Consumer protest against rising prices in Serbia

In the past few months, Serbia has witnessed a series of consumer-led protests against growing prices in supermarkets operated by major retail chains. These protests, marked by boycotts of specific chains and social media awareness campaigns, have highlighted growing public dissatisfaction with the pricing policies of major retailers.

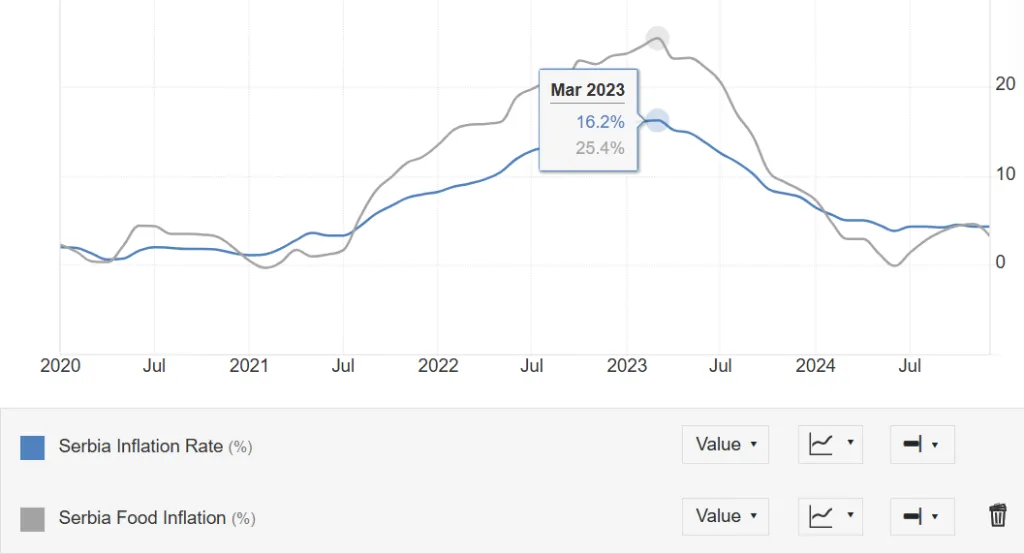

Inflation in Serbia has reached high levels in recent years: in December 2024, it increased by 4.3% compared to the previous year, while in 2023, it peaked at 16.3%. Food inflation, in particular, hit 25.4% year-on-year in March 2023. These figures have been influenced by global factors such as rising energy costs, increasing raw material prices, and geopolitical tensions. However, consumers accuse the large retail chains of exploiting the situation to increase profit margins at the expense of the population’s purchasing power.

The first boycott, held on 31 January, led to a one-third reduction in supermarket revenue, with a 37% drop in earnings. The consumer association Efektiva urged citizens to refrain from shopping at major chains, including Delhaize (which operates under the brands Maxi and Shop&Go), Mercator (which owns Idea and Roda), DIS, Lidl, and Univerexport. As a result, the five major retail chains suffered a collective loss of €4.5 million.

The overlapping curves of total inflation and food inflation show how July 2021 and the end of 2024 there was a sharp spread between them, exceeding 10 percentage points in March 2023. Source: Trending economics.

Despite the boycott and the demand for a concrete response from retailers, suppliers, and the state, no significant action was taken. On the contrary, some supermarkets even increased prices in an attempt to compensate for their losses. In response, consumer associations announced a second, five-day boycott from 10 to 15 February, hoping for more tangible results. The first boycott was widely covered by television and social media, demonstrating the strong public support for the movement.

The boycott movement has not been limited to Serbia; it has also spread to Montenegro, Croatia, Bosnia and Herzegovina, and North Macedonia. However, achieving fair pricing remains a significant challenge. Sociologist Tomislav Tadić has pointed out that this issue is closely linked to crony capitalism, where connections between the private sector and political structures create a shared interest in keeping prices high.

Retail prices consist of three key components: the purchase (or production) price, the retailer’s profit margin, and state-imposed taxes. The boycotts aim to challenge retailers’ profit margins, questioning whether these can be reduced to lower consumer prices.

According to data from the Serbian Tax Administration, on 31 January, the number of fiscal receipts issued was 25% lower than the previous day and approximately 20% lower than on the same date the previous month. Total revenue on that day amounted to around €7.77 million, compared to €11.34 million the day before.

Despite the initial impact of the boycott, large companies may be able to withstand such actions without making permanent price reductions. Moreover, for consumers, it is challenging to completely avoid the convenience of major supermarkets for an extended period.

“The question is how much citizens are willing to sacrifice their convenience. Completely avoiding these supermarkets, even for five days, is difficult,” commented Aleksandar Milošević from Nova Ekonomija. While some believe that prolonged boycotts can be effective, others argue that they are only a temporary solution and that broader economic measures are needed to truly tackle inflation.

The retail chain sector in Serbia

The retail chain sector in Serbia recorded significant profits in 2023, emerging as the most profitable sector in the Serbian economy, according to the annual report of the Serbian Business Registers Agency (APR).

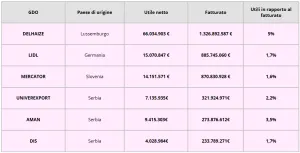

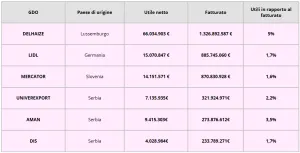

The Serbian retail market is primarily dominated by foreign chains, with a few exceptions. The Belgian chain Delhaize, which owns Maxi, Tempo, and Shop&Go supermarkets with a total of 600 stores, achieved the highest revenue in 2023, amounting to €1.3 billion, with a net profit exceeding €66 million. It also had the highest margin among competitors, reaching 44.25%. This result highlights the effectiveness of Delhaize’s business model, which successfully combines a wide product offering with a solid cost and margin management strategy.

In second place by revenue is the German retail giant Lidl, which generated €885,745,060 from 70 stores. Despite strong revenues, Lidl’s net profit stood at just €15,070,847, a decline of nearly €6 million compared to 2022. Additionally, Lidl reduced its profit margins from 33.3% in 2022 to 30.2% in 2023, indicating a slowdown in growth.

Another significant player is the Slovenian chain Mercator, which recorded revenues of €870,830,928 in 2023 from 200 stores, with a net profit of €14,151,571 – almost three times higher than the previous year. Mercator operated with a 36.5% margin in 2023, reinforcing its strong position in the Serbian retail landscape.

Serbia’s retail market is characterised by a high concentration of international operators, but domestic chains also play a crucial role. Among the 11 largest retail groups, only three are domestically owned, although even some of these have notable international ties.

The key Serbian-owned chains include Univerexport, DIS, Aman, and Gomex. Univerexport recorded a €321,924,971 turnover in 2023 (+21%) with a €7,135,935 net profit (-4%), operating with a 26.6% margin. The chain operates 200 stores, mainly in Vojvodina. DIS, one of the best-known and widespread Serbian chains, is owned by Zoran Tirnanić. In 2023, DIS generated €233,789,271 in revenue (+12% growth compared to the previous year) and a net profit of €4,028,984 (+8% growth). Aman, despite being technically foreign-owned by Jordanian businessman Nedal Halil, is managed by an entrepreneur who has acquired Serbian citizenship. Aman’s 2023 revenue reached €273,876,612 (+8% growth), with a €9,415,303 net profit (+4% growth). Gomex, with a 2023 revenue of €187,326,072 and profits of €4,426,872, is majority-owned by a Luxembourg-based company. However, the chain’s founder, Goran Kovačević, retains a 47.5% stake, allowing him to maintain a degree of influence over the company’s strategy.

Despite the presence of around twenty retail operators, the Serbian retail sector remains highly concentrated. The top three companies by revenue in 2023 (Delhaize, Lidl, and Mercator) accounted for a total revenue of €3,083,468,575, out of an overall industry turnover of €3,913,059,429. This means that 77% of the market is controlled by just three companies, enabling them to easily implement cartel-like strategies.

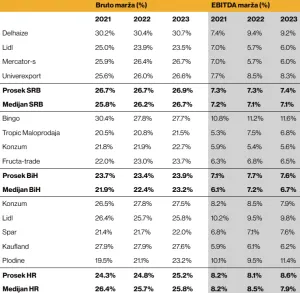

Gross margins in Serbia 6% higher than in Europe. Compared to large continental chains, Serbian realities perform much better: credit to exceptional efficiency or cartel agreements?Comparison with foreign retail chains

The data presented above clearly show that the leading retail chains in Serbia report significantly better results than the major players in the sector in Italy, France, and Belgium. The case of Delhaize in Serbia is particularly telling: the subsidiary of the Ahold Group, operating in a much less affluent market with a more limited product range and a significantly lower average transaction value than its Belgian parent company, manages to achieve profits twice as high as those of its controlling company.

According to an analysis by Bloomberg Adria, in 2023, the average gross margin of the four largest retail chains in Serbia was 26.9%. In this respect, Serbia and Slovenia display similar figures, standing out compared to Croatia and Bosnia and Herzegovina, where margins are lower.

According to an analysis by Bloomberg Adria, in 2023, the average gross margin of the four largest retail chains in Serbia was 26.9%. In this respect, Serbia and Slovenia display similar figures, standing out compared to Croatia and Bosnia and Herzegovina, where margins are lower.

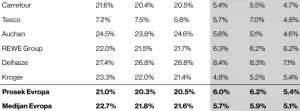

Unlike the Adria region, where in 2023 the average gross retail margins did not fall below 23.9% in any country, European retailers operated with an average gross margin of 20.5%.

“The high profitability of the Adria region exceeds both the average and median values of European retailers,” states the analysis. Official data suggest that changes in procurement costs have been directly passed on to the end consumer.

“The high profitability of the Adria region exceeds both the average and median values of European retailers,” states the analysis. Official data suggest that changes in procurement costs have been directly passed on to the end consumer.

Investigations into the retail chain sector

Only recently have investigations conducted by the Commission for the Protection of Competition raised suspicions of anti-competitive behaviour by some of the major retail chains, including Delhaize, Mercator, DIS, and Univerexport. The Commission launched an inquiry into suspected price-fixing agreements after monitoring the price movements of 35 selected products, suggesting the possibility of collusion.

According to operational profit data available from the Business Registers Agency, the total profit of these four retail chains amounted to €31.6 million in 2016, while in 2023, it reached €159 million. This means that in the past year, the leading retail chains recorded a total net profit of approximately €160 million, five times higher than seven years ago.

Beyond competition investigations, the Commission found that the retail market in Serbia grew in value between April 2023 and March 2024, despite a slight decrease in sales volume. Additionally, price increases were nearly double the inflation rate, raising concerns about their actual impact on consumers’ purchasing power.

These market dynamics, including the consolidation of foreign chains and the concentration of purchasing power, are shaping an increasingly competitive landscape. However, concerns over competition and profit margins are prompting questions about the future of the retail sector in Serbia and its impact on consumers. The Commission for the Protection of Competition will continue monitoring market practices to ensure a balance between key industry players and protect consumer rights.

According to a study by the Serbian Statistics Office (RZS), the gross margin for retailers on food products was 14.9%, while producers’ margins were significantly higher, reaching 54.1%. This gap highlights the difference between production costs and retail prices, suggesting that rising retail prices are primarily due to high production costs and low production volumes.

For example, the production price of milk varies significantly compared to the final price paid by consumers, ranging from 37 to 65 dinars, while the supermarket price is at least 160 dinars.

The study also revealed that the top 20 retail chains control 83% of the market. While sales margins for these top players tend to be lower, they benefit from better purchasing conditions from suppliers. Additionally, producers of certain foods, such as baked goods, oil, and fats, have exceptionally high margins, with bread producers reaching margins of up to 98.8%.

A sector that is growing due to oligopolies and weak public oversight

The extra margins achieved in Serbia may be the result of excessive pricing policies that are not truly tested by adequate competition. It is difficult to justify how a country with lower logistical efficiency than major European economies can achieve better results than well-established and structured chains in Italy or France. In such a context, the only plausible explanation would be the existence of cartel agreements, allowing these operators to maintain high margins at the expense of Serbian consumers. These practices not only distort the market but also directly harm competitiveness and the quality of offerings to the public, creating a system that penalises consumers instead of rewarding them with fairer and more transparent choices.

The Serbian retail market is heavily influenced by a few large groups, with a dominance of international players that exert increasing control over the local market. Although Serbian chains still represent a significant portion of the industry, their size and bargaining power are limited compared to international giants. The high level of market concentration and the dynamics of price-fixing agreements raise concerns about the future development of the sector, as further mergers or acquisitions could easily disrupt the balance. Protecting competition and monitoring market practices remain essential to ensuring that the benefits of globalisation translate not only into higher profits for large chains but also into tangible advantages for consumers.

Why are retail margins in Serbia higher than in other countries?

The significant increase in supermarket prices in Serbia has raised questions about the profit margins of large retail chains. Unlike other countries, where margins are generally lower and proportionate to the cost of living, the situation in Serbia appears different.

Two possible explanations help to understand this phenomenon:

· Laissez-faire approach to consumer interests

In Serbia, the lack of strict regulatory policies and weaker effective competition may have given companies more room to set higher prices and increase their profits. Major retail chains in Serbia seem to prioritise a profit-driven strategy rather than a balanced approach that considers both business growth and the protection of citizens’ purchasing power. In contrast, in many European markets, competitive pressure and greater social awareness push companies to maintain lower margins to meet consumer needs.

· Tax policy

Serbia’s tax system includes three VAT (PDV) rates: 4%, 10%, and 20%. The 4% rate applies to essential goods and services, the 10% rate to food products and medicines, while the standard 20% rate applies to other goods and services. Additionally, Serbia imposes a 15% corporate income tax (CIT), while individual residents are subject to a 10% personal income tax. This fiscal structure reflects a clear government choice not to increase direct taxation on businesses but instead to raise revenue by taxing consumer spending.

If supermarkets raise their prices, tax revenues also increase, creating a scenario that benefits both the state and large retail chains—at the expense of consumers. This explains why, despite Serbia’s generally lower cost of living compared to other European countries, food and consumer goods prices have risen disproportionately.

The combination of oligopolistic corporate strategies and a tax system that is not consumer-friendly could therefore be at the root of the current tensions in the Serbian retail sector.

By Katarina Ivanović

Source link : http://www.bing.com/news/apiclick.aspx?ref=FexRss&aid=&tid=67b75bf408624cd586054f2fcc9084ff&url=https%3A%2F%2Fwww.serbianmonitor.com%2Fen%2Fgod-in-serbia-extra-margins-at-consumer-expense%2F&c=14640470550762225949&mkt=de-de

Author :

Publish date : 2025-02-20 03:12:00

Copyright for syndicated content belongs to the linked Source.