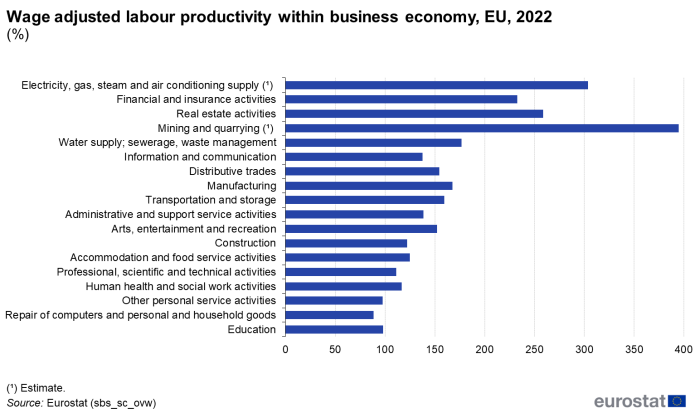

The influence of part-time employment is largely removed in the wage adjusted labour productivity ratio, which shows the relation between average value added per person employed and average personnel costs per employee (see Figure 3). This ratio was particularly high (395%) in the EU for the mining and quarrying sector in 2022, as well as in electricity, gas, steam and air conditioning supply activities (303%) and in real estate activities (259%). The wage adjusted labour productivity ratio fell below 100% in three services activities: education, other personal service activities and repair of computers, personal and household goods.

Figure 3: Wage adjusted labour productivity within the business economy, EU, 2022 (%)

Figure 3: Wage adjusted labour productivity within the business economy, EU, 2022 (%)

Source: Eurostat (sbs_sc_ovw)

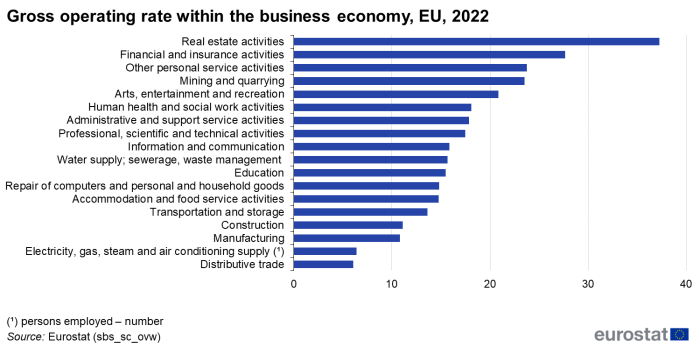

The gross operating rate shown in Figure 4 relates the gross operating surplus (value added less personnel costs) to the level of turnover and in this way indicates the extent to which sales are converted into gross operating profit (before accounting for depreciation or taxes). Due at least in part to the very high level of sales inherent in wholesaling and retailing, the EU distributive trades sector displayed the lowest gross operating rate across NACE sections, at 6.1% in 2022. Capital-intensive activities (such as real estate activities; 37.3% and financial and insurance activities; 27.7%) tended to have high gross operating rates as the gross operating surplus by definition does not take account of financial or extraordinary costs related to capital expenditure.

Figure 4: Gross operating rate within the business economy, EU, 2022 (%)

Figure 4: Gross operating rate within the business economy, EU, 2022 (%)

Source: Eurostat (sbs_sc_ovw)

Size class analysis

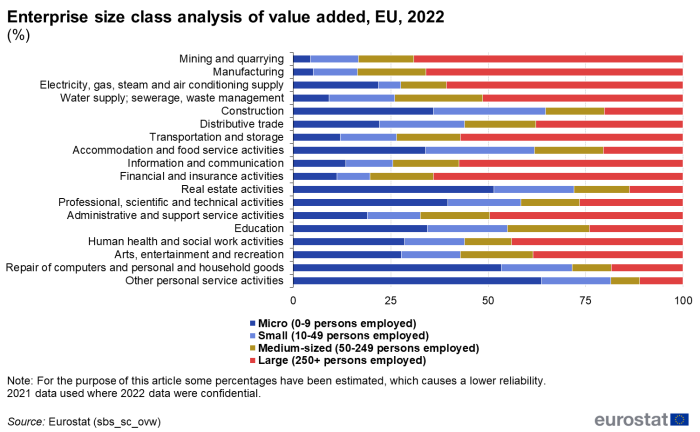

Structural business statistics can be analysed by enterprise size class (defined in terms of the number of persons employed). The overwhelming majority (99.8%) of enterprises active within the EU’s business economy in 2022 were micro, small and medium-sized enterprises (SMEs) — some 31.9 million — together they contributed 50.2% of the value added generated within the EU’s business economy. More than 9 out of 10 (93.2%) enterprises in the EU were micro enterprises (employing less than 10 persons) and their share of value added within the business economy was considerably lower, around one-fifth (19.3%).

Figure 5: Enterprise size class analysis of value added, EU, 2022 (% of sectoral total)

Figure 5: Enterprise size class analysis of value added, EU, 2022 (% of sectoral total)

Source: Eurostat (sbs_sc_ovw)

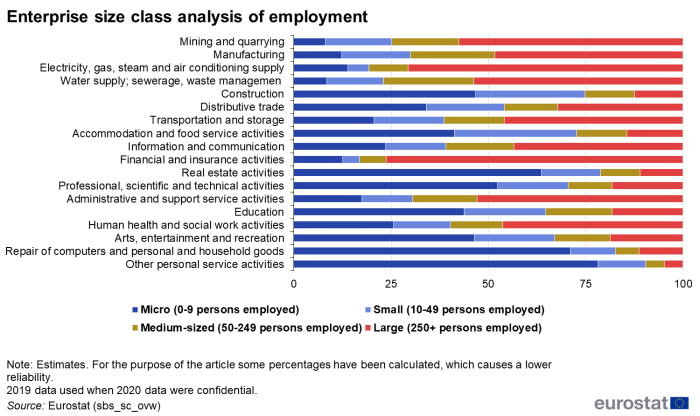

Perhaps the most striking phenomenon of SMEs is their contribution to employment. Almost two-thirds (63.4%) of the EU’s business economy workforce was employed in an SME in 2022. Some 20.2 million persons worked in SMEs in the distributive trades sector, 15.5 million in manufacturing and 12.1 million in construction; together, these three activities provided work to around 47.1% of the business economy workforce in SMEs.

In 2022, micro enterprises in the EU employed more people than any other enterprise size class in more than half of the service sectors (at the section level of detail). This pattern was particularly pronounced for real estate activities, the repair of computers, personal and household goods and other personal service activities where an absolute majority of the workforce worked in micro enterprises. By contrast, for mining and quarrying as well as electricity, gas, steam and air conditioning supply and water supply, waste and remediation, financial and insurance activities and administrative and support service activities, large enterprises employed more than half of the workforce.

Figure 6: Enterprise size class analysis of employment, EU, 2021 (% of sectoral total)

Figure 6: Enterprise size class analysis of employment, EU, 2021 (% of sectoral total)

Source: Eurostat (sbs_sc_ovw)

The contribution of SMEs to total value added within the EU’s business economy was lower than their contribution to total employment, resulting in a lower level of apparent labour productivity; this situation was particularly clear in arts, entertainment and recreation, manufacturing and information and communication services. However, the exceptions were electricity, gas, steam and air conditioning; water supply; sewerage, waste management and remediation activities as well as human health and social work activities.

Business demography

Business demography statistics are presented in Table 4, which shows enterprise birth and enterprise death rates as well as the average size of newly born enterprises in terms of their employment. There are significant changes in the stock of enterprises within the business economy from one year to the next, reflecting among other things the level of competition, entrepreneurial spirit and the business environment.

Eurostat publishes detailed Business demography statistics compiled along the requirements of the new framework for European Business Statistics (EBS). Several improvements enhance the data’s capacity for analysis of the activity of enterprises in the EU, in particular for high-growth and young high-growth enterprises (also known as gazelles). The data now cover more economic activities, e.g. within services (education; human health and social work activities; arts, entertainment and recreation) and financial and insurance activities. Moreover, regional Business demography statistics are now available for all EU countries.

In 2022, the rate of enterprise births in the EU was 10.5%. Among the EU Member States it ranged from 6.2% in Austria to 14.3% in Latvia and Malta, 16.6% in Estonia, 16.7% in Portugal and 18.3% in Lithuania. The most dynamic activity at EU level in 2022 was Information and communication sector, where 16.7%. of active enterprises with 10 employees or more showed high-growth. (18).

The average employment size of newly born enterprises in 2022 varied between 0.4 persons in Finland and 2.6 persons in Greece. At the EU level, the average size of newly born enterprises was 1.1 persons.

In 2022, enterprise death rates, which are based on provisional data, were particularly low in Greece (3.1%), Belgium (5.2%) and Cyprus (5.8%), ranging up to 20.6% in Bulgaria and 25.1% in Estonia. At EU level, the preliminary rate of enterprise deaths stood 8.7%.

In most EU countries more companies were created than dissolved. The exceptions to this were Bulgaria, Denmark, Germany, Estonia, Ireland and Poland, where the number of enterprises dissolved surpassed the number of companies created.

Table 4: Enterprise demography, business economy, 2022

Table 4: Enterprise demography, business economy, 2022

Source: Eurostat (bd_l_form)

Source data for tables and graphs

Data sources

Eurostat’s structural business statistics describe the structure, conduct and performance of economic activities, down to the most detailed activity level (several hundred sectors). Without this structural information, short-term data on the economic cycle would lack context and would be more difficult to interpret.

Coverage, units and classifications

Structural business statistics cover the ‘business economy’, which includes industry, construction and many services (NACE Rev. 2 sections B to N, P to R as well as division S95 and S96). Structural business statistics do not cover agriculture, forestry and fishing, nor public administration.

Structural business statistics describe the business economy through the observation of units engaged in an economic activity; the unit in structural business statistics is generally the enterprise. An enterprise carries out one or more activities, at one or more locations, and it may comprise one or more legal units. Enterprises that are active in more than one economic activity (plus the value added and turnover they generate, the people they employ, and so on) are classified under the NACE heading corresponding to their principal activity; this is normally the one which generates the largest amount of value added.

NACE Rev. 2 was adopted at the end of 2006, and implemented in structural business statistics from the 2008 reference year. Compared with NACE Rev. 1.1, this has enabled a broader and more detailed set of information to be compiled on services, while also updating the classification to identify new areas of activity better.

Starting with the reference year 2021, Structural Business Statistics are compiled under the legal basis of the EU regulation 2019/2152 on European business statistics and its implementing act, EU regulation 2020/1197 on technical specifications and arrangements.

Size class and regional analysis

Structural business statistics are also available with an analysis by region or by enterprise size class. In structural business statistics, size classes are defined by the number of persons employed, except for specific data series within retail trade activities where turnover size classes are also used. A limited set of the standard structural business statistics variables (for example, the number of enterprises, turnover, value added and persons employed) is analyzed by size class, mostly down to the three-digit (group) level of NACE. For statistical purposes, SMEs are generally defined as those enterprises employing fewer than 250 persons. The number of size classes available varies according to the activity under consideration. However, the main groups used in this article are:

small and medium-sized enterprises (SMEs): with less than 250 persons employed, further divided into;

micro enterprises: with less than 10 persons employed;

small enterprises: with 10 to 49 persons employed;

medium-sized enterprises: with 50 to 249 persons employed;

large enterprises: with 250 or more persons employed.

Structural business statistics contain a comprehensive set of basic variables describing business demographics and employment characteristics, as well as monetary variables (mainly concerning operating income and expenditure, or investment). In addition, a set of derived indicators has been compiled: for example, ratios of monetary characteristics or per head values.

Business demography

Business demography are statistics about, amongst other things, the birth, survival (followed up to five years after birth) and death of enterprises within the business population. It reports changes in the stock of enterprises within the business economy from one year to the next, reflecting among other things the level of competition, entrepreneurial spirit and the business environment. Within this context the following definitions apply.

Enterprise birth amounts to the creation of a combination of production factors, with the restriction that no other enterprises are involved in the event. Births do not include entries into the business population due to mergers, break-ups, split-offs or restructuring of a set of enterprises, nor do the statistics include entries into a sub-population that only result from a change of activity. The birth rate is the number of births relative to the stock of active enterprises.

Enterprise birth rate: number of enterprise births in the reference period divided by the number of enterprises active in that same period.

Enterprise death amounts to the dissolution of a combination of production factors, with the restriction that no other enterprises are involved in the event. An enterprise is only included in the count of deaths if it is not reactivated within 2 years. Equally, a reactivation within 2 years is not counted as a birth.

Enterprise death rate: number of enterprise deaths in the reference period divided by the number of enterprises active in that same period.

Average employment size of newly born enterprises: average number of persons employed in the reference period (t) among enterprises newly born in t divided by the number of newly enterprises born in t. If an enterprise was created later in the year with one self-employed person, the rounded annual average might be less than 1.

SME Relief Package and aligned to the SME definition regulated by the Recommendation 2003/361/EC.

Context

In March 2020, the European Commission presented a new Industrial Strategy for Europe that laid out a plan for how the EU’s world-leading industry could lead the twin green and digital transitions, drawing on the strength of its traditions, its businesses and its people to enhance its competitiveness. It set in motion a new policy approach to deliver on this, focused on better connecting the needs and support provided to all players within each value chain or industrial ecosystem. To support this, it underlined the fundamentals of industry – innovation, competition and a strong and well-functioning single market – while strengthening EU global competitiveness through open markets and a level playing field.

In May 2021, the Commission updated the EU Industrial Strategy to ensure that its industrial ambition took account of the circumstances following the COVID-19 crisis, while ensuring EU industry could lead the way in transitioning to a green, digital and resilient economy. In particular, it focused on strengthening of the resilience of the Single Market; supporting Europe’s open strategic autonomy through dealing with dependencies; supporting the business case for the twin transitions.

The internal market remains one of the EU’s most important priorities. The central principles governing the internal market for services were set out in the EC Treaty. This guarantees EU enterprises the freedom to establish themselves in other EU Member States and the freedom to provide services on the territory of another Member State other than the one in which they are established.

With the Single Market Programme (SMP) the European Commission helped the single market reach its full potential and ensured Europe’s recovery from the COVID-19 pandemic providing an integrated package over the period of 2021-2027 to support and strengthen its governance.

SMEs are often referred to as the backbone of the European economy, providing a potential source for both jobs and economic growth. In March 2020, the European Commission adopted a Communication on SMEs referred to as An SME Strategy for a sustainable and digital Europe. The objective was to unleash the power of Europe’s SMEs of all kinds to lead the twin transitions. It aimed to considerably increase the number of SMEs engaging in sustainable business practices as well as the number of SMEs employing digital technologies. Ultimately, the goal was that Europe became the most attractive place to start a small business, make it grow and scale up in the single market.

In September 2023 the European Commission presented the SME Relief Package that aimed to provide short-term relief, boost long-term SME competitiveness and resilience, and foster a fair and SME-friendly business environment. The actions set up all revolve around the three main operational challenges for SMEs – administrative burden, finance and skills – with the aim to achieve very concrete goals: providing an enabling regulatory framework, reducing reporting requirements, simplifying taxes, fostering liquidity, improving access to finance, providing SMEs with the right skills and supporting them throughout their life cycle.

Source link : https://ec.europa.eu/eurostat/statistics-explained/index.php/Structural_business_statistics_overview

Author :

Publish date : 2024-10-25 07:00:00

Copyright for syndicated content belongs to the linked Source.